National Bank of Sweden (Riksbank) rises interest rates by 25 bp to 4.25%.

The Riksbank has raised its policy rate by 0.25 bp to 4% in an effort to curb persistently high inflationary pressures in the Swedish economy. This move, combined with decreasing energy prices, aims to stabilize inflation around the 2% target. The bank's forecast suggests that there could be further rate hikes in the future.

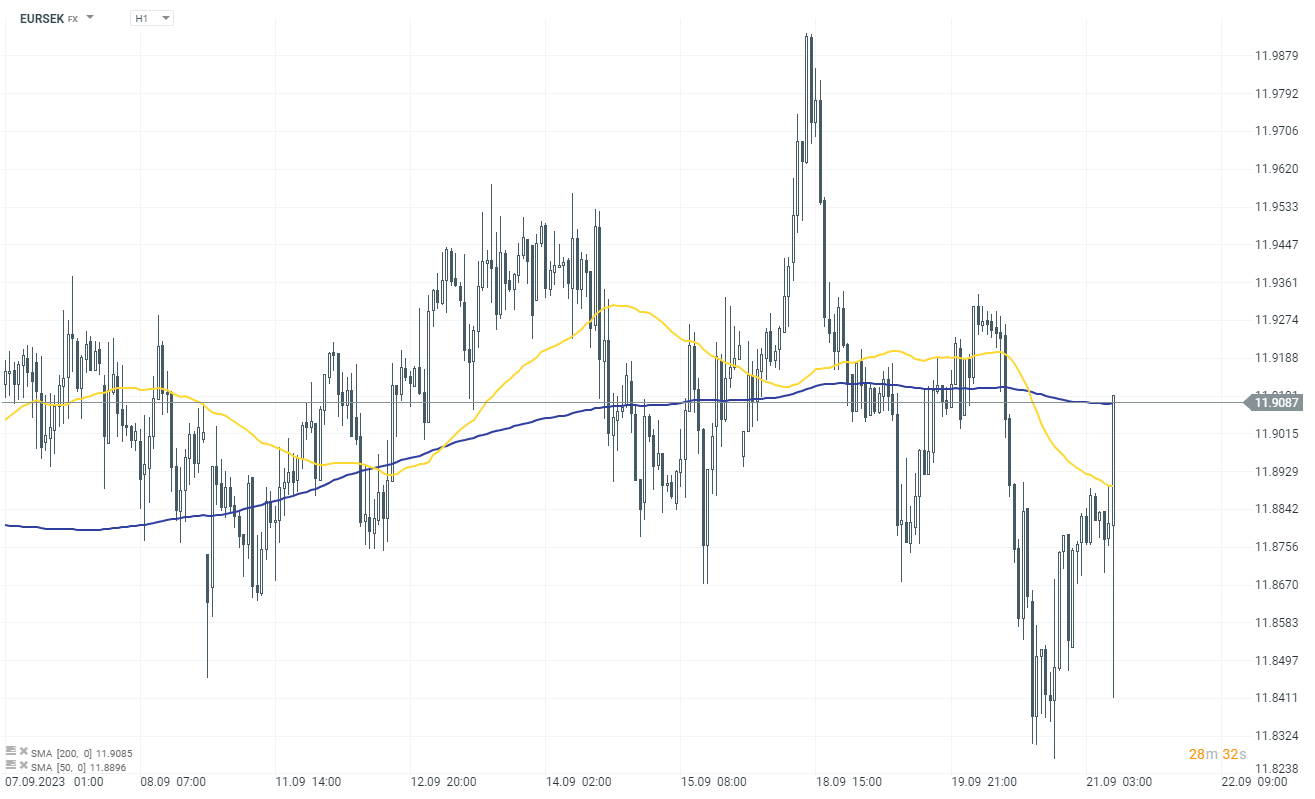

The market reaction is somewhat contrary to the decisions of Riksbank. Since rates are higher now, the SEK should appreciate. The Swedish krona's initial depreciation could be a result of the Riksbank's decision to hedge a portion of its foreign exchange (FX) reserves by selling 8 billion USD and 2 billion EUR in exchange for Swedish kronor. This process will start on September 25, 2023, and is expected to take four to six months to complete. The move is intended to curb potential losses for Riksbank in the event of the krona appreciating, and is not motivated by monetary policy objectives.

Source: xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.