Summary:

-

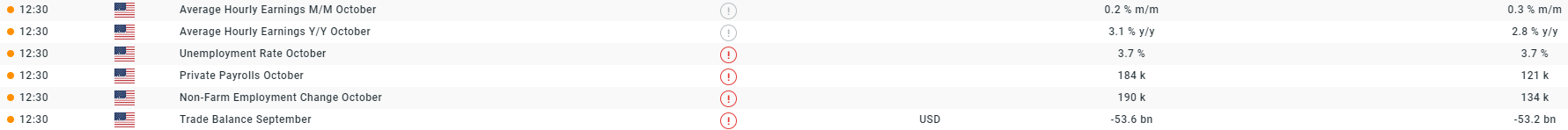

US jobs report to be released at 12:30 PM GMT

-

Employment change exp at 190k. Average earnings Y/Y: 3.1%

-

USD, Gold and US indices all sensitive to the release

The monthly US jobs report known as non-farm payrolls is always one of the main economic events on trader’s calendars and the release this lunchtime will likely garner even greater attention due to its proximity to Tuesday’s Midterm elections. There’s been some pretty strong moves in the markets of late with US indices surging up to their highest levels of the week on hopes of a thawing in the frosty US-Chinese relations on trade. It appears likely that these developments are more than coincidental given the short space of time to the Midterms and Trump’s propensity to use stock market gains as a gauge of his economic policy. There are 3 key aspects to the jobs report that attract traders attention with the non-farm employment change and average earnings often seen as the most important.

The non-farm employment change for October is expected to bounce back to 190k after 134k seen previously. Average earnings are also expected to rise in Y/Y terms to 3.1%. Source: xStation

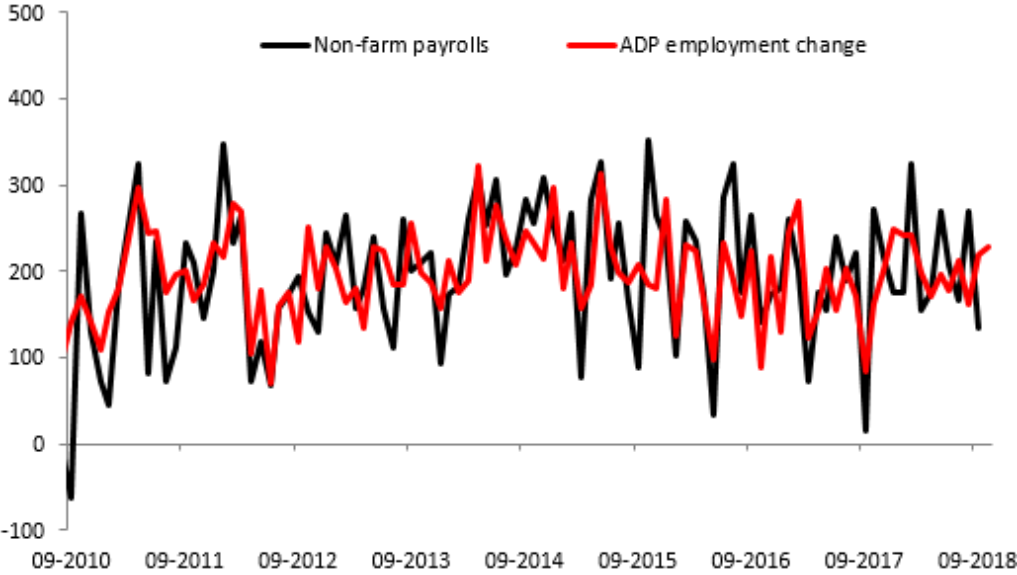

The September data for employment change was the lowest since March with bad weather and storms negatively impacting the labour market. These short term events often lead to a bounce back in the not too distant future but there’s been more adverse weather last month with Hurricane Michael. The ADP release on Wednesday came in above a forecasted 188k at 227k, but the prior reading was revised lower by 12k to 218k. Yesterday’s ISM manufacturing PMI disappointed and the employment index also fell to 56.8 from 58.8 prior.

