-

US indices finished yesterday's trading mostly higher. S&P 500 gained 0.10%, Dow Jones moved 0.3% higher and Russell 2000 rallied 1%. Nasdaq was a laggard and finished flat

-

Indices in Asia-Pacific traded mostly higher today - Nikkei and S&P/ASX 200 gained around 1.2% each, Kospi rallied 1.4% and Nifty 50 traded 0.6% higher

-

Indices from China traded 0.1-0.5% lower

-

DAX futures point to a higher opening of the European cash session today

-

New Bank of Japan Governor Ueda said that a small rate hike would not be a problem for the Japanese financial system. Ueda also said that he agreed with PM Kishida that there is no need to revise government-BoJ joint statement

-

AUD gains after Australia and China reached agreement on barley exports and Australia suspended WTO dispute against China

-

Fed Williams said he expects inflation to get back under 2% by 2025

-

Citigroup expects oil to drop below $70 per barrel amid slower-than-expected demand recovery in China and significant production potential in Iraq and Venezuela

-

Chinese CPI inflation decelerated from 1.0 to 0.7% YoY in March (exp. 1.0% YoY). PPI inflation came in at -2.5% YoY as expected (-1.4% YoY previously)

-

Bitcoin jumps 3% and trades above $30,000 mark for the first time since June 2022

-

Energy commodities trade mixed - oil gains 0.5% while US natural gas prices drop 0.3%

-

Precious metals benefit from USD weakness - gold gains 0.5%, silver trades 0.6% higher and platinum adds 0.4%

-

AUD and EUR are the best performing major currencies while USD and NZD lag the most

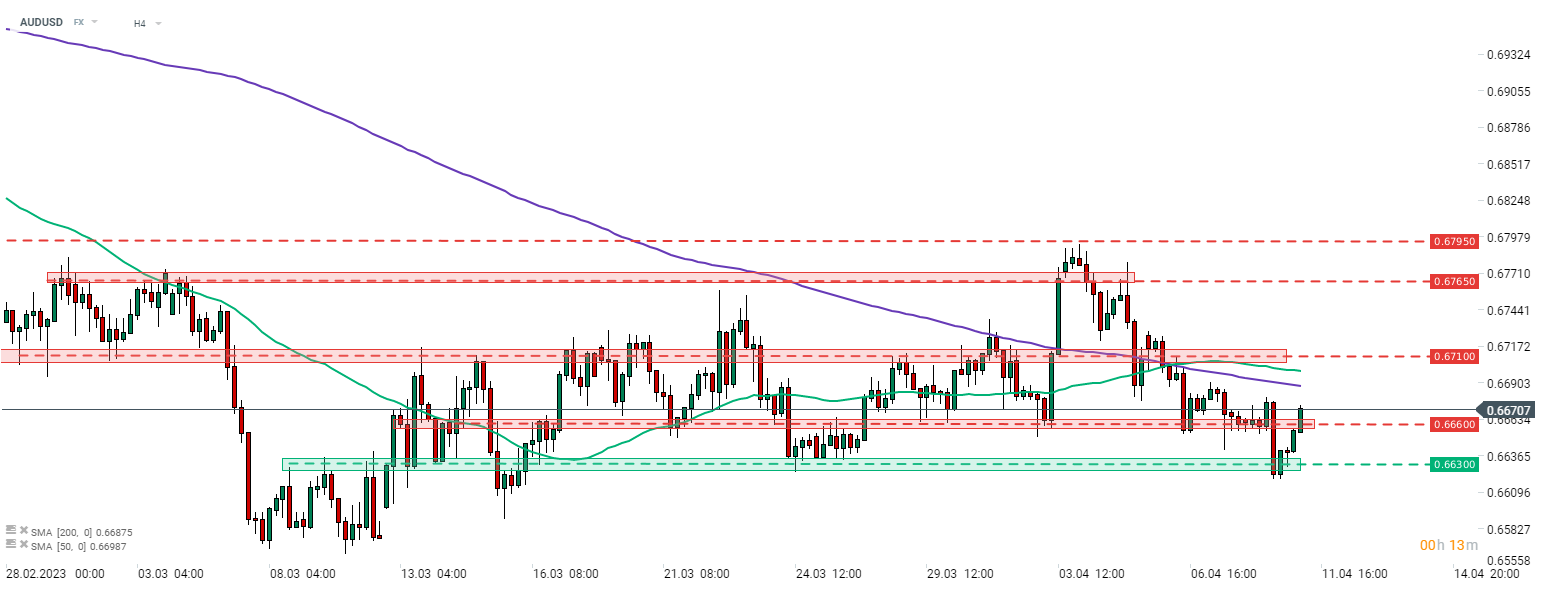

AUDUSD bounced off the 0.6630 support zone and climbed back above the 0.6660 area. Improvement in Australia-China trade relations is driving today's upward move on the pair. Source: xStation5

AUDUSD bounced off the 0.6630 support zone and climbed back above the 0.6660 area. Improvement in Australia-China trade relations is driving today's upward move on the pair. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.