-

US indices finished trading significantly higher following the Fed decision. S&P 500 jumped 2.62%, Dow Jones gained 1.37% and Nasdaq rallied 4.06%. Russell 2000 added 2.39%

-

Stock market indices from the Asia-Pacific region gained as well but the scale of moves was not as big as on Wall Street. Nikkei gained 0.2%, S&P/ASX 200 moved 1% higher and Kospi jumped 0.7%. Indices from China traded up to 0.6% higher

-

DAX futures point to a slightly higher opening of the European cash session today

-

FOMC delivered a 75 basis point rate hike, in-line with expectations. While Powell sounded rather upbeat on the economy and said that US economy is not in a recession, he also hinted that pace and magnitude of rate hikes may have to slow down at some point

-

Powell also said that current rate levels (2.25-2.50%) can be seen as neutral and that Fed may move to meeting-by-meeting basis instead of providing clear guidance as it used to

-

According to Reuters report, People's Bank of China plans to issue low interest loans worth around $148 billion to support domestic real estate sector

-

Meta Platforms dropped almost 5% in the after-hours trading following the release of Q2 2022 earnings report. Company reported revenue at $28.8 billion (exp. $28.9 billion) and EPS at $2.46 (exp. $2.54). Net income was 36% year-over-year lower. CEO Mark Zuckerberg said that recession is already here and Meta needs to be more efficient with its resources

-

Australian retail sales increased 0.2% MoM in June (exp. 0.5% MoM)

-

Car production in the United Kingdom increased 5.6% YoY in June but output still remains around a third below 2019 levels

-

Cryptocurrencies rally for another day in a row. Bitcoin and Ethereum trade over 2% higher. BitcoinCash rallies around 10% on the day

-

Energy commodities and precious metals trade slightly higher, benefitting from US dollar weakening.

-

CHF and JPY are the best performing major currencies while AUD and USD lag the most

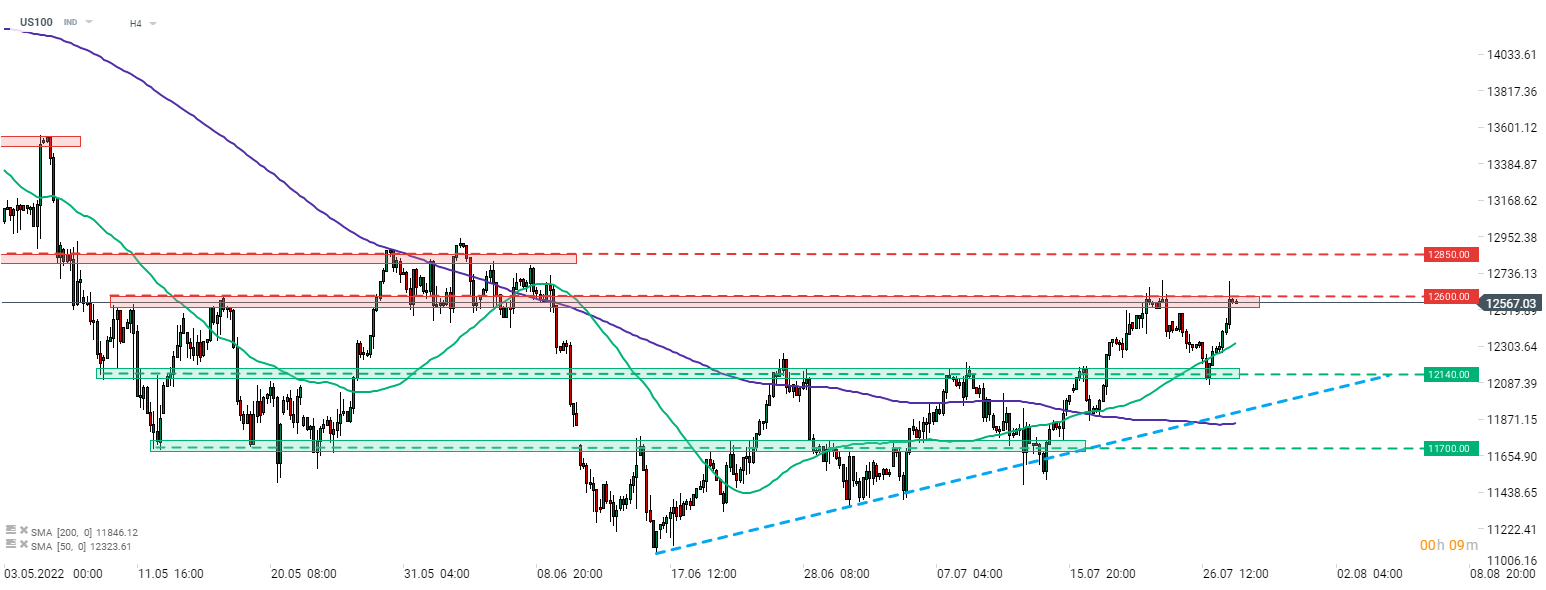

Nasdaq-100 (US100) rallied yesterday after Powell hinted that pace and size of rate hikes may need to slow. Index briefly traded above the 12,600 pts resistance zone but has pulled back below since. Source: xStation5

Nasdaq-100 (US100) rallied yesterday after Powell hinted that pace and size of rate hikes may need to slow. Index briefly traded above the 12,600 pts resistance zone but has pulled back below since. Source: xStation5

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

Wall Street extends gains; US100 rebounds over 1% 📈

Market wrap: Novo Nordisk jumps more than 7% 🚀

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.