Oil prices are clearly being weighed down by a strong dollar index at 20-year highs and fears of a global recession causing a drop in demand for crude. Currently, 2022 is among the 6 most volatile years in the oil market over the past 30 years. The price of brent crude dropped below $84 per barrel today:

- The oil market will hold its breath on October 5, when OPEC and OPEC+ meet. At the previous meeting, the groups reached an agreement in the form of a small production cut. A decision to drastically reduce production could theoretically support a price increase. On the other hand, OPEC+ is still deciding below its production target, so further cuts might not have a significant impact on actual;

- Data published last week indicated that OPEC+ countries failed to produce even 3.58 million barrels per day (target) in August, indicating an even greater shortfall than in the previous month;

- Global oil stocks are still relatively low after losses in 2021, when OPEC+ producers failed to keep up with increasing production for the massive demand resurgence after the pandemic. Additionally, sanctions on Russia could further hit available supply and petroleum products. The recession in Europe and the US could also affect China and dampen demand (decline in orders) for oil even if COVID restrictions are lifted in the Middle Kingdom;

- On the other hand, this is contradicted by the Baltic Dry Index, which tracks dry freight prices on the 20 most popular trade routes. The index has risen nearly 100% since the beginning of the month, which could herald resurgent demand in the global economy and more intensive trade, which could support a potential rebound in oil prices. As a rule, the index declines when trade between countries slows, which is reflected in the falling price of freight;

- An EU sanctions package banning Russian oil sales is set to begin in December under the G7 plan, which could tighten crude supply. Bloomberg reported Monday that the EU is having trouble agreeing on a cap on the price of crude, and unanimity has not been reached on the issue;

- If oil demand is not destroyed, it appears that 'black gold' still has a solid case for a rebound toward the psychological $100 per barrel limit. The physical supplier market remains tight, with physical crude prices diverging from the futures situation.

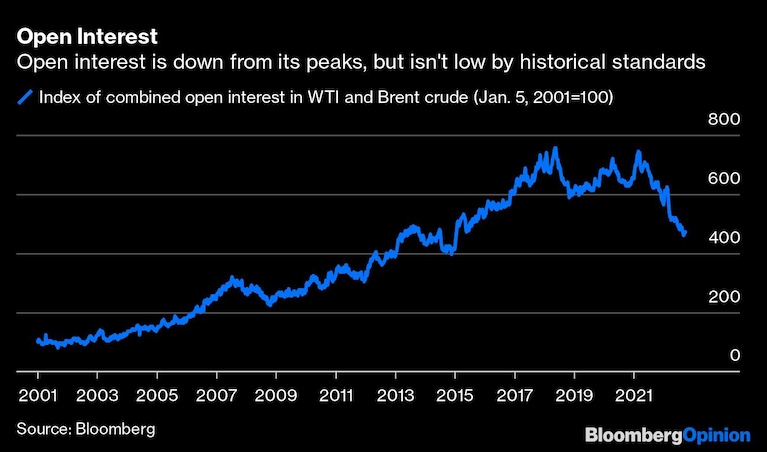

The number of open positions in the oil futures market has fallen, but historically looking is still at high levels. Source: Bloomberg

The number of open positions in the oil futures market has fallen, but historically looking is still at high levels. Source: Bloomberg

OIL chart, D1 interval. On the chart we can see how the 50-session average crossed the top of the 200-session average, which in technical analysis is referred to as a 'death cross', which usually heralds a prolonged weakening of demand and further declines. However, it is worth noting the high volatility of oil and the possible extended sanctions on Russian crude, which could further tighten supply and contribute to the rise in oil futures. Source: xStation5

OIL chart, D1 interval. On the chart we can see how the 50-session average crossed the top of the 200-session average, which in technical analysis is referred to as a 'death cross', which usually heralds a prolonged weakening of demand and further declines. However, it is worth noting the high volatility of oil and the possible extended sanctions on Russian crude, which could further tighten supply and contribute to the rise in oil futures. Source: xStation5

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.