Shortly after the publication of the Dallas Fed index for April (which we wrote about at 16:40), retreat in the main US indexes and European index contracts was observed. Today's reading of regional activity data from the US showed a decrease to -23.4 points, with expectations of a decrease to -12 points and the previous reading at 15.7 points, which was a clear underperformance. This may indicate that the US economy is close to a recession, which in turn could raise questions about further interest rate hikes by the Fed.

Despite a fairly good start to the session on Wall Street, the technology-heavy Nasdaq is currently performing the worst, down about 0.65% on the day. Other indexes are also trading in negative territory.

Looking at the M15 chart just after the data release, the U100 index fell about 70 points, and the declines were then continued. We saw a retest of Friday's lows at 12,982 points and currently price is at 13,005 points.

US100 interval M15. Source: xStation5.

US100 interval M15. Source: xStation5.

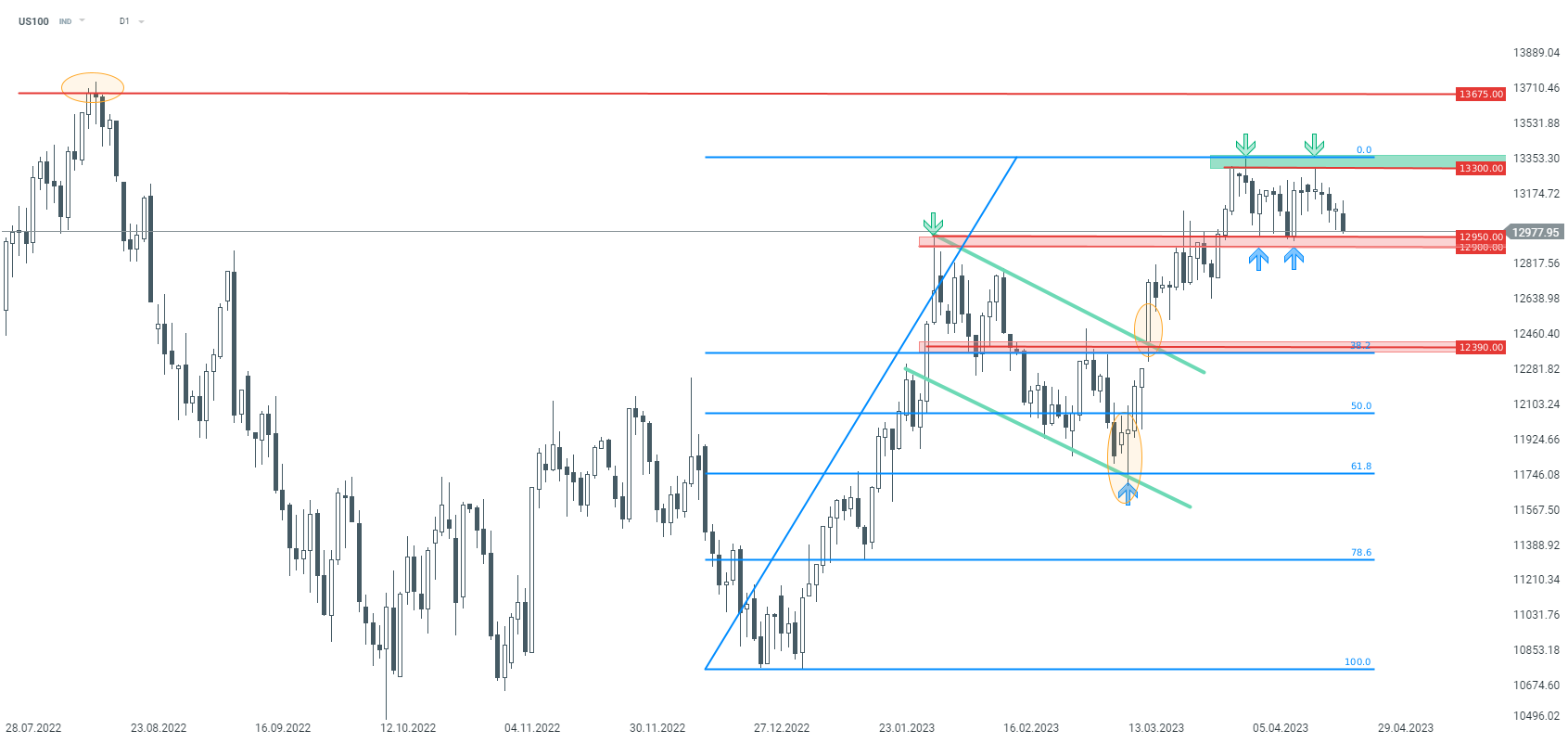

However, looking at the broader time frame, the US100 index remains in consolidation range between support at 12,900 points and resistance at 13,300 points. It seems that until we see a breakout in one direction, the base scenario is further consolidation at current levels. Nonetheless, a breakout up or down may be a pretext for a larger trend movement.

US100 interval D1. Source: xStation5.

Wall Street extends gains; US100 rebounds over 1% 📈

Market wrap: Novo Nordisk jumps more than 7% 🚀

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

The Week Ahead

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.