Oil prices jumped yesterday on the news that Libya plans to halt all oil production and exports, and announce force majeure at all oil fields and refineries. This has sent Brent (OIL) above $80 per barrel and to the highest level since August 16, 2024. However, those moves are being partially retraced today with Brent dropping back below $80 per barrel. Today's pullback can be justified with news that US sees smaller risk of Israel-Hezbollah war as no escalation followed a weekend exchange of fire. The other reason behind oil weakness are continued concerns over global demand amid weakness in global economy.

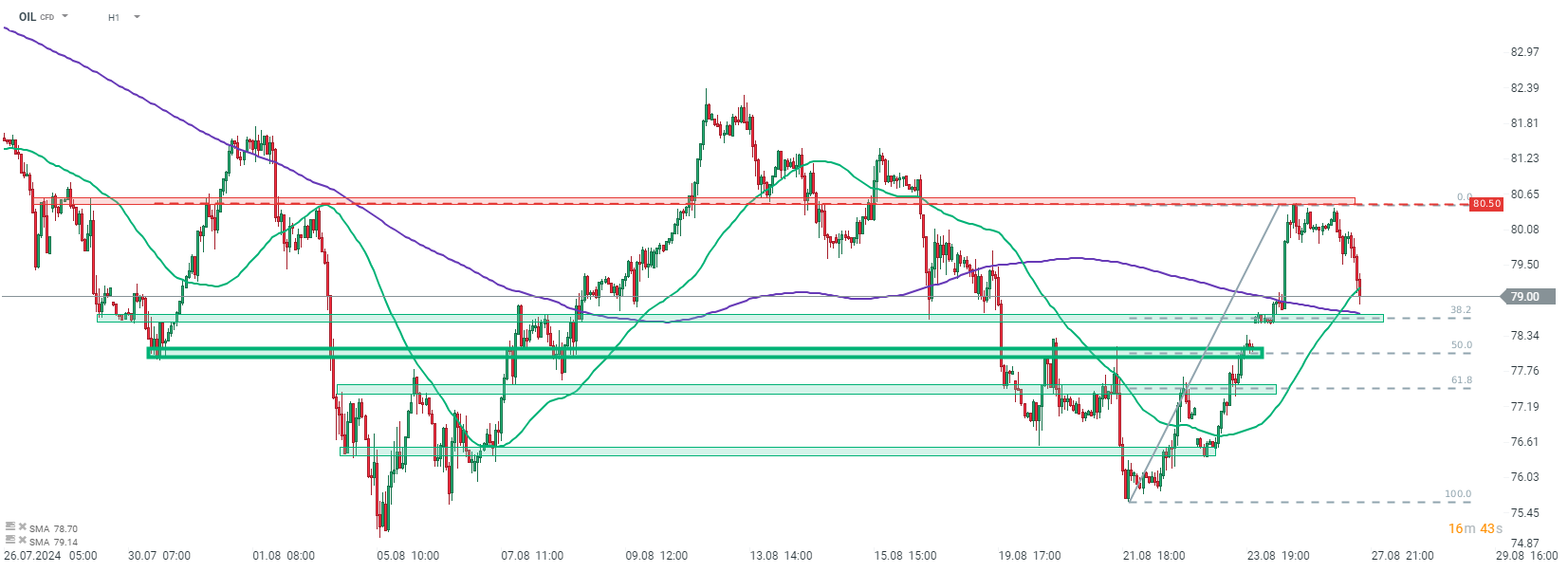

Taking a look at OIL at H1 interval, we can see that the price tested resistance zone ranging above $80.50 per barrel yesterday, but failed to break above. Oil is pulling back today, dropping around 1.3% at press time and returning below $80 mark. Bears are now attempting to push the price below 50-hour moving average (green line) in the $79 per barrel area. Should they succeed, the near-term support to watch can be found in the $78.60 area, where the 200-hour moving average (purple line) and 38.2% retracement of recent upward impulse can be found.

Source: xStation5

Source: xStation5

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

Three markets to watch next week (09.02.2026)

Market update: recovery takes hold, but investors remain on edge

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.