Oil is trading higher today, with Brent (OIL) advancing 1.2% and WTI (OIL.WTI) trading around 1.6% higher at press time. The move higher is a continuation of the rebound launched last week, and comes even in spite of OPEC lowering its global demand growth forecasts today. Growth forecast for 2024 was lower by 140 thousand barrels per day, while forecast for 2025 saw a 70 thousand barrels downward revision. Group explained that the revision was driven by deterioration in outlook for Chinese oil demand growth. However, growth is still expected to remain 'healthy'.

New OPEC global demand growth forecast

- 2024: +2.11 million barrels per day, down from previous forecast of +2.25 million bpd

- 2025: +1.78 million barrels per day, down from previous forecast of +1.85 million bpd

The move higher today can be blamed on geopolitics as tensions in the Middle East remains high and the feared Iranian response to assassination of Hamas leader in Teheran is yet to come. Fox News came out with a report today saying that Iran and its proxies in the region may launch a large missile attack on Israel within the next 24 hours. However, it should be said that there have been a number of such warnings from news outlets in recent days.

Near-term outlook for oil will depend on the scale of Iranian attack and damage it causes. If the majority of missiles are intercepted by Israel and its allies, as was the case in April, then Israeli response will likely be limited and the Middle East should avoid broader conflict, at least for now. However, if the attack causes significant damage, then it is more likely than not that Israel will retaliate with significant force as well, which would trigger an Iranian response, and the situation in the region could escalate into an all-out war between Israel and Iran.

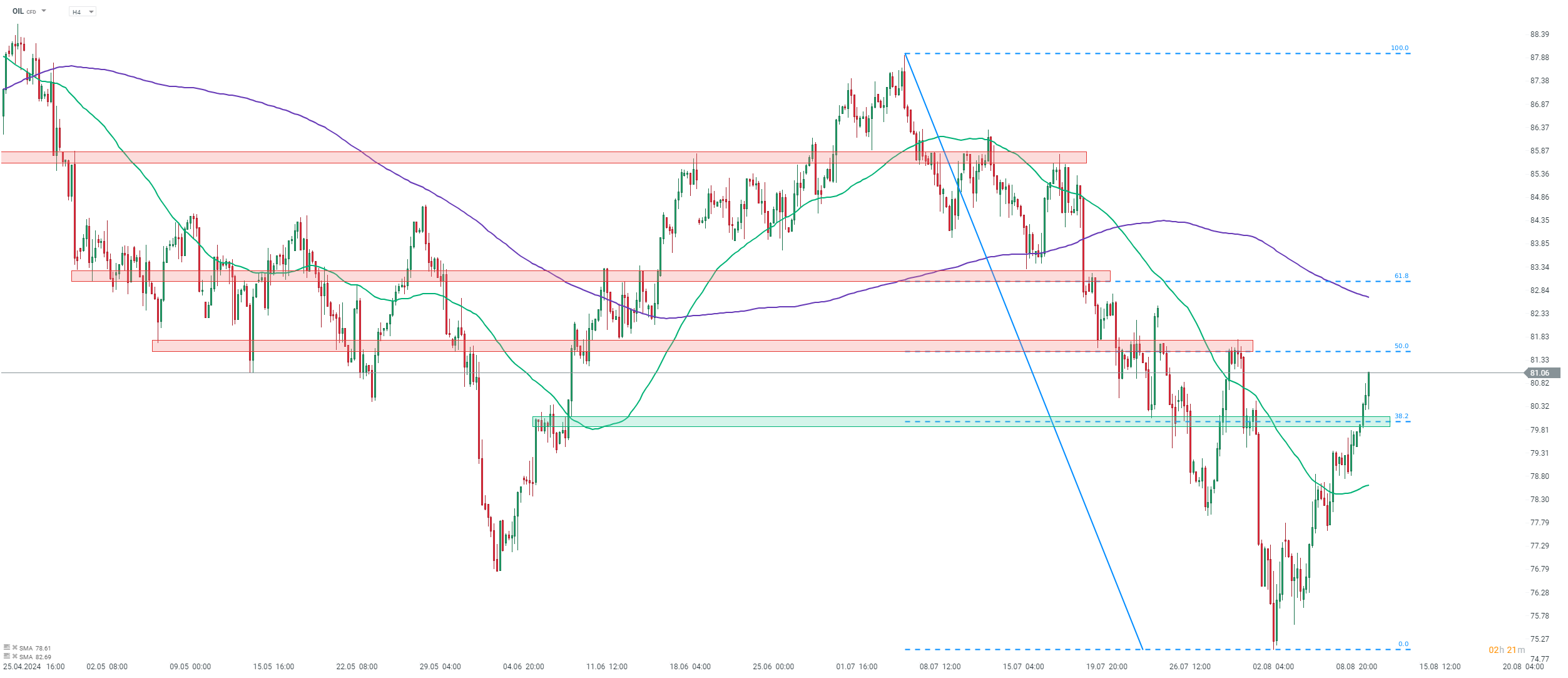

Taking a look at OIL chart at H4 interval, we can see that price is trading around 8% above last week's lows and is making a break above the $81 per barrel mark at press time. A potential near-term resistance zone to watch can be found in the $81.50 area, where the 50% retracement of the downward move launched at the beginning of July can be found.

Source: xStation5

Source: xStation5

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.