-

Asia-Pacific indices traded mostly lower during Friday’s trading session. Japan's Nikkei lost close to 0.52%, Australia's S&P/ASX 200 traded 0.20% lower and Chinese futures traded 0.2% higher.

-

Asian markets showed volatility on Friday due to weak US tech earnings, robust labor market signs that could push for another 2023 rate hike.

-

Major Asian indices traded mostly flat, Japan and China stocks fluctuated. MSCI Asia Pacific Index dropped for the fifth consecutive day. US equity contracts traded in a tight range post Nasdaq 100's first drop in over five months on Thursday.

-

US market declines potentially disrupting this year's massive gains with S&P 500 up by 18% and Nasdaq 100 by 41%, amidst a frail economic outlook and Federal Reserve's tough tightening moves.

-

Chinese investors are on the lookout for further government support measures.

-

More cautious and balanced policy actions could extend decision-making timelines, possibly exerting additional pressure on corporate profits for the next two quarters.

-

Offshore yuan saw little change on Friday post a higher-than-expected fixing by PBoC. Yuan rose Thursday after increased central bank support.

-

The AI boom prompts index rebalancing effective July 24, potentially reducing the weights of Amazon, Nvidia, Microsoft stocks, thereby possibly exerting downward pressure due to passive fund adjustments.

-

Japanese CPI Nationwide Actual stands at 3.3%, against the forecast of 3.2% and previous 3.2%.

-

Japanese Core CPI Nationwide YoY Actual remains steady at 3.3%, in line with the forecast, slightly up from the previous 3.2%.

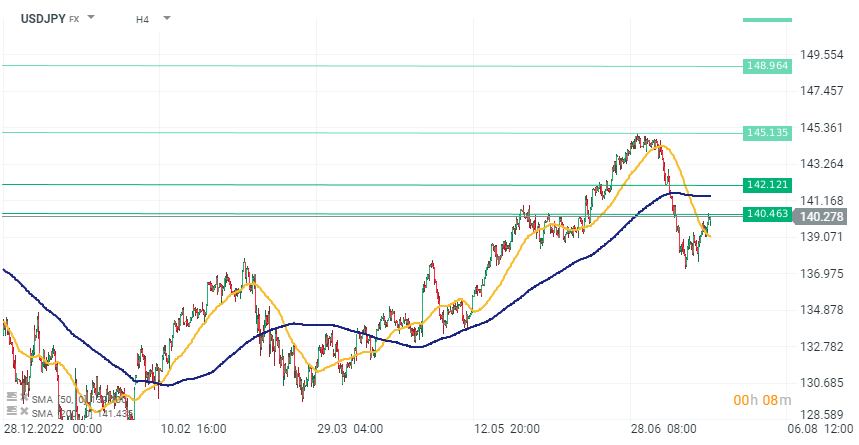

USDJPY is again trading around 140 points. After today's higher inflation reading, the Japanese currency does not seem to react significantly. Despite the higher than expected inflation, which increases the chances of any action from the Bank of Japan (BoJ).

USDJPY is again trading around 140 points. After today's higher inflation reading, the Japanese currency does not seem to react significantly. Despite the higher than expected inflation, which increases the chances of any action from the Bank of Japan (BoJ).

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.