-

Tuesday's session on Wall Street saw declines in US indices. The Nasdaq lost 1.14% and the S&P500 fell 1.16%, closing the session below its 50-day EMA.

-

Asia-Pacific (APAC) markets traded in a weaker mood today, mimicking the momentum of yesterday's US session. Japan's Nikkei 225 is currently losing nearly 1.22%, the Hang Seng index is subtracting more than 1.36% and Korea's KOSPI is down 1.65%.

-

Futures based on the German DAX and the European benchmark Eurostoxx point to a lower opening in today's European cash session.

-

The RBNZ kept interest rates unchanged as expected and reiterated that the OCR rate will need to remain restrictive for the foreseeable future.

-

Zhongrong International Trust Co. has missed payments on dozens of products and has no immediate plan to repay customers, indicating that the troubles of the US$138 billion-plus Chinese financial giant are more serious than previously expected. The corporation has short-term liquidity problems.

-

Tesla is slashing prices for the Model S and Model X in the Chinese market. Yesterday, a similar decision was made for the Y models.

-

JP Morgan has lowered its forecast for China's 2023 GDP after weak macro data this week. The new expectation is +4.8% compared to the last forecast published in May of 6.4%.

-

Wells Fargo forecasts a rise in US inflation in the second half of 2023, which is expected to encourage the FOMC to raise interest rates further

-

Data from Australia - the twelfth consecutive negative reading of the momentum of the leading indicators index.

-

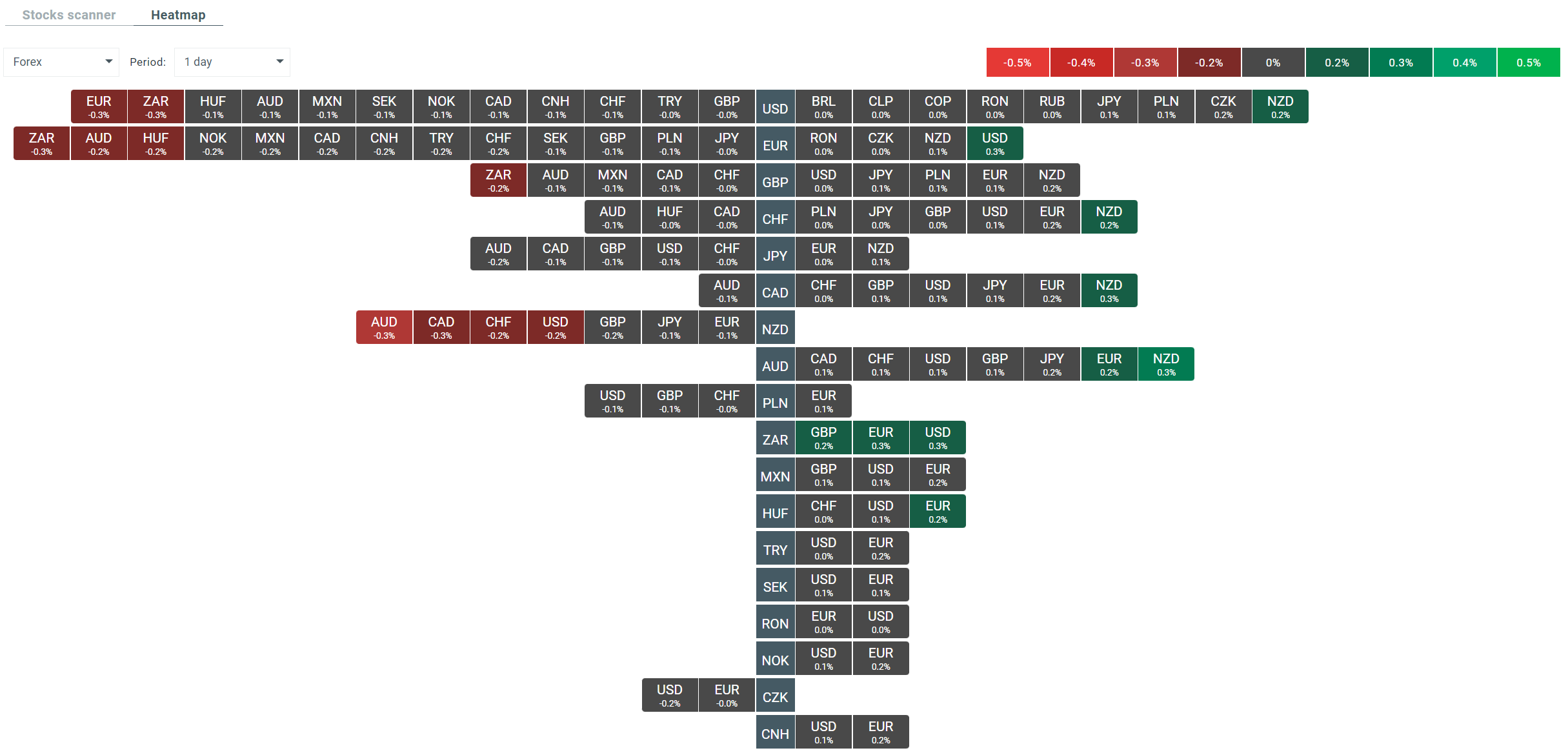

In the FX market, we are currently seeing mild gains in EURUSD, however, the USDIDX index remains above the 103.00 zone. The New Zealand dollar is currently seeing the biggest gains in the broad market, while the Australian dollar is under pressure.

-

Data from the API private oil inventory survey shows a much larger decline in oil stocks than expected. On the other hand, the start of the European session brings declines in energy commodities, with WTI crude oil losing nearly 0.6%.

-

Bitcoin and gold are trading close to important support levels, the $29 000 and $1 900 barriers respectively.

-

The most important macro readings of the day will be the UK inflation report, the GDP and unemployment rate readings in the euro area, as well as the FOMC Minutes

Heatmap showing current volatility in the FX market and specific currency pairs. Source: xStation 5

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

Market wrap: Novo Nordisk jumps more than 7% 🚀

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.