Nvidia (NVDA.US) shares are trading down more than 1% ahead of the U.S. market open after executives at UXL, which is backed by Intel (INTC.US), Alphabet (GOOGL.US) and Qualcomm (QCOM.US), told Reuters that they are in the process of preparing technical specifications for AI software to compete with Nvidia's AI services, later in the first half of 2024. Executives from the three US giants have indicated that the obvious goal is to fight market dominance and take market share away from UXL technology. The announcement may signal a bit more caution on Wall Street, and while the AI market appears to be huge, concern about maintaining huge margins may put some short-term pressure on Nvidia's stock.

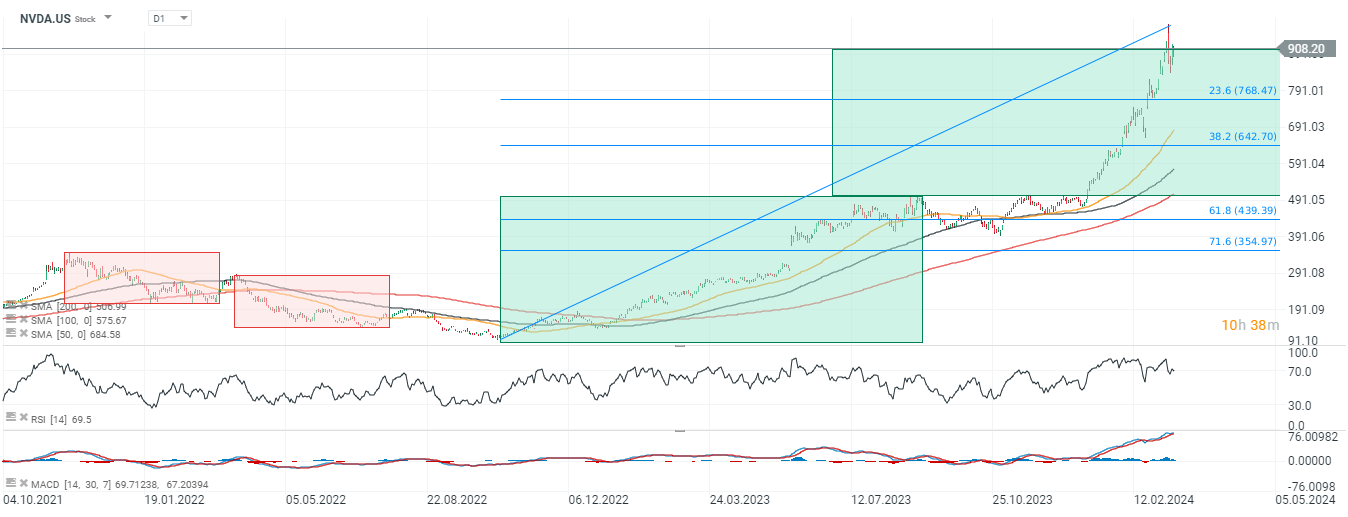

Nvidia shares (D1 interval)

Looking at the magnitude of the recent upward impulse, we see that it was slightly larger than the previous upward movement, but it seems that the scenario of consolidation after strong increases may continue. The first significant resistance is the level around $770, where we see the 23.6 Fibonacci retracement of the 2022 upward wave.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.