-

US indices finished yesterday's session with big gains, led by tech sector. Nasdaq rallied 2.15%, Dow Jones added 1.45% and S&P 500 jumped 1.61%. Small-cap Russell 2000 added 2.04%

-

Stocks in Asia traded higher, although ranges were much smaller. Nikkei gained 0.9%, S&P/ASX 200 and Kospi added 0.1% each while indices from China traded lower

-

DAX futures point to a higher opening of the European cash session

-

People's Bank of China left loan prime rates unchanged at a meeting today. Chinese central bank was expected by some to cut rates in order to support pandemic-hit economy

-

USDJPY jumped above 129.00. Bank of Japan intervened on the bond market today, buying unlimited amounts of 10-year bonds, but it provided only a small relief

-

API report pointed to a 4.5 million barrel drop in US oil inventories (exp. +2.5 mb)

-

Netflix (NFLX.US) plunged over 20% in the after-hours trading, following release of Q1 2022 earnings report. Subscriber base shrank by 200 thousand, marking the first drop in overall users in more than a decade. Drop was led by a loss of 700 thousand subscribers from Russia as company suspended services in the country

-

IBM (IBM.US) gained 1.5% in the after-hours trading after reporting almost 8% YoY revenue jump in Q1 2022, to $14.2 billion (exp. $13.85 billion). Net income from continuing operations increased 64% YoY. EPS reached $1.40 (exp. $1.38)

-

Cryptocurrencies trade mixed. Ethereum drops below $3,100 (-0.2%) while Bitcoin approaches $41,500 (+0.3%)

-

Oil is trading higher. WTI broke above $103 per barrel while Brent jumped above $108

-

Precious metals are trading lower. Palladium is an exception as it trades 1.3% higher

-

AUD and NZD are the best performing major currencies while USD and CHF lag the most

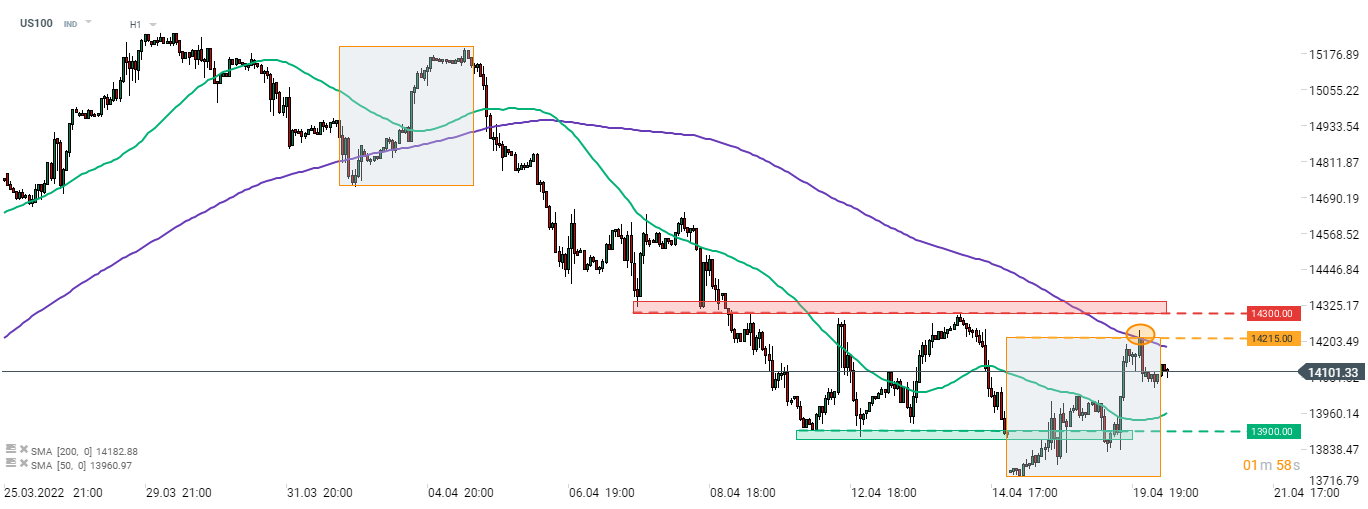

US indices gained yesterday, led by the tech sector. However, US100 started to underperfom after the close of Wall Street session as Netflix earnings hit sentiment towards techs. Index pulled back from a key 14,215 resistance zone, marked with upper limit of market geometry and 200-hour moving average (purple line). Source: xStation5

US indices gained yesterday, led by the tech sector. However, US100 started to underperfom after the close of Wall Street session as Netflix earnings hit sentiment towards techs. Index pulled back from a key 14,215 resistance zone, marked with upper limit of market geometry and 200-hour moving average (purple line). Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.