- Nvidia is the clear leader in the hardware vendor segment in the development of artificial intelligence and cloud. GPU card market share exceeds 80%

- The company intends to introduce new products in the near future. The company's CEO indicates that the competition is far behind.

- However, the competition is growing. The competitor is not only AMD or also Intel, but also Amazon or Microsoft, which also plan to open production of their own chips for artificial intelligence

- Nvidia faces major geopolitical risks due to strong cooperation with Taiwanese semiconductor manufacturer TSMC

- Board members sell shares worth $250m

Key conference for the company coming up on 18 March

An important conference for developers related to artificial intelligence will take place on 18 March. The GTC conference is being hosted by Nvidia and the event is expected to showcase further important products from the company. The company is expected to show an update of its chips called B1000 and N100, Ethernet switches and plans for 'edge' artificial intelligence and the use of this technology in PCs and smartphones. The company is also likely to refer to the monetisation of its cloud or also the automotive or gaming sector.

The global market related to AI chips was estimated until recently at less than USD 250 billion, while already forecasts for the next three to five years indicate a market of USD 250-500 billion. At the moment, Nvidia owns the majority of this market, although this may change.

Growing competition

AMD or Intel are trying to catch up with Nvidia, although according to the company's current CEO, even if competitors gave away their chips for free, customers would still continue to buy from Nvidia. Nonetheless, it seems that the biggest risk is coming from the company's biggest customers, although of course the risk is much delayed. Companies leading the way in providing cloud solutions such as Amazon, Google Cloud and Microsoft are expected to have plans to develop their own Chips, which Taiwanese semiconductor manufacturer TSMC could help them with. Orders from Microsoft and Meta accounted for 1/4 of Nvidia's total orders in the last two quarters, which may cause these companies to look for alternatives. Microsoft already boasts its own processors that are optimised for GPT models from OpenAI. Amazon, on the other hand, which is also a significant Nvidia customer is working with UK-based Arm, which is also a rising chip star.

Geopolitical risks

TSMC is the largest semiconductor manufacturer in the world and is therefore also the largest supplier to Nvidia. In the event of production or supply problems, Nvidia could fall behind in delivering finished processors to the market. Moreover, the lack of access to the Chinese market, due to the US technology export ban, may limit Nvidia's growth prospects.

Insiders sell shares

Tench Coxe, who has been on the company's board since 1993, recently sold 200,000 shares he has held since 1997, before the company went public. The shares were acquired for 82 cents! In total, board members and other insiders have recently sold their shares for $250 million.

Still high valuations

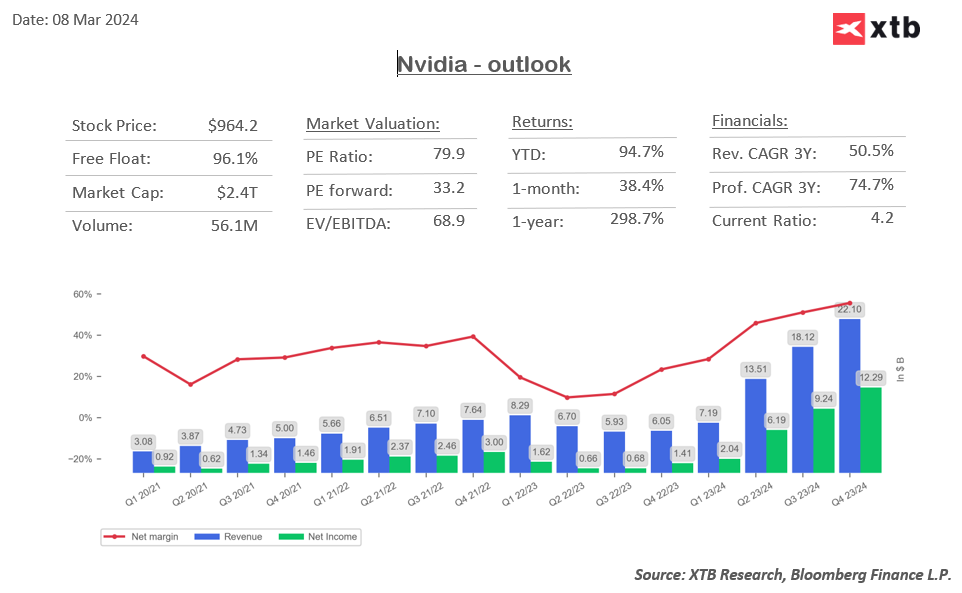

Jeremy Siegel, a well-known US economist, believes that the company could almost triple its value in the coming years from its current $2.3 trillion, which would be expected to surpass giants such as Microsoft and Apple. In his view, the company is following a similar growth trajectory to Cisco from the dot-com bubble period, but is only at the very beginning, not the end as some are comparing. Siegel points out that the bubble is not yet in sight and the companies are presenting forward PE values half that of growth companies during the dot-com bubble.

