US natural gas prices were dropping at the end of the previous week and the move was deepened at the beginning of this week with a bearish price gap. Price has recovered off the daily lows but continues to trade below the range of a recent consolidation.

Drop in prices is driven primarily by concerns over excessive supply in the United States as well as in Europe as winter period draws to a close. Natural gas stockpiles in Europe are over-60% full while the 5-year average for the period is just 44%. Situation in the United States looks similar with inventories sitting well above the 5-year average. However, it should be noted that stockpiles should be even higher given such a mild winter as we experienced this year.

US natural gas stockpiles sit well above the 5-year average. Source: Bloomberg, XTB Research

Taking a look at key US heating regions, we can see that weather in the United States remains relatively mild for this period of the year. End-of-February period will likely mark an end to a period when "extreme weather anomalies" may occur. Source: Bloomberg

Taking a look at key US heating regions, we can see that weather in the United States remains relatively mild for this period of the year. End-of-February period will likely mark an end to a period when "extreme weather anomalies" may occur. Source: Bloomberg

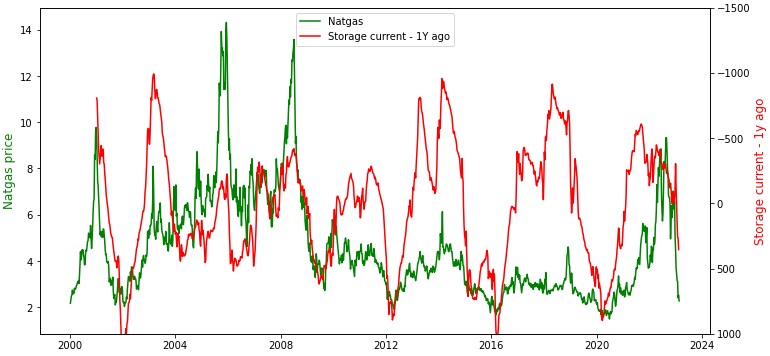

Analyzing deviation of inventories from 5-year average we do not see any extremely high levels. Nevertheless, comparing stockpiles to levels from a year ago, we can see quite a significant increase. So-called 'comparative stockpiles' justify further drops on the NATGAS market. Simultaneously, this data is far off showing a contrarian signal that could be used by bulls.

Comparative inventories keep rising (inverted axis). Nevertheless, they would need to climb to 600-800 area (last year's levels) for a strong contrarian signal to be generated. Source: Bloomberg, XTB Research

Comparative inventories keep rising (inverted axis). Nevertheless, they would need to climb to 600-800 area (last year's levels) for a strong contrarian signal to be generated. Source: Bloomberg, XTB Research

However, price alone suggests that natural gas may be oversold already as suggested by 1- and 5-year standard deviations. Source: Bloomberg, XTB Research

NATGAS broke below the lower limit of a trading range but remains close to it. It should be noted that historically painting a move's low during consolidation was also marked with some false, lower breakouts. Nevertheless, fundamentals remain strongly negative for prices therefore a move lower and forming a new bottom as low as in the $2 per MMBTu area cannot be ruled out. Source: xStation5

NATGAS broke below the lower limit of a trading range but remains close to it. It should be noted that historically painting a move's low during consolidation was also marked with some false, lower breakouts. Nevertheless, fundamentals remain strongly negative for prices therefore a move lower and forming a new bottom as low as in the $2 per MMBTu area cannot be ruled out. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

Three markets to watch next week (09.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.