-

US indices seesawed during the session yesterday but ultimately finished the day lower. S&P 500 dropped 0.13%, Dow Jones and Nasdaq moved 0.15% lower and Russell 2000 dipped 0.22%

-

Indices from Asia-Pacific region traded higher today. Nikkei gained 0.2%, S&P/ASX 200 added 0.5% while indices from China traded 0.2-1.4% higher. Kospi was a laggard, dropping 0.5%

-

DAX futures point to a more or less flat opening of the European cash session

-

According to Reuters report, G7 leaders will discuss energy and food issues during the upcoming meeting as well as ways to increase pressure on Russia

-

Credit Suisse says that Chinese fiscal stimulus that may amount to $1.5 trillion in infrastructure spending will have a big impact on the global economy, especially on Chinese trading partners like Australia

-

Citi sees 50% chance of US recession as higher interest rates and elevated inflation are putting drag on consumer spending and economic output

-

Japanese manufacturing PMI dropped from 53.3 to 52.7 in June (exp. 53.5)

-

Australian manufacturing PMI ticked higher from 55.7 to 55.8 in June

-

API report pointed to a 5.61 million barrel build in US oil inventories (exp. -1.35 mb)

-

Oil deepened yesterday's drop during the Asian session today. However, those losses were erased already and now Brent and WTI trade flat on the day

-

Cryptocurrencies trade higher on Thursday morning. Bitcoin gains 2% and returns above $20,000

-

Precious metals trade mixed - gold and silver drop while palladium and platinum gain

-

EUR and JPY are the best performing major currencies while AUD and NZD lag the most

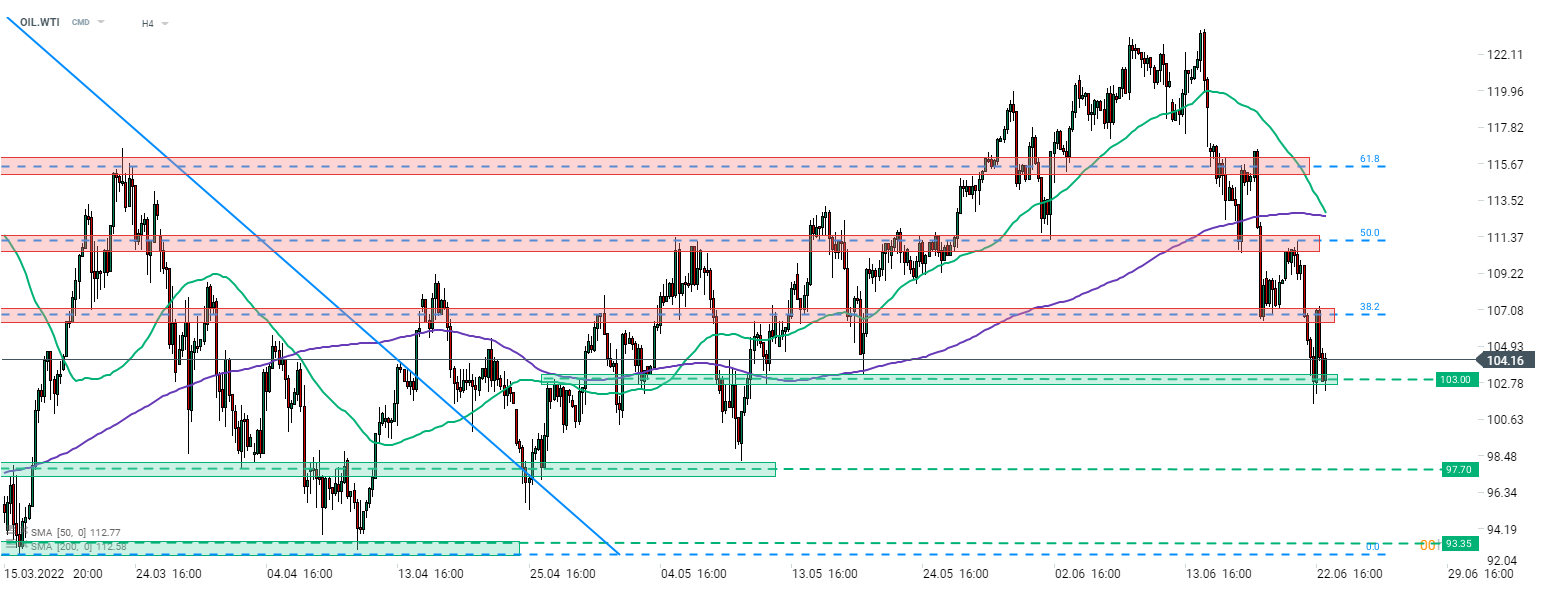

WTI (OIL.WTI) deepened declines during the Asian session, following a big and surprising inventory build signalled by API report. However, bulls managed to recover from the drop and now WTI trades flat on the day. Source: xStation5

WTI (OIL.WTI) deepened declines during the Asian session, following a big and surprising inventory build signalled by API report. However, bulls managed to recover from the drop and now WTI trades flat on the day. Source: xStation5

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

Three markets to watch next week (09.02.2026)

Market update: recovery takes hold, but investors remain on edge

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.