-

Indices from Asia-Pacific traded mixed today. Nikkei and S&P/ASX 200 dropped 0.2% each, Kospi and Nifty 50 gained 0.1% while indices from China traded mostly lower

-

DAX futures point to a more or less flat opening of the European cash session today

-

RBA minutes showed that Australian central bankers see inflation as more broad and persistent than expected. The document also strongly hinted that rate hike pause at meeting in February was not an option

-

New Zealand Treasury said in a statement that reconstruction after a cyclone hit will be a boost to the New Zealand economy. Treasury noted, however, that boost to the demand will increase inflationary pressures in the economy and may cause RBNZ to hold rates at higher levels for longer

-

BoJ Governor Kuroda expects wage growth in the Japanese economy to accelerate as labor market gets tighter

-

Australian manufacturing PMI index ticked higher in February, from 50.0 to 50.1. Services index moved from 48.6 to 49.2

-

Japanese manufacturing PMI dropped from 48.9 to 47.4 in February (exp. 49.2)

-

Cryptocurrencies are trading mixed with major coins posting decent gains. Bitcoin trades 1% higher, Ethereum gains 0.6% and Dogecoin moves 0.4% higher

-

Energy commodities trade mixed - Brent drops 0.6%, WTI trades 0.9% lower and US natural gas prices increased 0.3%

-

Precious metals pull back as USD strengthens - gold trades 0.2% lower, silver drops 0.5% and platinum declines 0.7%

-

USD and GBP are the best performing major currencies while NZD and AUD lag the most

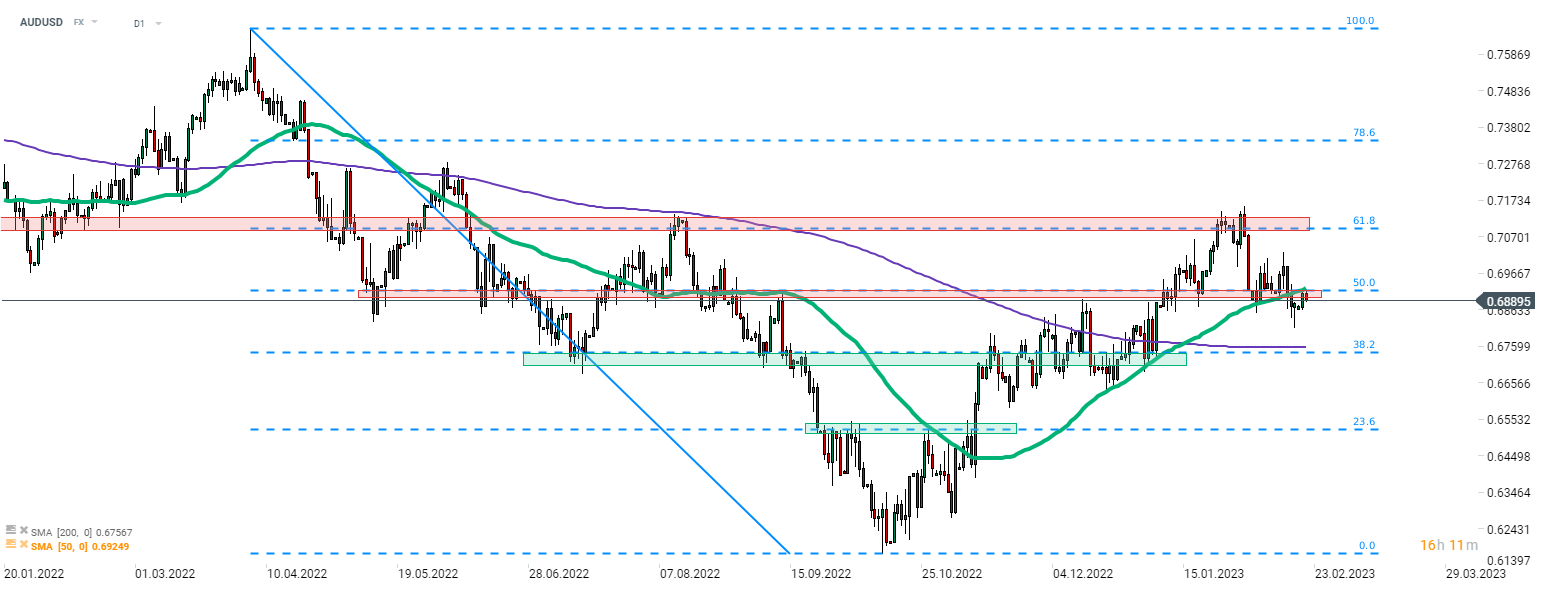

In spite of a rather hawkish RBA minutes release, Australian dollar is pulling back today. AUDUSD is one of the worst performing major FX pairs as USD is on the rise. AUDUSD made an attempt at breaking back above a price zone marked with 50-session moving average (green line) and 50% retracement of the downward move launched in April 2022 but failed and a pullback was launched. Source: xStation5

In spite of a rather hawkish RBA minutes release, Australian dollar is pulling back today. AUDUSD is one of the worst performing major FX pairs as USD is on the rise. AUDUSD made an attempt at breaking back above a price zone marked with 50-session moving average (green line) and 50% retracement of the downward move launched in April 2022 but failed and a pullback was launched. Source: xStation5

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.