-

US indices bounced off the daily lows but bulls were unable to fully erase declines. S&P 500 dropped 0.70%, Dow Jones moved 0.87% lower and Russell 2000 plunged 1.74%. Nasdaq outperformed and managed to finish 0.05% higher

-

Moods started to improve after Credit Suisse announced that it will take actions to improve liquidity position

-

Credit Suisse intends to exercise an option to borrow an additional 50 billion CHF from Swiss National Bank. CS will also buy back senior debt worth up to 3 billion CHF

-

Indices from Asia-Pacific traded lower today - Nikkei dropped 0.8%, S&P/ASX 200 moved 1.5% lower while Kospi and Nifty 50 traded little changed

-

Indices from China traded 0.6-1.8% lower

-

DAX futures point to a higher opening of today's European cash session

-

G7 countries oppose the idea of lowering price cap on Russian oil below current $60 per barrel

-

Goldman Sachs estimates the probability of US recession in the next 12 months at 35%, up from 25% in the previous estimate

-

Goldman Sachs also lowered the 2023 GDP growth forecast from 1.5 to 1.2%. Meanwhile, forecast for China 2023 GDP growth was boosted from 5.5 to 6.0%

-

Australian employment increased by 64.6k in February (exp. +49.1k) while the unemployment rate dropped from 3.7 to 3.5% (exp. 3.6% YoY)

-

New Zealand GDP shrank by 0.6% QoQ in Q4 202 (exp. -0.2% QoQ)

-

Japanese exports increased 6.5% YoY in February (exp. 7.1% YoY) while imports were 8.3% YoY higher (exp. 12.2% YoY)

-

Japanese machinery orders increased 9.5% MoM in January (exp. +1.6% MoM)

-

Japanese industrial production dropped 3.1% YoY in January (exp. -2.3% YoY)

-

Cryptocurrencies are trading slightly higher today - Bitcoin gains 0.2%, Dogecoin adds 0.8% and Ripple advances 1.2%

-

Energy commodities are trading little changed - oil drops 0.2% while US natural gas prices add 0.1%

-

In spite of USD weakening, precious metals trade mixed today - silver drops 0.3%, gold trades 0.1% lower and platinum adds 0.2%

-

AUD and CHF are the best performing major currencies while USD and GBP lag the most

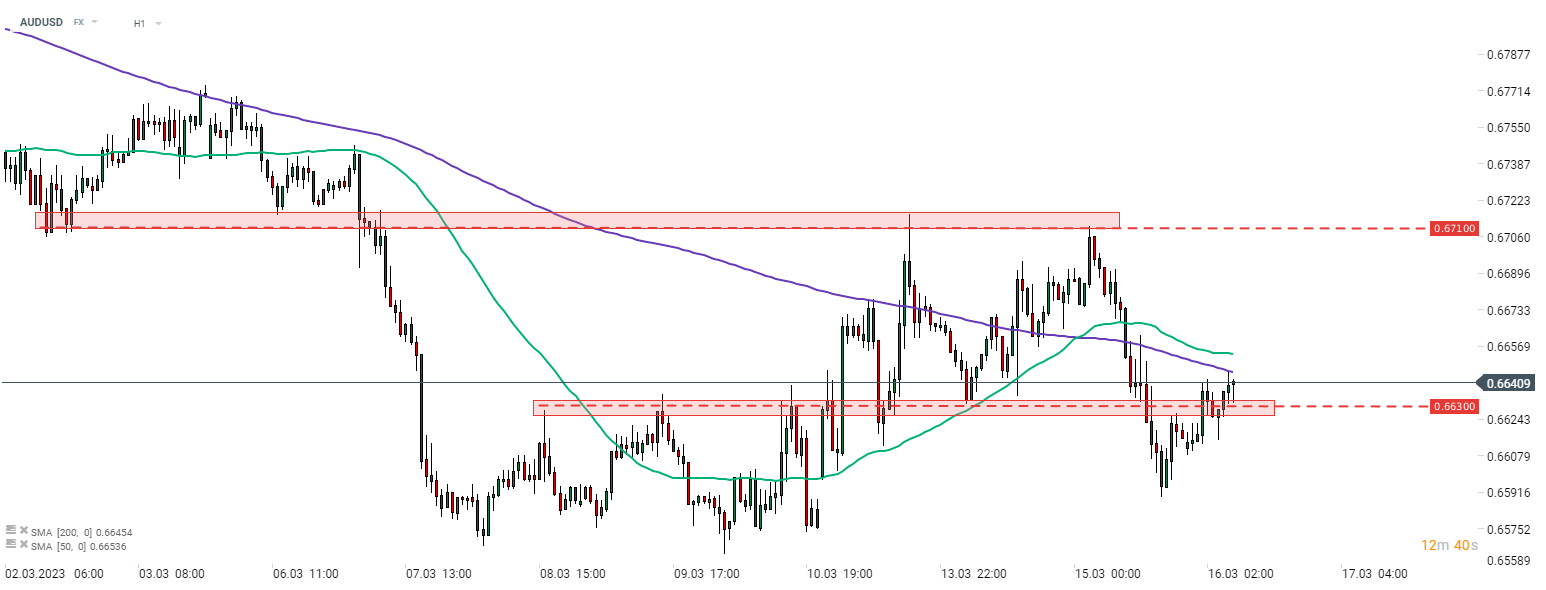

AUDUSD broke above the 0.6630 resistance zone following a solid jobs report from Australia. The pair is now testing the 200-hour moving average (purple line). Source: xStation5

AUDUSD broke above the 0.6630 resistance zone following a solid jobs report from Australia. The pair is now testing the 200-hour moving average (purple line). Source: xStation5

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.