Oil continues to trade near but has not yet managed to close a bullish price gap, triggered by an unexpected OPEC+ output cut announcement. A bearish sentiment can be spotted on the crude market since mid-April and is trading less than $1 per barrel away from closing a bullish gap. Taking a look at OIL.WTI at the D1 interval from a technical point of view, we can see that downward move accelerated after the price failed to break above $82 resistance. According to the Overbalance methodology, this hints that the long-term trend remains bearish. Moreover, price dropped back below 100-period EMA, what further supports the bearish outlook.

OIL.WTI at D1 interval. Source: xStation5

OIL.WTI at D1 interval. Source: xStation5

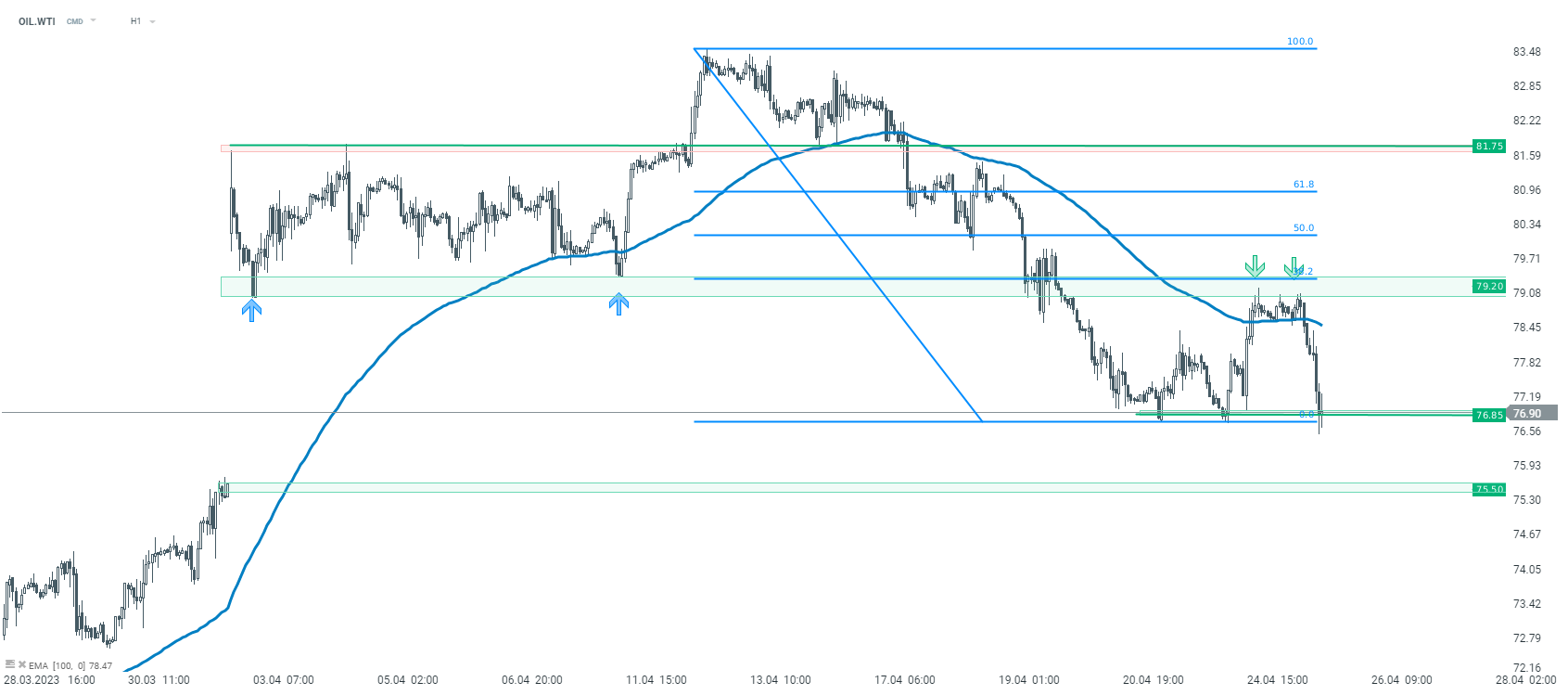

Taking a look at WTI at a lower interval (H1), we can see that price tested a recently-broken support as a resistance and, after a failure to break above it, downward move was resumed. Currently, we are observing OIL.WTI testing recent local lows in the $76.85 per barrel area and should we see a break below this zone, the way towards $75.50 - lower limit of bullish price gap - will be left open.

OIL.WTI at H1 interval. Source: xStation5

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

Three markets to watch next week (09.02.2026)

Market update: recovery takes hold, but investors remain on edge

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.