- First BoJ decision with new chief after ultra dovish Kuroda's departure

- Ueda has repeatedly stressed recently that policy must remain accommodative

- According to commentators, Ueda is not a "fan" of the yield curve steering tool

- The BoJ believes that the banking crisis has added a lot of uncertainty and a premature rate hike could lead to a miss on the long-term inflation target

- Economic projections may be key to the reaction, in particular whether we will see inflation at the target by the forecast date

- The decision should be published at 3:00 GMT

The Bank of Japan remains the last bastion of ultra-loose monetary policy in the world. Not counting the adjustment in the yield curve steering tool, rates have remained unchanged for quite some time (they were lowered to negative levels during the pandemic). Although inflation exceeded the target, according to the BoJ, this was due to temporary factors and also the new head indicates that inflation will fall below 2% later this year.

Higher wages

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile appMarkets were making hopes that the new BoJ chief would bring freshness to policy and make an exit from the ultralow monetary policy in which Japan has been stuck in recent decades. This was supported by wage growth, which is not only in line with the 2% inflation target, but also points to stronger upward pressure. Annual wage negotiations are expected to produce the largest wage increases in 3 decades at 3.8% y/y. Previously, it was specified that 3% wage growth was a prerequisite for starting discussions on tighter monetary policy. Despite the fact that wages are already growing much more strongly, there are no statements about tightening monetary policy.

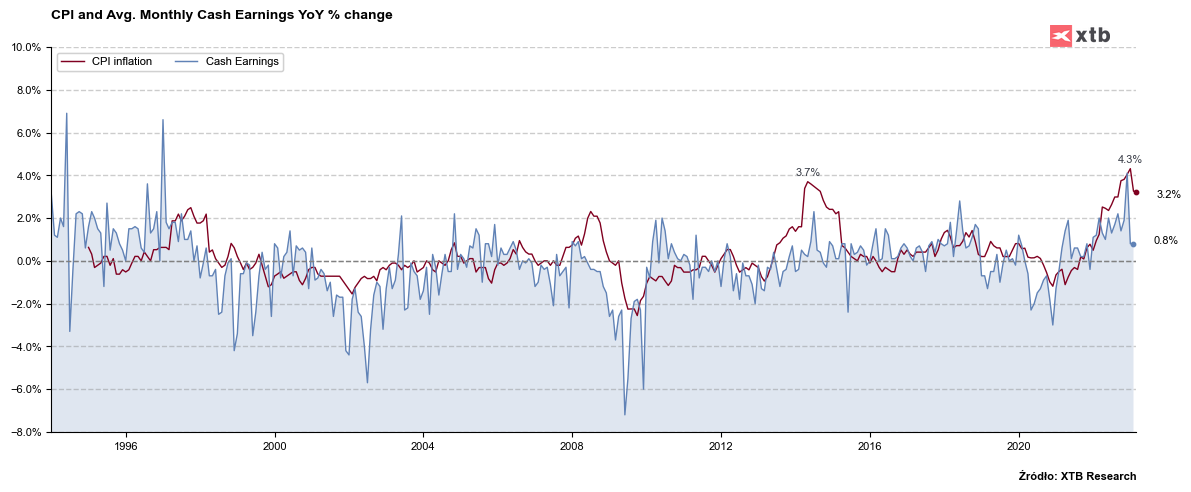

Monthly earnings in annual growth - here we see a marked decline in the last month, but previously the pace suggested a positive impact on inflation. The wage negotiations should contribute to the strong growth in monthly wages again. Source: Bloomberg, XTB

Monthly earnings in annual growth - here we see a marked decline in the last month, but previously the pace suggested a positive impact on inflation. The wage negotiations should contribute to the strong growth in monthly wages again. Source: Bloomberg, XTB

Yield curve control

The yield curve control (YCC) program remains one of the most important factors. Last year, a two-fold increase in the volatility band for 10-year yields was made, avoiding a problem in which 8- to 9-year yields were higher than 10-year yields, and allowing a near-dead trade in 10-year bonds to unravel. The market speculated that the program might even be abandoned, particularly with the new BoJ chief expected to not be a big fan of the tool. On the other hand, the banking crisis has led to greater demand for safe debt, which has lowered yields somewhat and does not require the current correction.

Macro projections

Attention will be focused on the inflation forecast for fiscal year 2025. If the forecast here falls below 2.0%, it will indicate a dovish stance by the Bank of Japan. In the case of a forecast above 2.0%, it can be expected that changes may come later this year.

What's the future of JPY?

A surprise can't be ruled out, particularly since Ueda has announced a review of past monetary policy. This review may suggest that changes are coming, although it may be too early for them. In addition, macroeconomic projections may breathe renewed hope into the financial markets that changes will be more rapid. Some private institutions in Japan suggest that changes to the YCC will be announced in June or July. However, this will depend on whether the BoJ sees inflation at target by the forecast deadline.

If the BoJ doesn't surprise, it could even be possible to go out near 135 pt. before the Fed rate hike decision, but thereafter the pair will largely depend on the Fed overall policy and it's 'hawkishness'. We believe that despite the pro-inflationary GDP data, the US dollar should start losing in the next few days. Confirmation of this would be a move below the local minima of mid-March. Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.