-

US indices finished yesterday's trading mixed - S&P 500 gained 0.17%, Dow Jones added 0.55%, Nasdaq dropped 0.50% and Russell 2000 moved 0.15% lower

-

Biden used his speech yesterday to blame oil companies for high gas prices. US President warned that action undertaken, like SPR release, will have an impact but it will not be immediate

-

Stocks in Asia traded mixed today - Nikkei dropped over 1%, S&P/ASX 200 and Kospi moved around 0.1% lower while indices from China gained slightly

-

DAX futures point to a higher opening of today's European session

-

Reserve Bank of New Zealand hiked rates by 25 basis points. NZD moved lower as some market participants hoped for a 50 bp hike

-

New forecasts from RBNZ show cash rate rising from current 0.75% to 2% by the end of 2022

-

Flash Japanese manufacturing PMI for November jumped from 53.2 to 54.2 (exp. 53.5)

-

New Zealand will allow fully vaccinated visitors from Australia to enter the country from January 16, 2022

-

According to Goldman Sachs, coordinated SPR release announced yesterday is worth less than $2 per barrel

-

API report pointed to a 2.31 million barrel build in US oil inventories

-

Oil holds onto yesterday's gains made after the SPR release announcement from Biden. WTI trades near $79 per barrel while Brent tested $81.50 area

-

Precious metals and industrial metals are trading higher

-

GBP and JPY are the best performing major currencies while NZD and CAD lag the most

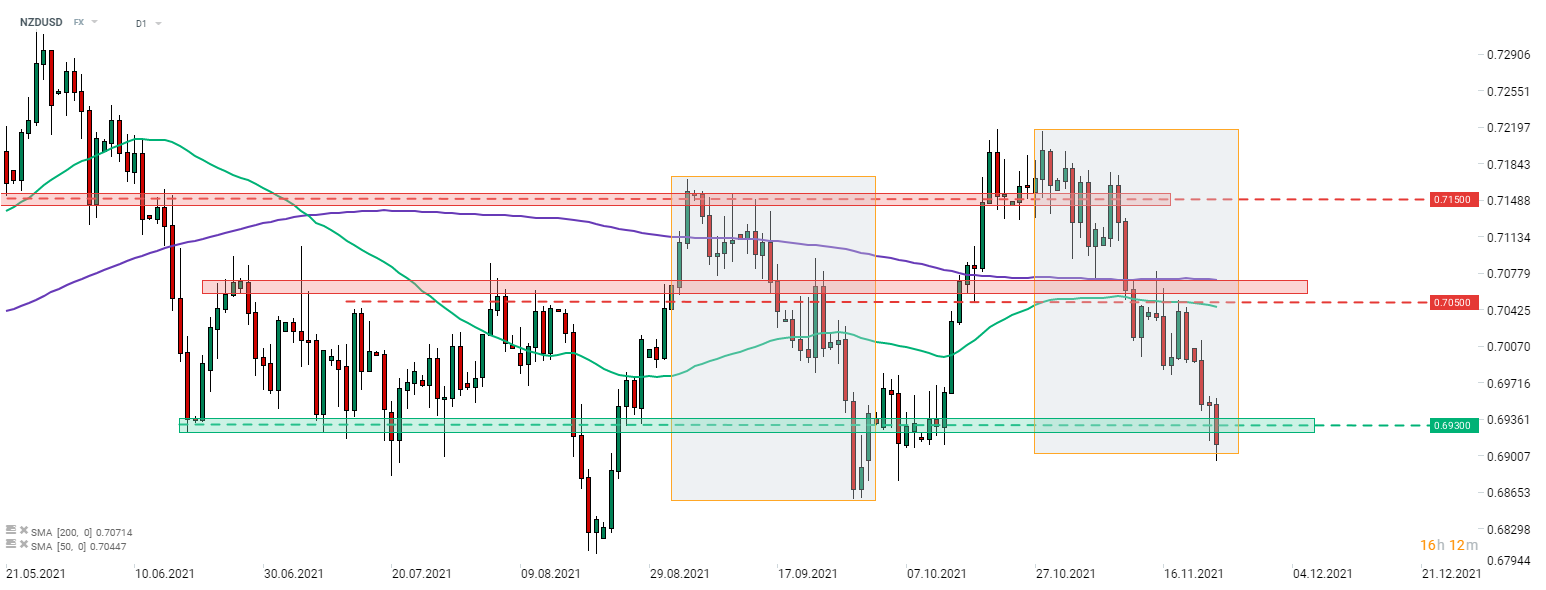

While NZDUSD has been pressured recently by USD strength, today the pair is moving lower on the back of NZD weakness. RBNZ delivered a 25 basis point rate hike but some hoped for a 50 bp move. The pair tested the lower limit of the Overbalance structure in the aftermath of today's RBNZ rate decision. Source: xStation5

While NZDUSD has been pressured recently by USD strength, today the pair is moving lower on the back of NZD weakness. RBNZ delivered a 25 basis point rate hike but some hoped for a 50 bp move. The pair tested the lower limit of the Overbalance structure in the aftermath of today's RBNZ rate decision. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.