-

US indices plunged yesterday following another acceleration in the US CPI inflation. S&P 500 dropped 1.81%, Dow JOnes moved 1.47% lower while Nasdaq and Russell 2000 dropped 2%

-

Stocks in Asia moved lower as well with S&P/ASX 200 dropping 1%, Kospi moving 0.9% lower and indices from China trading 0.2-1.2% lower

-

DAX futures point to a lower opening of the European cash session today

-

Fed's Bullard said that 100 basis points of tightening may be needed by July. He also hinted at a possibility of a 50 bp hike in March

-

Fed's Barkin said that the US economy will recover to pre-pandemic levels in Q1 2022. Barkin said he is not convinced of a 50 bp rate hike in March

-

Goldman Sachs expects a total of seven 25 bp rate hikes this year

-

ECB President Lagarde said that rate hikes will not solve current problems of the euro area economy

-

RBA Governor Lowe said at a parliamentary testimony that there is a big divergence between central bank and market expectations

-

Cryptocurrencies are trading slightly lower - Bitcoin approaches $43,000 area while Etehereym drops below $3,100

-

Commodities trade lower today under pressure from stronger USD. Brent and WTI trade around 0.8% lower. Gold trades 0.2% lower on the day while other precious metals drop over 1%

-

USD and JPY are the best performing major currencies while AUD and NZD lag the most

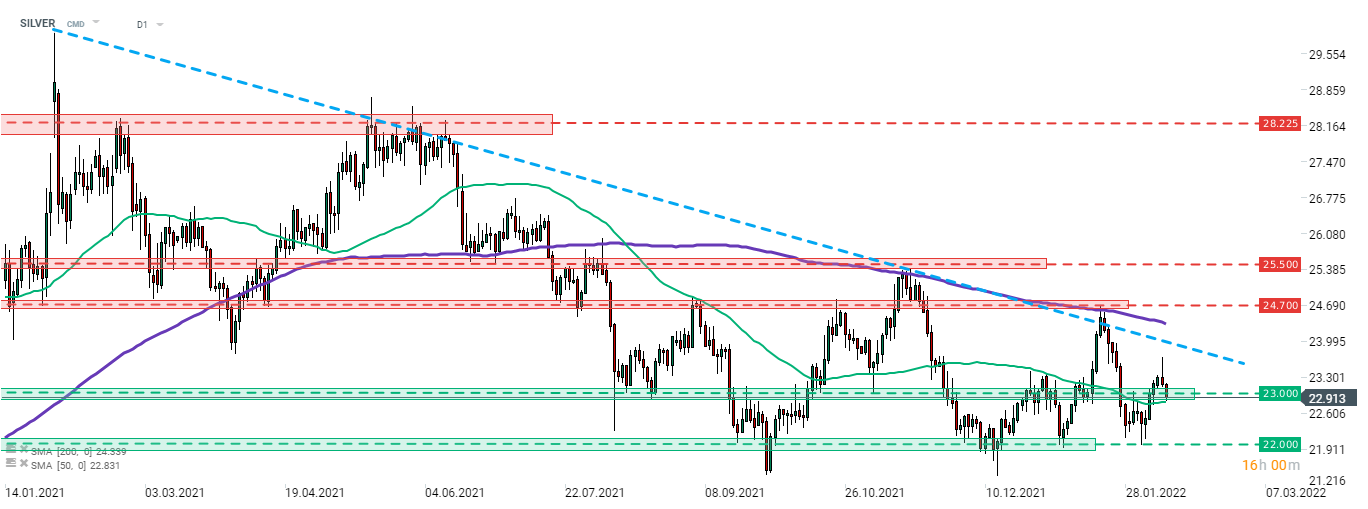

Higher-than-expected reading of US inflation has triggered reversal on precious metals markets. Silver erased daily gains and finished yesterday's trading lower. Downward move is being continued today with price attempting to make a break below the support zone at $23 per ounce, marked with previous price reactions and a 50-session moving average. Source: xStation5

Higher-than-expected reading of US inflation has triggered reversal on precious metals markets. Silver erased daily gains and finished yesterday's trading lower. Downward move is being continued today with price attempting to make a break below the support zone at $23 per ounce, marked with previous price reactions and a 50-session moving average. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

Three markets to watch next week (09.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.