The latest ADP figure came in above forecasts on Wednesday. These private payrolls have historically had a good correlation with NFP, but it is worth pointing out that they have been far less volatile in recent months. Source: XTB Macrobond

Looking at average earnings these are predicted to rise strongly in y/y terms but decline in m/m. This is unusual but can be explained from base level effects with last October’s earnings number coming in pretty low, and now this rolls from the present year to the previous one it will provide a boost.

The expected rise in average earnings Y/Y is due to last October’s figure being so low. It will no longer be included in the present year from today’s release and instead be in the prior so provides a double boost to the reading. Source: XTB Macrobond

Let’s now look at the market and here are 3 charts that could be worth watching over the release, USDIDX, US500 and Gold.

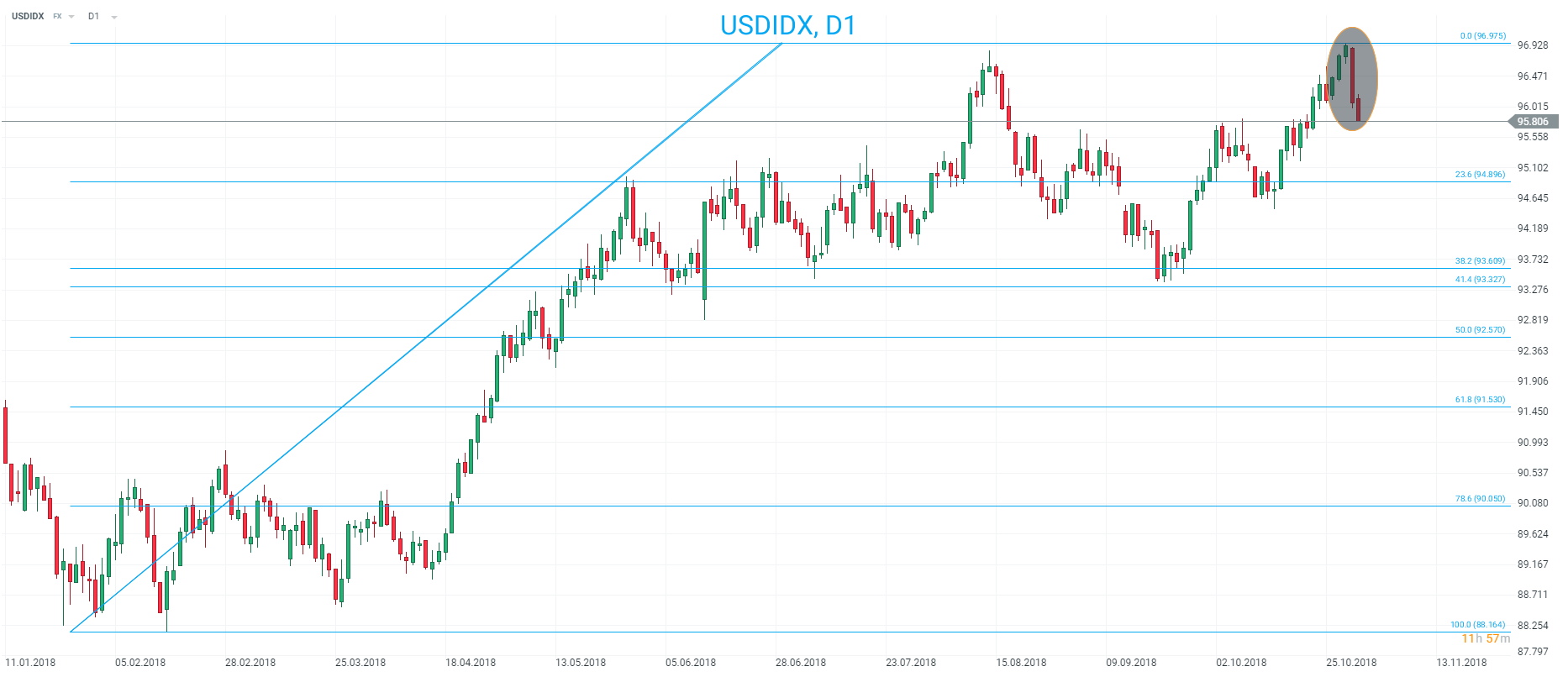

USDIDX

The USDIDX has pulled back rather sharply from its 2018 peak around the 97 level and this is now an obvious place to look for possible resistance. Fib retracements of the rally from the Jan low can offer targets to shorts or possible support for longs with the 23.6% at 94.90. Should price fall below there the 38.2%-41.4% region could be of particular interest with the 93.61-93.33 zone previously acting as a swing level. Source: xStation

