The New Zealand dollar is today a victim of low inflation in Australia. Inflation in Australia fell today for May to 5.6% year-on-year (YoY) with an expected 6.1% YoY and a previous level of 6.8% YoY. The Australian Bureau of Statistics has been publishing monthly data for over a year, but from a market perspective, the quarterly index still seems to be more important. This index for Q1 was 7.0%. Why is the NZD falling harder today than the AUD?

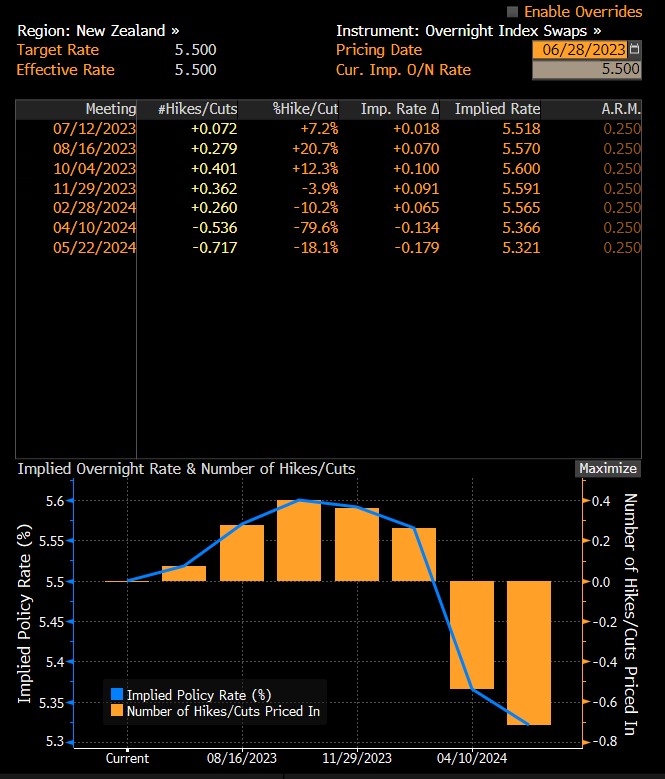

The CPI index for Q1 in New Zealand was 6.7% YoY, which may indicate that inflation for Q2 in this country will fall even more. Of course, it's worth remembering that the RBNZ has already announced that it will not raise rates, but the market indicated that after the recent surprise from the RBA, BoC, BoE or Norges Bank, the RBNZ could also return to rate hikes. However, inflationary trends suggest that the RBNZ will likely keep rates unchanged at 5% during the decision on July 12. Currently, the market sees only a 7% probability of a hike, and by the end of this year, it values a maximum of 10 basis points increase. Meanwhile, despite a clear drop in inflation in Australia or Canada, there the valuations of rate hikes are significantly higher.

NZDUSD is falling today to its lowest level since June 8. It is rare for a daily change in a G10 currency pair to exceed 1%. Meanwhile, AUDNZD recently fell to 1.0800, but the pair is currently recovering losses. Stronger declines in NZDUSD can be seen as a delayed movement compared to the fairly strong shock of AUDUSD at the end of last week. The NZDUSD pair is currently testing around 0.6000 and may be planning to test the 50.0 retracement of the last major upward wave. The pair remains within a rather weakly inclined downward trend channel.

Expectations for RBNZ rate movements. Source: Bloomberg

Source: xStation5

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.