Summary

-

Front-month WTI price dropped into negative territory for the first time in history

-

WTI settled at -$37.63 per barrel yesterday!

-

Decline into negative territory caused by contract expiry (expires April 21)

-

What negative oil price means to the oil market?

The worst day in the oil market history

Monday, April 20 will be remembered as the worst day in the history of the oil market. Putting the situation short and simple, one can say that the oil price dropped below $0 per barrel. What does it mean? In short, the seller pays the buyer to take the oil away from him. Of course, the situation is not so simple. In fact, it is much more complex. More importantly, it is the first time the oil market is experiencing such a situation and on such a large scale. Moreover, asset price dropping below 0 is unusual itself.

How is it possible for the oil price to be negative?

In the first place it should be said that the whole situation relates to WTI oil and May20 contract that expires on Tuesday, April 21. It means that drop into negative territory related to just a small portion of the market because Jun20 is the most liquid contract now. Contracts with later settlement dates are also more liquid than May20 contract. Contracts with later settlement dates are also quoted at much higher prices. Such a situation on the futures market is called "contango". In theory it means that there is a lot of crude on the market and producers prefer to store it and sell later for much higher prices. Crude at that quantity is simply not needed on the market now.

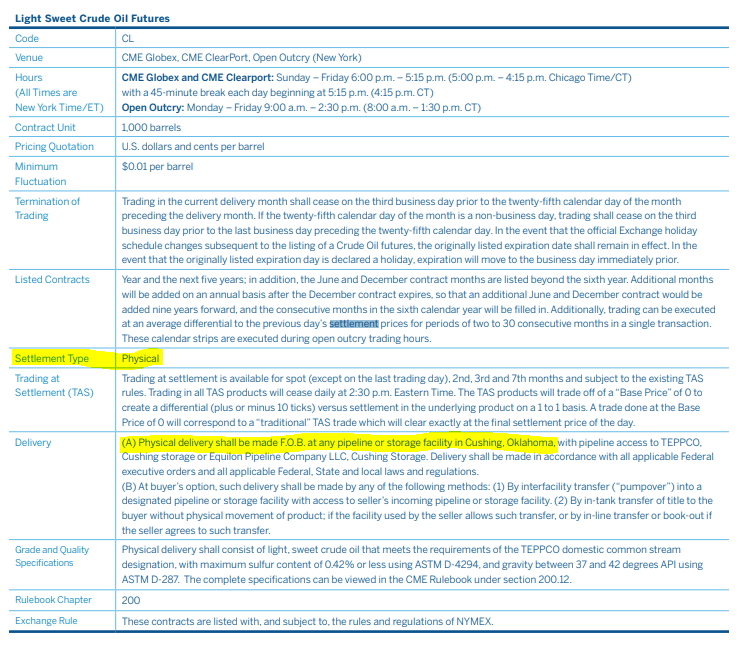

Continuing, it should be noted that WTI contracts that serve as a benchmark are deliverable - it means that unless the position is closed, buyer/seller will have to collect/deliver physical crude. Delivery specifications for contracts quoted on CME exchange can be found below.

Once the contract expires, physical delivery takes place. "Delivery" part of the table above specifies details of delivery. Keep in mind that each contract equals 1,000 barrels of oil. Source: CME

Once the contract expires, physical delivery takes place. "Delivery" part of the table above specifies details of delivery. Keep in mind that each contract equals 1,000 barrels of oil. Source: CME

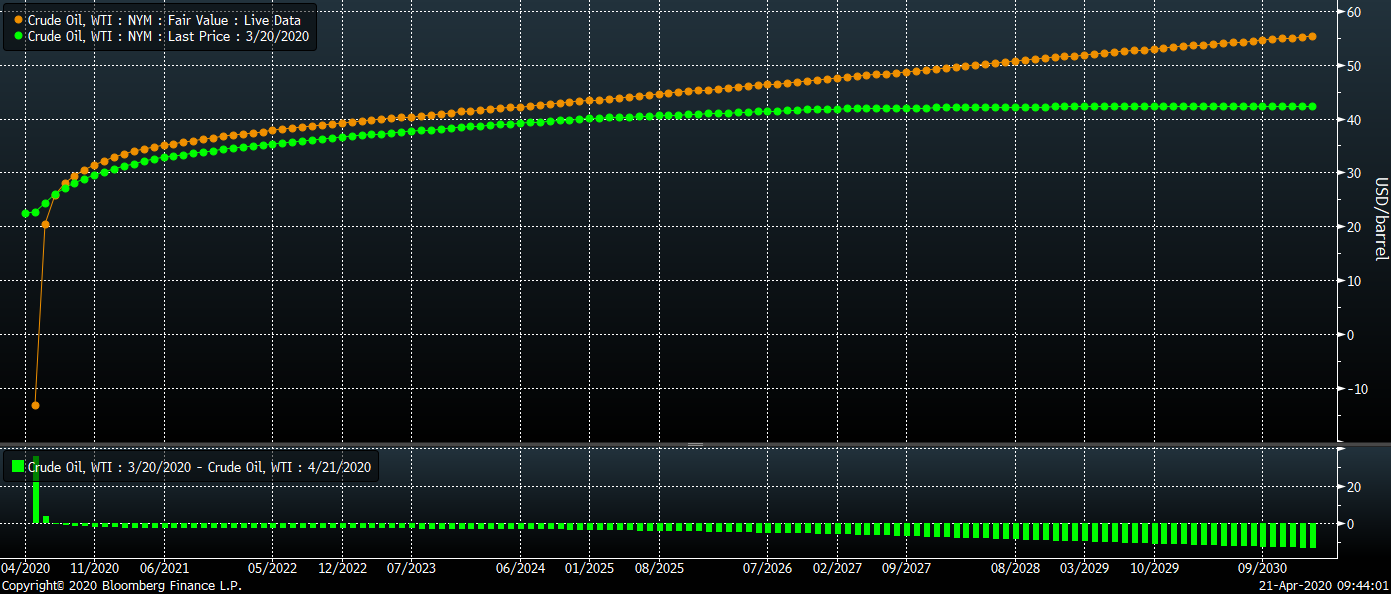

Price of the May20 contract is still negative. This is the biggest spread between front- and second-month contracts in history. As one can see, this spread was not that big a month ago (green line). Spread between Jun20 and Jul20 contracts equals around $5 per barrel. Source: Bloomberg

