Nvidia (NVDA.US) joins a select group of companies reaching a trillion dollar valuation.

The company founded exactly 30 years ago, in Santa Clara (California) in 1993, has achieved what very few listed companies have achieved in the history of financial markets, reaching a stock market valuation of 1 trillion dollars. Which means for those who are not aware of the figure, a one ahead "1" and the astonishing amount of 12 zeros "0" behind (1,000,000,000,000$).

Although this figure was maintained for a short period of time, because investors took the opportunity to collect part of the benefits (it rose 29% after its results). Nvidia maintains the upward trend from the October lows with a revaluation of 287.85% from this reference, to the new ATH at $419.38 per share.

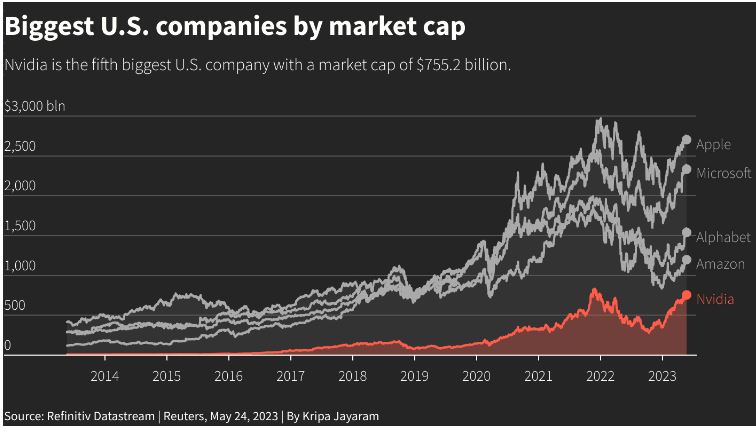

By the time the price reached $405.85, Nvidia's capitalization exceeded $1 trillion. Only a few stocks maintain their price above one trillion, namely Apple ($2.7 trillion), Microsoft ($2.4 trillion), Saudi Aramco ($2 trillion), Alphabet ($1.6 trillion) and Amazon ( $1.2 trillion) retain status. Although it must also be remembered that Tesla in October 2021 was also part of this exclusive league and that in turn made Elon Musk the first person to reach a waalth of 300$ billions.

This was Nvidia's market capitalization just before its results. Source: Refinitiv

Returning to Nvidia, the company offered mixed results:

- Revenue: $7.190 million vs. $6.520 million forecast (Refinitv) (19% decrease YoY)

- Earnings Per Share (EPS): $1.09 vs $0.92 estimated (FactSet)

- Net profit: $2.040 million vs. $1.620 million in the first quarter of 2022 (decrease 20% yoy, +24% qoq)

- Data Center Revenue: $4.280 million vs. $3.890 million forecast (FactSet) (14% increase YoY, 18% increase QoQ)

- Gaming revenue: $2.240 million vs. $1.970 million expected (FactSet) (38% decrease YoY, +22% QoQ)

- Professional viewing revenue: $295 million (down 53% from prior year, up 31% quarterly)

- Automotive segment revenue: $296 million (114% increase YoY, 1% increase QoQ)

Let's leave aside the following data, because it was this that made the company's price explode. Nvidia CEO Jensen Huang was very positive about what is expected of AI developments in both the medium and short term. When indicating that the expected income for the technology company was 53.85% above the market consensus:

- Revenue estimate for Q2-2023: $11 billion vs. $7.15 billion estimate (Refinitiv)

This was the moment in which the price, in extended hours, soared up 29%.

Nvidia results by business segment. It can be seen that the revenue share on the data center side has increased significantly in recent years. They now account for the majority of revenue, whereas just 2 years ago they dominated gaming revenue. Until recently, the demand for cloud computing services and now also the technology revolution related to AI are supporting the performance of the company, related to chips for data centers. The market sees the company as the main 'beneficiary' of AI among semiconductor manufacturers. Source: Reuters, Nvidia

You can read more about Nvidia in our analysis of the company before the results (HERE) and in our extended analysis after its results (HERE).

The market received the report itself, as well as the comments on the development of the company's business, with euphoria. In fact, all possible comments were made from the side of the company which subsequently favored the bulls. From increased demand for chips for AI applications, competitive advantages, to a shift towards high-margin sales of complete AI supercomputer systems for large enterprises.

The market shrugged off the double-digit year-over-year decline in revenue and net profit, mainly highlighting positive guidance, a higher quarter-on-quarter rate and outperforming in key business segments. CEO Jensen Huang stressed that companies are starting to compete with each other to apply generative AI to every possible product, business process and service;

At the product level, the company announced the launch of four platforms that combine the company's inference software with Nvidia's latest Ada, Hopper and Grace Hopper processors. It also announced the debut of GeForce RTX 4060 GPUs, which use Nvidia's advanced Ada Lovelace and DLSS technology. As well as a significant increase in the number of projects aimed at the automotive sector.

Along with Nvidia, other companies related to the AI and semiconductor trend, including AMD (AMD.US), Intel (INTC.US), Arista Networks (ANET.US), Micron (MU.US) or Taiwan Semiconductor Manufacturing (TSM.US) (you can read our analysis HERE), benefited from the scenario proposed by Nvidia and its stock market behavior.

Now, Nvidia's corrections after reaching new all-time highs continue to keep the price above previous levels, forging a consolidation that keeps bulls on their toes. Source: xStation.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.