-

US indices finished yesterday's trading lower as moods remained sour following Powell's speech on Friday. S&P 500 dropped 0.67%, Dow Jones declined 0.57% and Nasdaq moved 1.02% lower. Russell 2000 dropped 0.89%

-

Indices from the Asia-Pacific traded mixed during a session on Thursday - Nikkei, Kospi and S&P/ASX 200 gained 0.7-1.1% while indices from China traded 0.7-0.9% lower

-

DAX futures point to a slightly higher opening of the European cash session

-

White House Press Secretary said that she expects slowdown in jobs growth and overall employment data to "cool off"

-

Chinese Premier Li Keqiang said that economic support right now is exceeding support policies from pandemic-hit 2020

-

According to a Bloomberg report, European Union is likely to meet its gas storage filling goals around 2 months ahead of a target. EU stockpiles are 80% full at the moment while it was not expected to happen before November 1, 2022

-

Japanese unemployment rate stayed unchanged at 2.6% in July (exp. 2.6%)

-

Australian building approvals plunged 17.2% MoM in July (exp. -2.1% MoM)

-

Cryptocurrencies are trading higher in an attempt to recover from recent declines. Bitcoin gains 1% and climbs back above $20,000 while Ethereum jumps 2.8%

-

Oil is trading a touch lower with Brent and WTI dropping around 0.2% each at press time

-

Precious metals are pulling back, although scale of declines is small. Gold drops 0.1% while silver and platinum trade 0.2% lower

-

JPY and CHF are the best performing major currencies while AUD and NZD lag the most

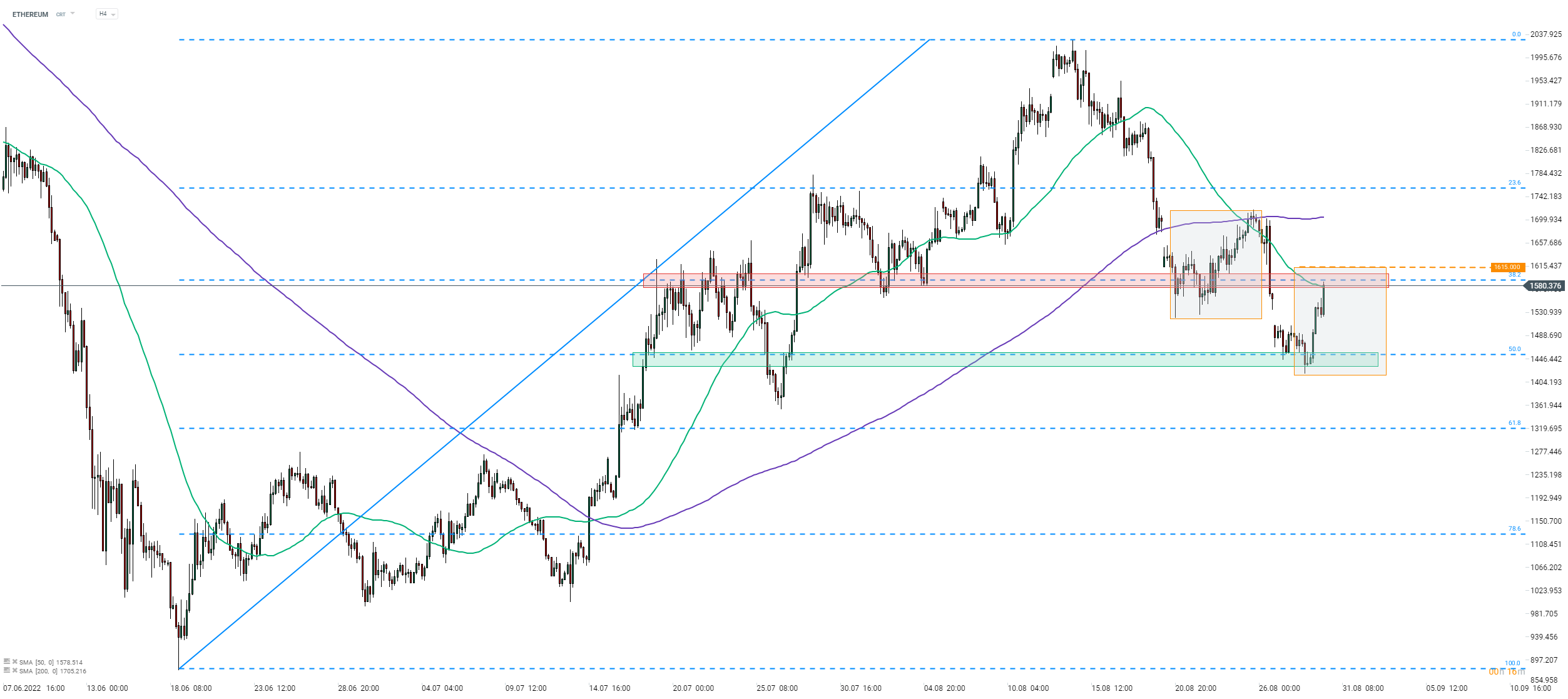

Cryptocurrencies are trying to recover from recent declines. Ethereum is approaching a key near-term resistance zone in the $1,600 area, marked with previous price reactions and the 50-period moving average (green line). Note that the upper limit of local market geometry can be found just slightly above the aforementioned zone. Source: xStation5

Cryptocurrencies are trying to recover from recent declines. Ethereum is approaching a key near-term resistance zone in the $1,600 area, marked with previous price reactions and the 50-period moving average (green line). Note that the upper limit of local market geometry can be found just slightly above the aforementioned zone. Source: xStation5

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

Morning wrap: Tech sector sell-off (06.02.2026)

Technical analysis: Bitcoin deepens decline falling to $66.5k 📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.