Price of the May20 contract is still negative. This is the biggest spread between front- and second-month contracts in history. As one can see, this spread was not that big a month ago (green line). Spread between Jun20 and Jul20 contracts equals around $5 per barrel. Source: Bloomberg

What has actually happened?

We can see that WTI May20 contract finished yesterday's trading close to -$40 per barrel. On the chart above, one can also see the price of Jun20 contract (blue line) and open interest on both contracts (middle panel, May20 - grey, Jun20 - red). In the lower panel one can see volume data (May20 - grey, Jun20 - orange). Source: Bloomberg

We can see that WTI May20 contract finished yesterday's trading close to -$40 per barrel. On the chart above, one can also see the price of Jun20 contract (blue line) and open interest on both contracts (middle panel, May20 - grey, Jun20 - red). In the lower panel one can see volume data (May20 - grey, Jun20 - orange). Source: Bloomberg

As we have already mentioned, contract expiry means that delivery or collection must be made. Nevertheless, physical deliveries are quite rare and represent just 1-10% of all futures contracts.

How does one realize profits and losses from futures trading then? Market participants do so by taking the opposite position of the same volume. For example, if an investor bought 4 WTI contracts, he can close this position by selling 4 WTI contracts (with the same expiry). In case of a liquid market, other sides for the offsetting trade are found easily and there is no need to make physical delivery once the position is closed. However, May20 market was not liquid yesterday. Everyone was selling and there were no buyers on the eve of expiry. Open interest was very low (less than 16k contracts) and volume was even lower (just 2489!). Producers may have not wanted to unwind their hedging trades and wanted to actually deliver crude.

Another possible explanation is additional selling of crude by producers in attempt to free up some storage space for crude that is currently being produced. It could have led to a situation when producers were even eager to pay someone to take the crude away from them so they can avoid production shutdowns (it is often very costly to shut down production).

Summing up, there were almost 16k contracts left at the end of the session yesterday, which equaled to 16 million barrels of oil. Assuming that all of those were long positions, there is an urgent need to find storage for 16 million barrels.

Where delivery issues came from?

Economic slowdown, massive oil supply and finally coronavirus pandemic caused the biggest oversupply on the oil market in history. Situation exerted big downward pressure on prices and led to significant contango. Producers and investors prefer to store crude and sell it later into the future at a higher price. In turn, global storage facilities are filling up.

It is estimated that the United States has free space to store 180-280 million barrels. Assuming that stockpiles rise by an average of 10 million barrels per week and production and demand will remain unchanged, storage space will run out in half a year or sooner. The word on the street is that available global storage ranges between 0.9 to 1.8 billion barrels. In case demand halts and production remains at 100 million barrels per day, all of the available storage space will be filled within 9 to 18 days. Given an oversupply of 10 million barrels this will, of course, take 10 times longer. In theory, there are no reasons to panic yet. However, the situation looks different when we take a look at Cushing, United States.

Cushing is the main point of settling oil futures and deliveries in the United States. It is also one of the biggest storage hubs in the United States and almost every oil pipeline links to this place. This is also the place where many of the pipelines running to the biggest refineries or storage centers start. This place sees the highest interest in storage services due to the ability of selling oil very fast.

It turns out that available storage space at Cushing is really running out. It is estimated that as much as 90 million barrels can be stored at Cushing but due to technical and logistical reasons this figure sits closer to 76-80 million barrels.

Over the past 2 weeks oil stockpiles at Cushing were increasing by around 6 million barrels per week. Assuming that the situation will continue at this magnitude and maximum storage capacity is 80 million barrels, available space at Cushing will run out in the next 4 weeks!

Oil stockpiles at Cushing are increasing rapidly. They are off the 5-year highs but at this pace available storage could run out very soon. Source: Bloomberg

Oil stockpiles at Cushing are increasing rapidly. They are off the 5-year highs but at this pace available storage could run out very soon. Source: Bloomberg

Additionally, a few other factors should be mentioned that could explain why there are no buyers of oil. US refineries do not demand as much oil as demand dropped and pipeline transfer capacity is limited as well.

What does it mean for future prices?

In theory, the market should not worry too much about the expiring contract. On the other hand, there is a high chance that situation will repeat in the future. If short-term storage problems persist and prices continue to fall, there is a chance for the problem to magnify in the future. Jun20 WTI contract price dropped to as low as $11 per barrel at one point of the session. The worst may be yet ahead of us, as the big US oil ETF - USO - holds around 20% of open interest in the Jun20 contract and it is expected that it will be over to future series between May 5 and May 8. Ongoing declines could be an attempt to front-run massive selling USO will be making.

In our opinion, the situation will improve once demand starts to rebound or such rebound will start to be anticipated. Expectations of declining stockpiles would allow near-term contracts to recover and limit contango on the market.

Oil price crates amid lack of available storage space in the short-term. Source: xStation5

Oil price crates amid lack of available storage space in the short-term. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

Three markets to watch next week (09.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.