- U.S. indexes failed to recover yesterday and closed the session lower. The S&P 500 lost 0.5%, the Dow Jones lost 0.3%, and the Nasdaq closed the session 1.3% lower at 14,850 points. The Russell 2000 retreated the least where declines reached 0.2%.

- Asia-Pacific indices traded mostly lower - Japan's Nikkei closed the session 0.7% lower, the ASX retreated nearly 1.5%. Indexes in China are not trading today due to a national holiday.

- Australia's trade balance unexpectedly fell to NZD 45 mln vs. NZD 236 mln previously and NZD 350 mln forecasted. AUDUSD loses almost 0.5%.

- Noguchi of the BoJ indicated that the weak Japanese yen is hurting households through price increases but is also bringing additional benefits in the form of increased foreign profits and domestic tourism

- DAX index futures point to slightly lower opening of European session

- Speaking in Congress, Powell indicated that the pause in the hike cycle is temporary and stressed the need for further tightening given

- The Fed chair indicated that balance sheet reduction has been accelerating recently, but stressed that the Fed will continue to assess the risks of the ongoing cycle for the economy as the full effects of the policy are yet to be seen.

- Moody's expects US consumer strength to weaken as the year progresses

- Raphael Bostic of the Fed indicated that rates should remain unchanged until the end of the year and if the economy does not slow down, the Federal Reserve will have to reconsider further policy

- Austan Goolsbee of the Fed conveyed that it has not yet made a decision on the July decision but for services inflation to weaken a cooling of the labor market will be needed, which at this point remains extremely resilient and tight

- Lisa Cook of the Fed stressed that economic growth may slow but commodity prices and supply chains still pose risks to inflation

- Thomas Jefferson of the Fed reported that the Fed is constantly monitoring the situation in commercial real estate and the progress of banks' credit tightening policies

- U.S. Treasury Secretary Janet Yellen indicated that the U.S. is exploring new ways to provide concessional credit in the global banking system, and called on global institutions to join the initiative

- Cryptocurrencies traded higher - Bitcoin climbed above $30,000. Another U.S.-based fund, WisdomTree and Invesco have applied to create a spot ETF for Bitcoin

- After Jerome Powell's comments, the market made sure that crypto would not face a complete blockade in the US. The Fed chief indicated yesterday that cryptocurrencies are showing strength of survival as a separate asset class

- The fintech company behind the Ripple cryptocurrency gains after news of a payments license in Singapore

- Energy commodities are trading flat, with prices of brent and WTI crude oil contracts seeing a slight pullback

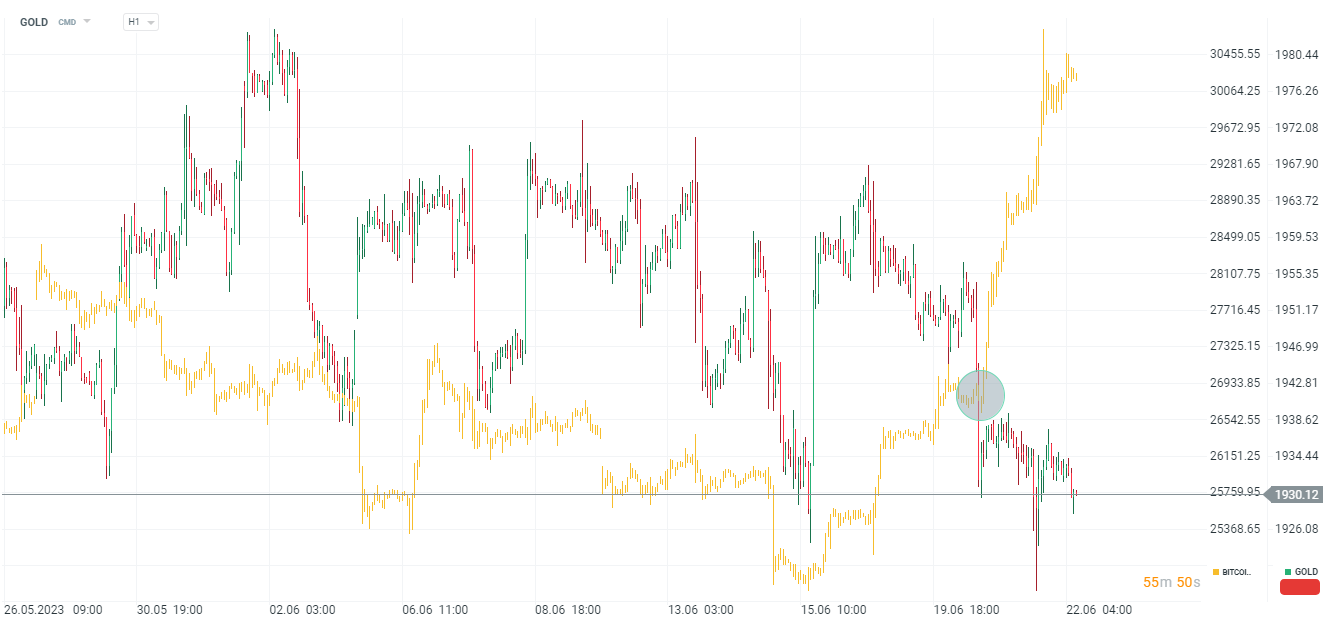

- Precious metals are trading lower - gold is around $1,930 per ounce and losing 0.12%, the strongest loss is in palladium where the sell-off reaches 0.9%

- The USDIDX dollar index is trying to make up for yesterday's losses, EURUSD approached near key resistance at 1.10

Bitcoin has broken the correlation with gold prices. While BITCOIN (gold chart) recorded a rally in recent days, GOLD was still under selling pressure.

Bitcoin has broken the correlation with gold prices. While BITCOIN (gold chart) recorded a rally in recent days, GOLD was still under selling pressure.

Wall Street extends gains; US100 rebounds over 1% 📈

Politics batter the UK bond market once more, as Starmer remains under pressure

Market wrap: Novo Nordisk jumps more than 7% 🚀

STM is growing stronger thanks to a new partnership with AWS!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.