Summary:

- RBNZ cuts its OCR by 50 bps, surprising market participants expecting a 25 bps rate reduction

- Governor Orr has not rule out further cuts along with the use of unconventional tools

- NZ dollar tumbles dragging the Aussie dollar down, markets are still hungry for subsequent rate cuts

Ahead of the curve

The Reserve Bank of New Zealand took market participants by surprise when it delivered a stunning 50 basis points rate cut in conjunction with a dovish statement. The consensus had called for a 25 basis points, hence a market reaction was tremendous and the decision saw immediately the kiwi tumbling. During a press conference Governor Adrian Orr did not rule out further action and even hinted at unorthodox policy. Moreover, he suggested that rates might have to be cut even below zero, but today’s substantial cut reduced this risk of such a scenario. That is a shocker for NZD traders as well as other market observers because subsequent rate reductions seem to be on the cards when the global economic outlook darkens further in the year. In its statement the RBNZ wrote “Growth has slowed over the past year and growth headwinds are rising. In the absence of additional monetary stimulus, employment and inflation would likely ease relative to our targets”. On top of that, Orr signalled that a rate cut as big as 50 bps was in line with the bank’s forward guidance and that the bank pondered over either 25 bps or 50 bps rate reduction at this meeting when analysing the pros and cons of both. The bank justified its decision by saying that more stimulus sooner was better to reach objectives. At the same time, the RBNZ cut its GDP forecasts and now it expects the economy to expand 2.7% during the year through March 2020, down from 3.2% seen previously. In turn, inflation is forecast to rise 1.4% this year compared to 1.6% previously and it is not expected to strike the goal until the final three months of 2021. The current RBNZ projections assign just a small probability of further rate cuts (the average OCR is forecast to drop to 0.91% in the fourth quarter of 2020), however, interest rate traders have already priced another 25 bps rate cut in almost 80% before the year-end. In our view, by doing rates so much the RBNZ wanted to get ahead of the curve predicting other central banks to act soon.

Markets shocked

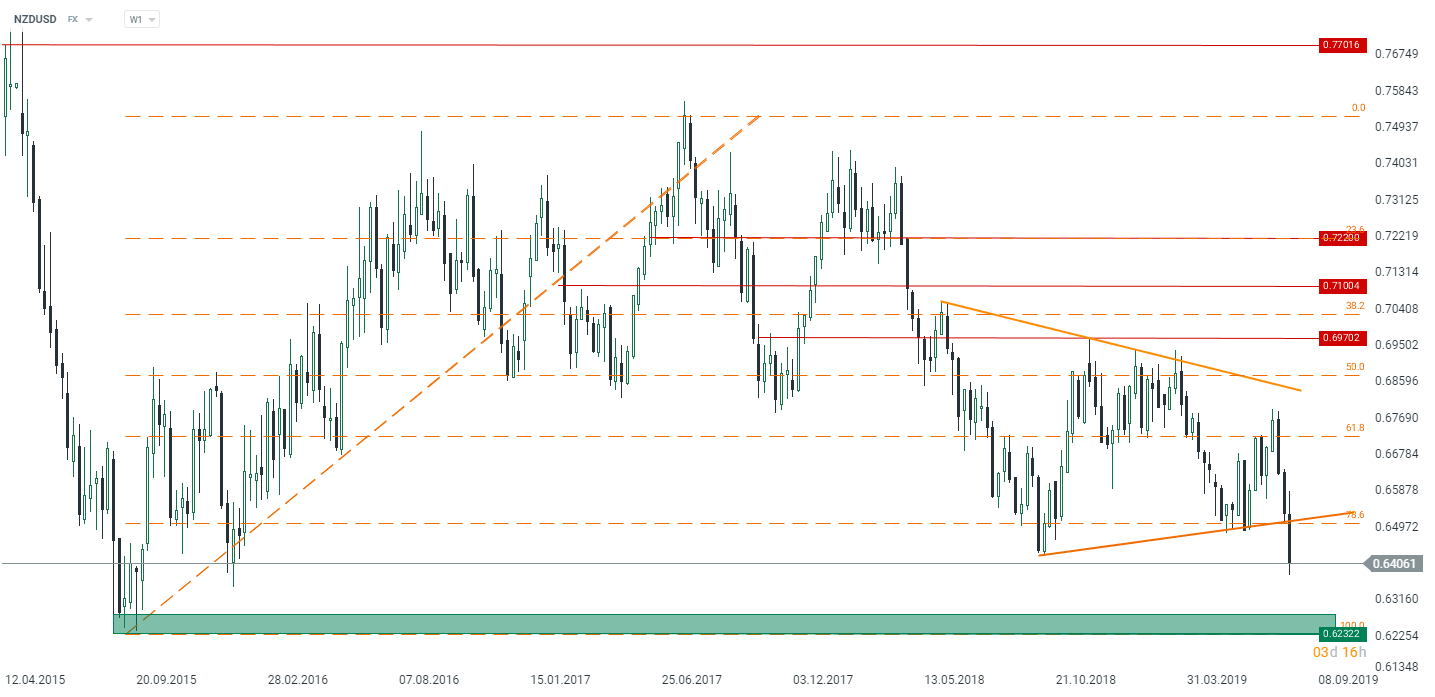

In response to the RBNZ decision the NZ dollar has tumbled and it is trading 1.8% down against the US dollar at the time of preparing this commentary. Gloomy mood surrounding the kiwi is also seen in the Australian dollar being down roughly 0.7% against the greenback as the massive rate cut in New Zealand may exert pressure on the RBA to follow (it held rates unchanged yesterday). Looking at the chart below one may notice that bulls could be doomed to failure seeing that there is no meaningful support until the lows from September 2015, implying a more than 2% decline from the current levels.

The NZDUSD has tanked on the shocking 50 bps rate cut delivered by the RBNZ. Source: xStation5

The NZDUSD has tanked on the shocking 50 bps rate cut delivered by the RBNZ. Source: xStation5

In the other news:

-

Asian indices trade mixed today with Hang Seng falling 0.3% and NIKKEI falling 0.4% while Shanghai Composite is rising 0.3% and S&P/ASX200 is going up 0.7% supported by the weak Aussie

-

Construction PMI from Australia for July came in at 39.1, down from 43, reaching its 6-year low

-

PBoC set the USDCNY reference point at 6.9996 compared to 6.9683 on Tuesday, the new point is still below the spot

-

German industrial output fell 1.5% MoM, the consensus had called for a 0.5% MoM decline

Daily Summary - Powerful NFP report could delay Fed rate cuts

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.