- US indices finished yesterday's trading higher, near the session highs. S&P 500 gained 0.43%, Dow Jones moved 0.19% higher and Nasdaq added 0.71%. Russell 2000 was a laggard with 0.2% drop

- FOMC minutes showed that central bankers see the need to proceed carefully when deciding on further tightening due to high volatility in data. FOMC members see need to keep rates at higher levels for longer

- Indices from Asia-Pacific traded higher today - Nikkei jumped 1.6%,, Kospi added 0.8% while Nifty 50 and S&P/ASX 200 were trading 0.1% higher. Indices from China gained 0.6-0.8%

- European index futures point to a higher opening of the cash session on the Old Continent today

- Fed Collins said that the FOMC is near or even already at the peak of rate hike cycle. She also said that Fed will factor in Middle East escalation when making decisions

- ECB Vujcic said that it is too early to declare victory over inflation and he would prefer to wait until early-2024 before doing so

- RBNZ Governor Orr said that official cash rate will remain at restrictive levels for foreseeable future to ensure CPI inflation returning to 1-3% target

- Japanese core machinery orders dropped 0.5% MoM in August (exp. +0.5% MoM)

- API report pointed to a massive oil inventory build of 12.94 million barrels (exp. +1.3 mb)

- Major cryptocurrencies are trading mixed - Bitcoin gains 0.4%, Dogecoin adds 0.2%, Ethereum drops 0.2% and Ripple declines 0.7%

- Energy commodities trade slightly lower - oil drops 0.2-0.3% while US natural gas prices are down 0.1%

- Precious metals gain - gold trades 0.3% higher, silver adds 0.6% and platinum gains 0.5%

- EUR and CHF are the best performing major currencies while NZD and JPY lag the most

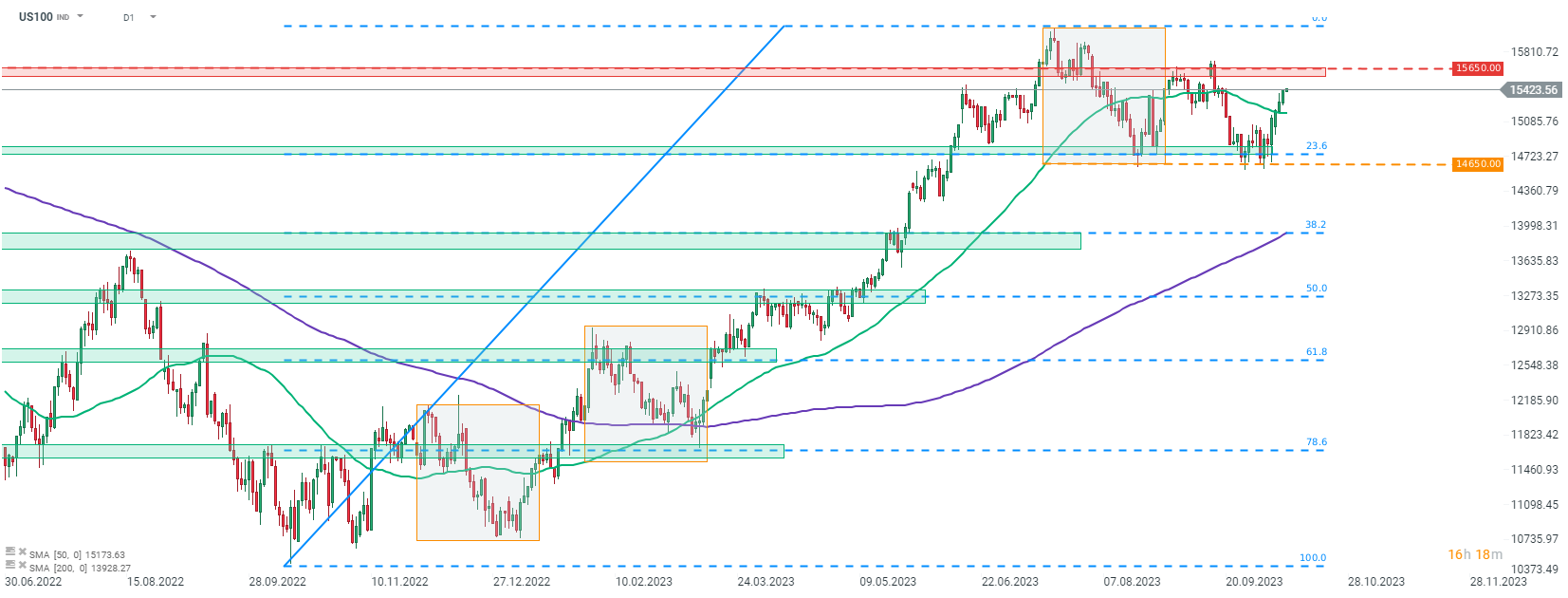

Lack of any strong hawkish remarks in FOMC minutes allowed US indices to extend recent gains. Nasdaq-100 futures (US100) jumped to a 3-week high and are now over 5% above recent lows. Source: xStation5

Lack of any strong hawkish remarks in FOMC minutes allowed US indices to extend recent gains. Nasdaq-100 futures (US100) jumped to a 3-week high and are now over 5% above recent lows. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.