Novavax (NVAX.US) reported higher-than-expected revenue for the third quarter, primarily due to U.S. government grants for clinical trials. Despite a year-over-year decline in revenue, from $734.58 million to $187 million, the company is focusing on optimizing these grant opportunities. To address the smaller-than-anticipated COVID-19 vaccine market, Novavax has reduced its liabilities and is preparing to cut costs by an additional $300 million in 2024.

Management expects the U.S. market for COVID-19 vaccines to demand 30 to 50 million doses in the 2023-2024 season. They also highlighted that over 15 million people in the U.S. have received updated COVID-19 shots, which is lagging behind the previous year's vaccinations.

Novavax has secured broad access to its COVID-19 vaccine across U.S. pharmacies and has received authorization for its updated vaccine. The company has already made significant cost reductions, cutting operating expenses by 47% compared to the previous year, and is on track to exceed its global restructuring and cost reduction plan. Moving forward, Novavax is focused on initiating a cost reduction program targeting over $300 million in 2024, maintaining financial stability, and advancing its vaccine technology.

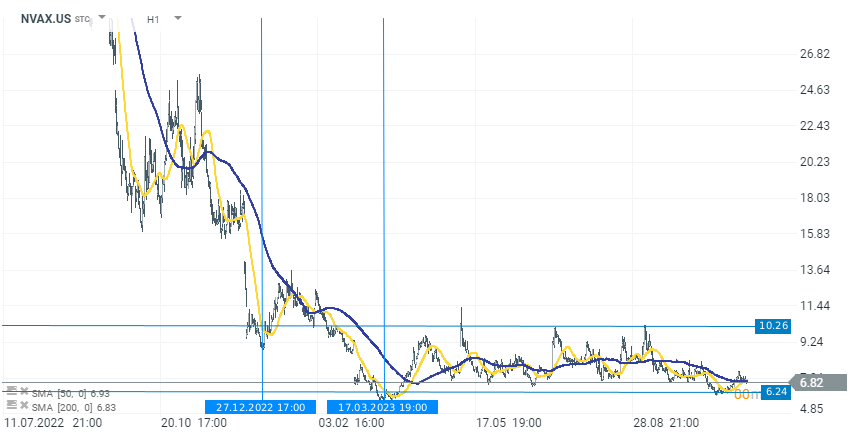

Looking at the chart technically, Novavax's (NVAX.US) price has been in a sideways channel since the beginning of this year fluctuating between $6.20 per share and $10.20 per share. Compared to 20221, the stock is trading lower by a glaring -98%. Today after the results, the stock is gaining 1.40% before the market open. Source xStation 5.

Kongsberg Gruppen after earnings: The company catches up with the sector

Market wrap: European indices attempt a rebound after Wall Street’s record selloff 🔨

Is a recovery on the cards? A deep dive into why bitcoin is weighing on tech stocks

Morning wrap: Tech sector sell-off (06.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.