-

US indices managed to recover most of the post-CPI losses but still finished yesterday's trading lower. S&P 500 dropped 0.45%, Dow Jones moved 0.67% lower while Nasdaq dipped 0.15%. Russell 2000 moved 0.12% lower

-

Mixed moods could be spotted during the Asian trading hours today. Nikkei gained 0.7%, S&P/ASX 200 moved 0.4% higher, Kospi dipped 0.1% and indices from China traded mixed

-

DAX futures point to a more or less flat opening of the European cash session today

-

After a higher-than-expected CPI reading, Fed funds futures price in an over-80% chance of a 100 basis point rate hike at the next FOMC meeting (July 27, 2022)

-

Fed's Daly said that a 75 basis point rate hike is her preferred option for the July meeting but a 100 bp move cannot be ruled out. Fed's Mester said that she does not see any evidence that inflation has peaked already

-

Turkey said that basic, technical agreement was reached between Ukraine and Russia to resume exports of grain from Ukraine

-

According to Bloomberg report, Chinese authorities asked domestic regulators to review offshore investment projects cautiously as Beijing fears that higher US interest rates may spur capital outflows

-

Australian employment increased by 88.4k in June (exp. +30k). Unemployment rate dropped from 3.9 to 3.5% (exp. 3.8%). This was another solid jobs report from Australia and it has boosted odds for an over-50 basis point rate hike at next RBA meeting

-

Japanese industrial production dropped 7.5% MoM in May (exp. -7.2% MoM)

-

USDJPY jumped above 138.00 during the Asian trading session - the highest level since 1998

-

Cryptocurrencies are trading higher today. Bitcoin gains 1.2% while Ethereum trades 1.8% higher. Polygon is outperformer with an over-10% gain

-

Oil is trading slightly lower this morning. Precious metals also pull back, with gold trading 0.5% lower on the day

-

USD and AUD are the best performing major currencies while JPY and EUR lag the most

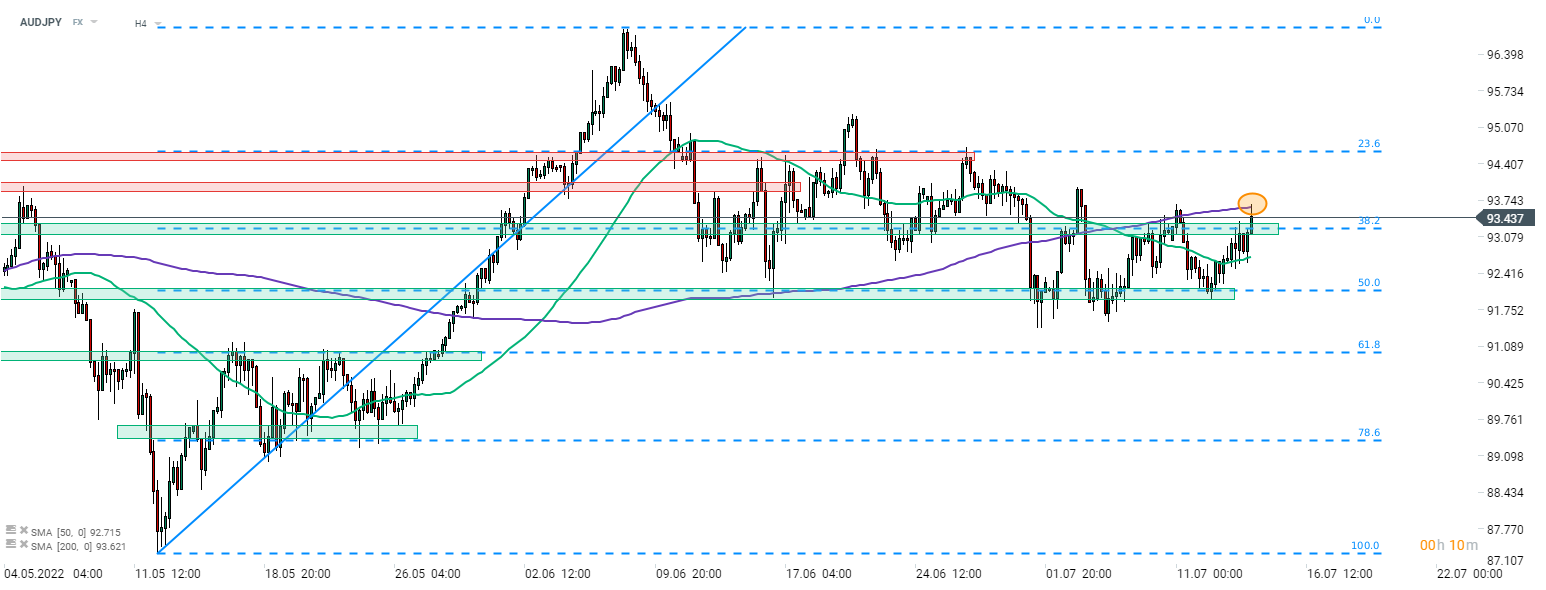

AUDJPY leaped higher today. Gain is fuelled mostly by solid showing of AUD, thanks to strong jobs report for June. However, JPY weakness also plays a role. The pair tested 200-period moving average (purple line, H4 interval) earlier today but failed to break above. Source: xStation5

AUDJPY leaped higher today. Gain is fuelled mostly by solid showing of AUD, thanks to strong jobs report for June. However, JPY weakness also plays a role. The pair tested 200-period moving average (purple line, H4 interval) earlier today but failed to break above. Source: xStation5

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.