US500

Hopes of a trade US-China trade deal have boosted stocks with the US500 breaking above the 61.8% fib at 2740 to hit its highest level in almost 2 weeks. This could now act as support. As for resistance recent highs around 2765 coincide with the mid-Oct lows while the 78.6% fib is at 2777. Source: xStation

Hopes of a trade US-China trade deal have boosted stocks with the US500 breaking above the 61.8% fib at 2740 to hit its highest level in almost 2 weeks. This could now act as support. As for resistance recent highs around 2765 coincide with the mid-Oct lows while the 78.6% fib is at 2777. Source: xStation

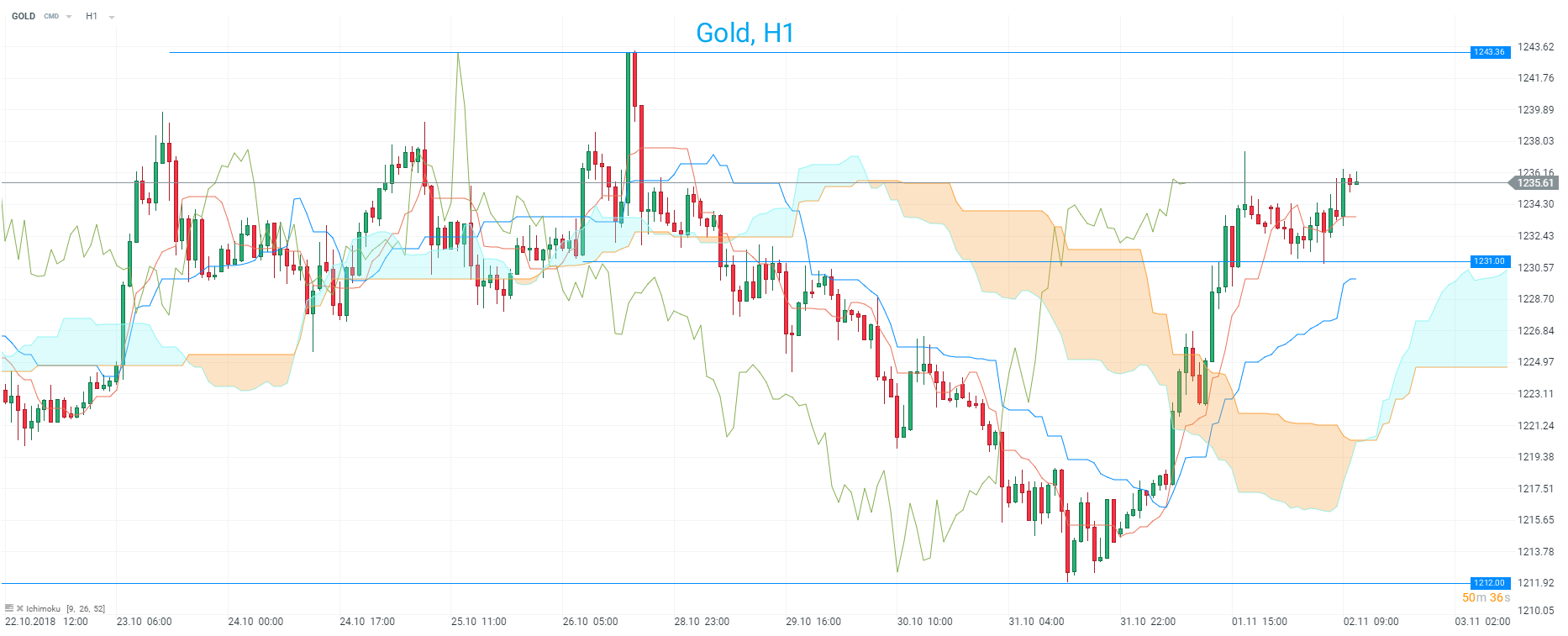

Gold

Gold enjoyed a strong push to the upside on Thursday and the market has remained bid despite the risk-on moves elsewhere. Price is back above the H1 cloud and could look to retest the 1243 and even go above if there’s a disappointment in NFP. Source; xStation

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.