-

Oil producers discuss additional output cut of 500k bpd

-

Saudi Arabia’s energy minister said that “beautiful news” are coming today

-

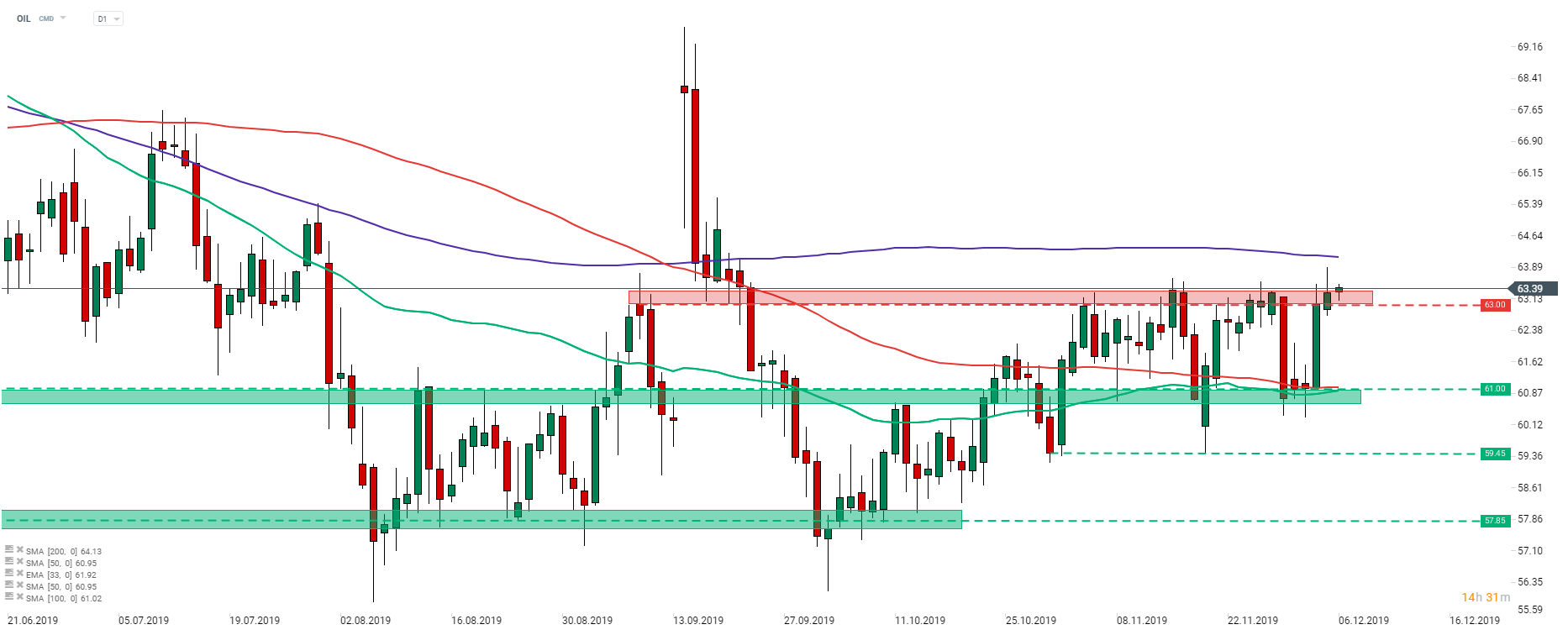

Brent (OIL) tests the upper limit of the trading range

OPEC members met yesterday in Vienna to discuss the future of the output cut agreement. It is said that oil producers are discussing an additional cut of 500 thousand barrels per day in the first quarter of 2020. However, no consensus was reached on the matter yesterday and, in turn, OPEC did not hold a post-meeting press conference for the first time in history. However, talks will continue today with non-OPEC producers, like Russia. Here is what we know at the moment:

-

It was rumoured that OPEC may deepen cuts by 300-800k bpd but 500k looks like the most probable scenario

-

Additional cuts are expected to take place in the first quarter of 2020

-

Whole output cut agreement may be extended until the end of the first half of 2020 (currently end-Q1 2020)

-

Russian cuts are expected to be left unchanged at 228k bpd

-

Russia and Oman want oil condensates to be exempted from the deal

-

Russian Energy Minister said that proposed quota will come into force only if all OPEC members commit to their pledged cuts

OPEC+ closed meetings session will start at 11:00 am GMT today. Press conference with a decision announcement is expected to be held afterwards. Comments from the Saudi Arabia’s energy minister suggest that deal is likely to be made as he promised “beautiful news” today. However, it should be noted that some oil producers were making deeper output cuts throughout the year and boosting agreement by additional 500k bpd cut may not have much of an impact on the fundamental situation. Meanwhile, Brent is testing the upper limit of recent consolidation range.

Brent (OIL) is attempting to break above the upper limit of the trading range. Crude price reached a 2.5-month high yesterday but failed to close above the resistance zone at $63. In case additional output cuts are announced today, prices could jump higher and test the next resistance in line - 200-session moving average (purple line, $64.15 area). Source: xStation5

Brent (OIL) is attempting to break above the upper limit of the trading range. Crude price reached a 2.5-month high yesterday but failed to close above the resistance zone at $63. In case additional output cuts are announced today, prices could jump higher and test the next resistance in line - 200-session moving average (purple line, $64.15 area). Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

Three markets to watch next week (09.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.