-

US indices rallied yesterday and finished trading significantly higher. S&P 500 added 1.71%, Dow Jones gained 1.56% and Nasdaq jumped 1.73%. Solid earnings from US banks supported upbeat moods

-

Positive moods extended into the Asian session with Nikkei jumping 1.6%, S&P/ASX 200 adding 0.6% and Kospi moving 0.9% higher. Indices from China traded higher

-

DAX futures point to a flat opening of today's cash trading session in Europe

-

US State Department is trying to convince OPEC+ to boost output and stabilize prices

-

Fed's Harker said he does not expect rate to be hiked until late-2022 or early-2023

-

TSMC, world's largest semiconductor manufacturer, will build a new facility in Japan. New factory will commence operations in 2024

-

According to Nikkei report, Toyota will cut global production by 15% in November amid semiconductor shortage

-

US SEC will reportedly not oppose launch of Bitcoin futures ETF. Cryptocurrencies jumped on the news with Bitcoin testing $60,000 mark for the first time since mid-April 2021

-

Precious metals trade mixed - gold and platinum drop while silver and palladium gain

-

Brent and WTI are trading almost 1% higher on the day. Industrial metals pull back

-

AUD and NZD are the best performing major currencies while safe haven currencies - JPY and CHF - lag the most

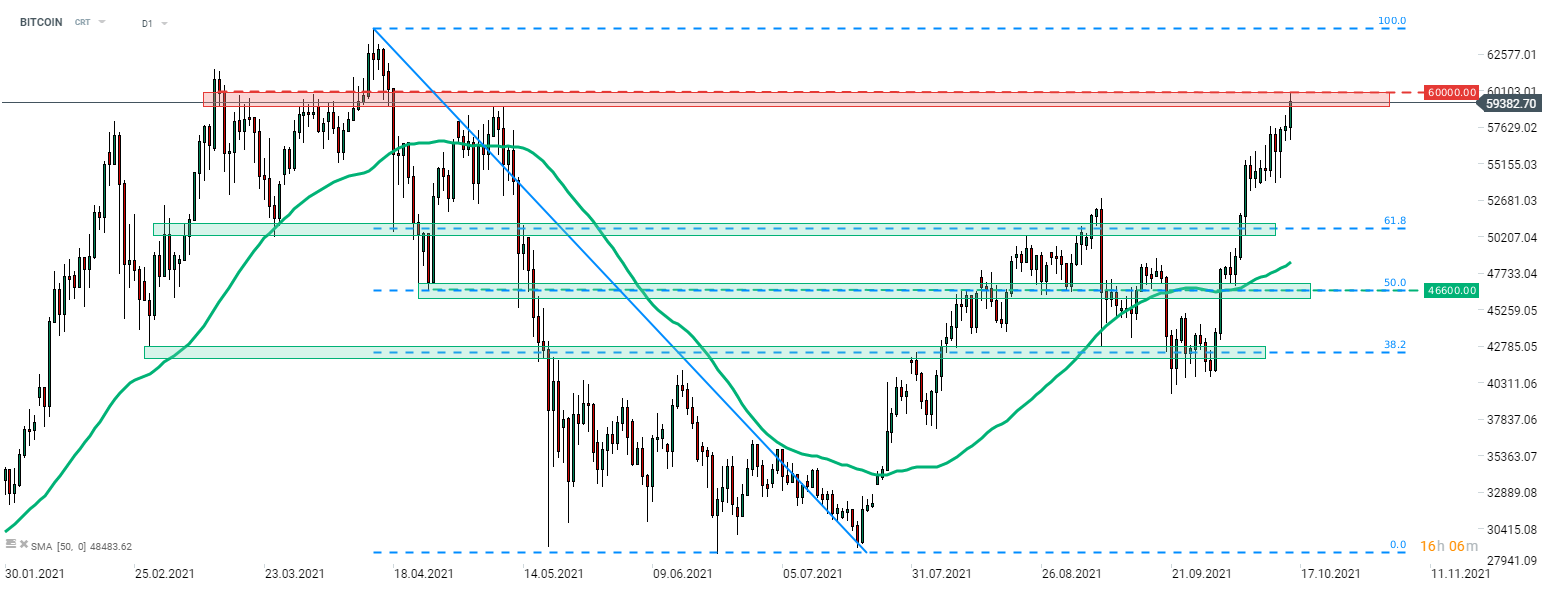

Bitcoin rallied on news that SEC will not oppose launch of Bitcoin futures ETF. Coin caught a bid and tested the $60,000 mark. So far, bulls failed to break above but Bitcoin continues to trade within the resistance area ranging below this hurdle. Source: xStation5

Bitcoin rallied on news that SEC will not oppose launch of Bitcoin futures ETF. Coin caught a bid and tested the $60,000 mark. So far, bulls failed to break above but Bitcoin continues to trade within the resistance area ranging below this hurdle. Source: xStation5

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

Morning wrap: Tech sector sell-off (06.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.