BofA, on the other hand, raises its forecast for the company today, pointing to the positive impact of the upcoming conference. The target price for the company is raised to USD 1100 from USD 925 per share.

The company currently boasts revenues of more than $20 billion per quarter, but given that the AI chip market is expected to be worth more than $250 billion in three to five years, and Nvidia still owns the lion's share of that market, high valuations don't seem like much at all. The company presents a relatively low forward PE of around 33. Source: Bloomberg Finance LP, XTB

The company currently boasts revenues of more than $20 billion per quarter, but given that the AI chip market is expected to be worth more than $250 billion in three to five years, and Nvidia still owns the lion's share of that market, high valuations don't seem like much at all. The company presents a relatively low forward PE of around 33. Source: Bloomberg Finance LP, XTB

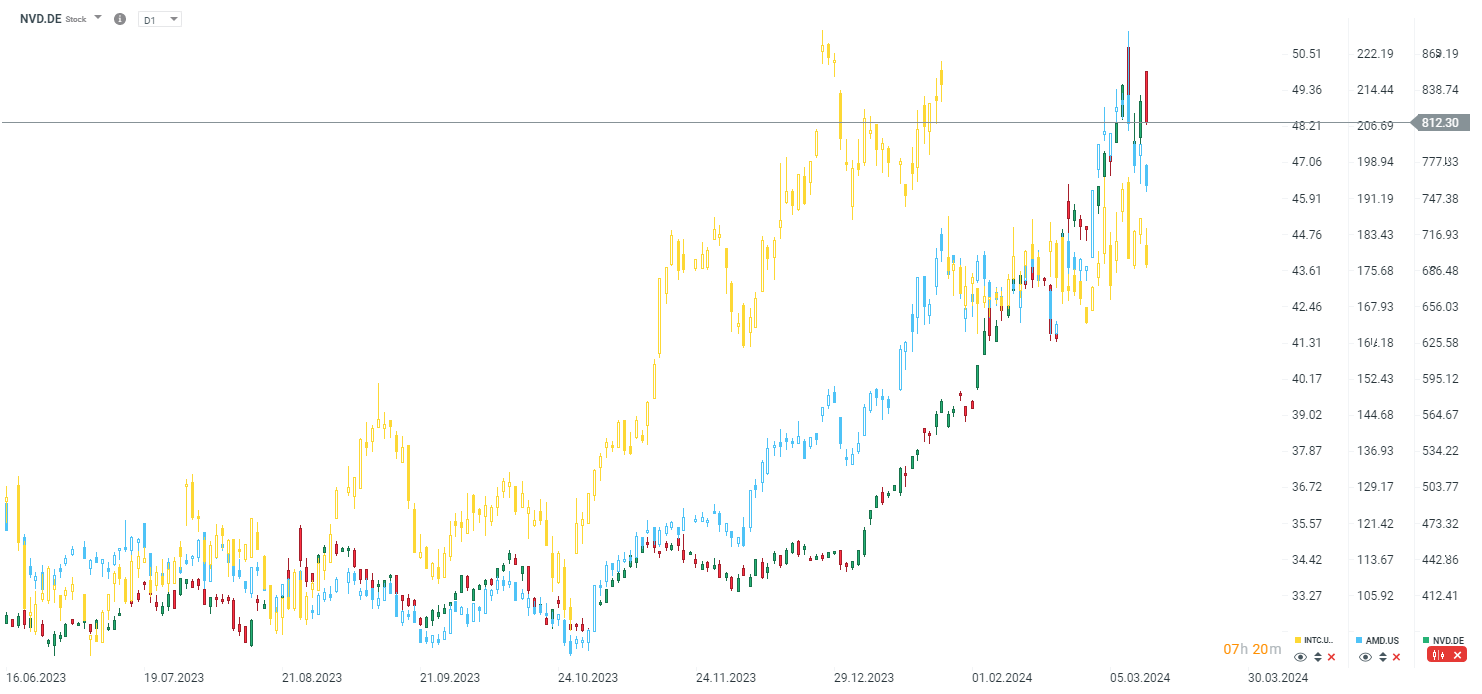

The company's shares are down today after a positive opening, but the key is to hold around $750 per share. If this level were to be permanently pierced, then the correction could reach as high as $600 per share. On the other hand, the levels of $1000-1100 per share at the current price action seem not far away. Source: xStation5

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

NFP preview

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.