- High expectations ahead of the NFP report

- Traders should pay attention to wage data

- USD looks stretched heading to the report

The NFP report is always the highlight even when the dominating story is something else – like the coronavirus this time around. The US dollar has been surging since the beginning of the year and the NFP could a reality check on this trend. Traders should focus on those 3 things:

1. The headline number

After a weak report for December (+145k) the consensus officially sees a modest improvement (+165k) but actual expectations are much higher after a stellar ADP report (+291k). ADP is strongly correlated with NFP but on month to month basis it’s been less reliable lately than in the past and ISM employment indicators actually deteriorated in January. Still, a reading below 170-180k would be considered a disappointment.

2. Wage growth

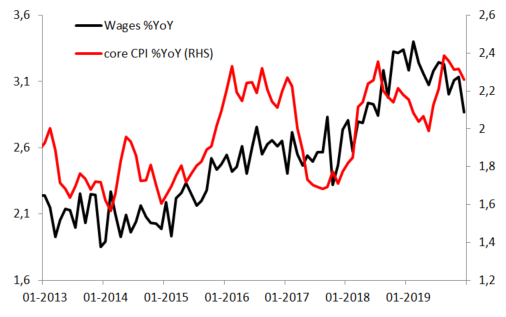

2. Wage growth

While employment gains continue push unemployment rate lower (currently 3.5%) wage growth stalled in 2019 and actually has been slowing down lately. Should wage growth accelerate towards 4% the Fed would be under pressure to raise rates again so the data is key for the dollar. Market consensus sees improvement to 3%.

3. USDCAD

There are 2 NFP reports today at 1:30pm GMT – in the US and Canada. After a strong report last month investors expect a modest increase in employment (15k). USDCAD has been rising lately on USD strength and declining oil price but the pair sees a strong resistance zone just above 1.33. If the zone is about to keep the pair in the long-term range traders need to see a weaker US report and/or stronger report from Canada.

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

Politics batter the UK bond market once more, as Starmer remains under pressure

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.