U.S. natural gas (NATGAS)-based futures are gaining nearly 3% today on higher temperature forecasts that could drive demand for electricity generated by burning gas to fuel air conditioning. Moreover, weak year-on-year production data and lower-than-expected inventories have undercut sentiment of an oversupplied market after an unusually mild winter that decimated demand.

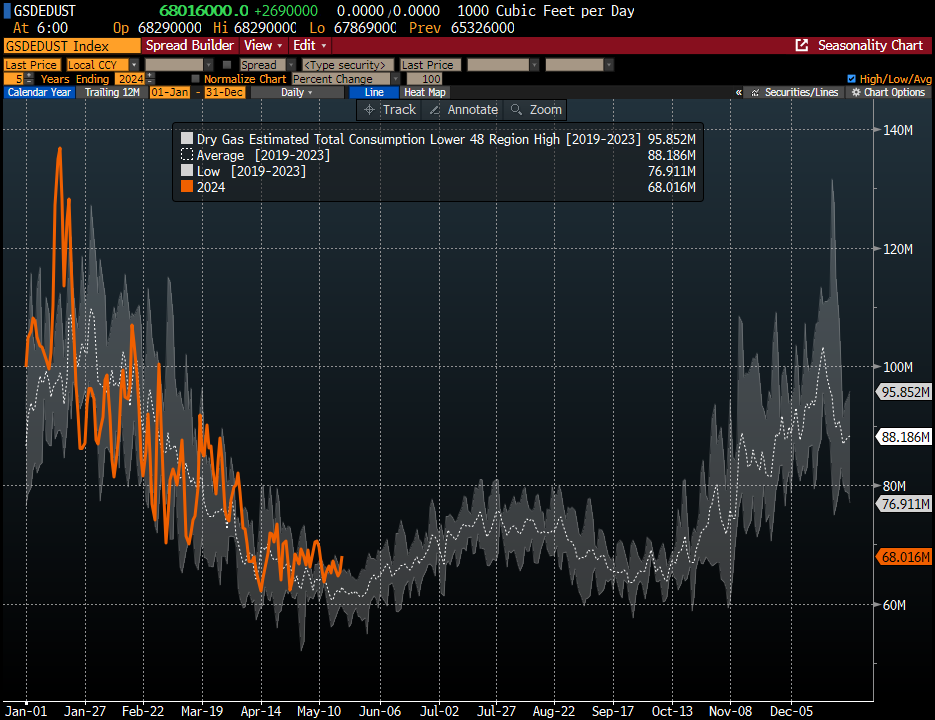

Demand for natural gas in the continental U.S. zone is now climbing above a five-year trading range showing the seasonality of demand for the commodity.

Demand for natural gas in the continental U.S. zone is now climbing above a five-year trading range showing the seasonality of demand for the commodity.

Source: Bloomberg Financial LP

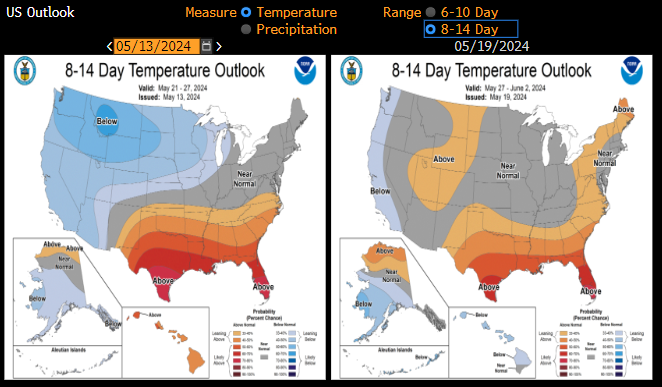

Early hot weather in Texas further bolstered upward movements in contracts. Source: Bloomberg Financial LP

NATGAS is trading at its highest levels since the beginning of the second half of January this year. The most important support point in the short term all the time may remain the 200-day EMA (gold curve on the chart). If the increases continue, the $3 zone could be an interesting test point for the buyers' side.

NATGAS is trading at its highest levels since the beginning of the second half of January this year. The most important support point in the short term all the time may remain the 200-day EMA (gold curve on the chart). If the increases continue, the $3 zone could be an interesting test point for the buyers' side.

Source: xStation

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.