-

US indices plunged yesterday amid concerns over monetary policy tightening and overall deterioration in global economic outlook due to pandemic situation in China

-

S&P 500 dropped 3.20%, Dow Jones moved 1.99%, Nasdaq plunged 4.29% and Russell 2000 finished trading 4.21% lower

-

Situation calmed during the Asia-Pacific session with indices from the region trading mixed. Nikkei dropped 0.3%, S&P/ASX 200 moved 1.2% lower, Kospi dropped 0.4% while indices from China traded up to 1.3% higher

-

DAX futures point to a higher opening of the European cash session today

-

According to media reports, United States is weighting a ban on US companies selling advanced chips to China

-

Chinese Vice Premier Liu He said that China is standing by its Covid Zero policy. China will launch another round of mass testing in Beijing

-

US President Biden said that he is worried that Russian President Putin has no way out of Ukraine and its creates uncertainty over what he will do next

-

European Commission President von der Leyen said that progress was made in talks with Hungary on Russian oil embargo

-

Japanese household spending dropped 2.3% YoY in March (exp. -2.9% YoY)

-

Australian retail sales increased 1.2% QoQ in Q1 2022 (exp. +1.0% QoQ)

-

Tesla halted production at factory in Shanghai, China due to supply chain issues

-

Cryptocurrencies are trying to recover from yesterday's plunge today. Bitcoin briefly dipped below $30,000 handle during the overnight trade but has managed to recover above $31,500 since

-

Oil continues to pull back after a massive plunge yesterday - WTI trades near $102 per barrel while Brent drops below $105 per barrel

-

Precious metals regained strength as US dollar lost its shine. Palladium gains over 3% while silver and platinum trade around 1% higher. Gold gains 0.5%

-

AUD and NZD are the best performing major currencies while USD and JPY lag the most

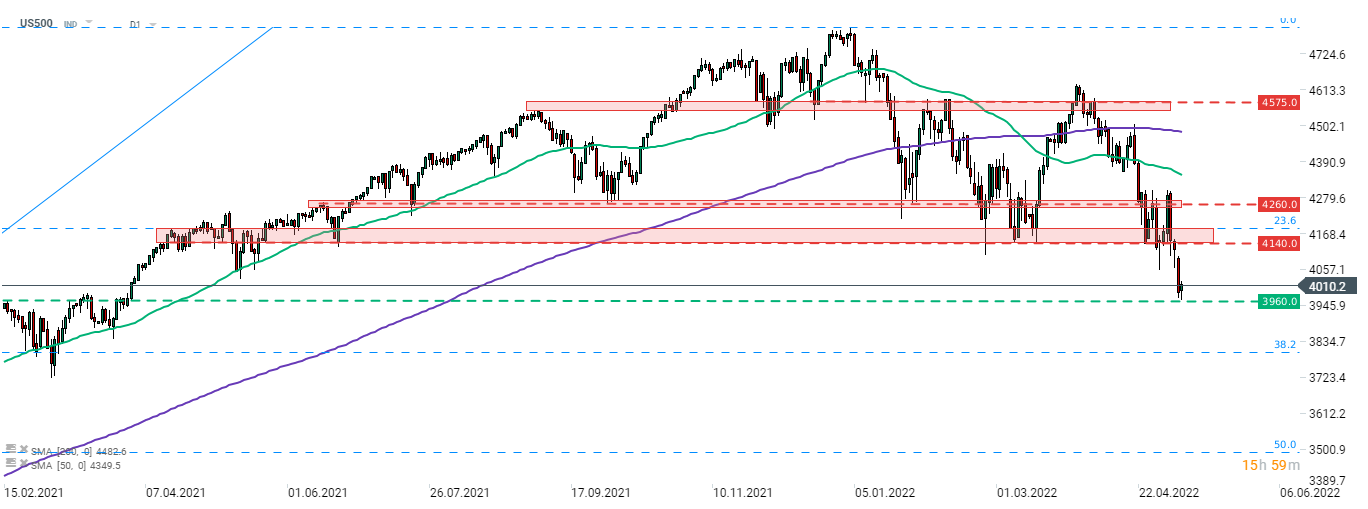

S&P 500 (US500) dropped below 4,000 pts handle yesterday and tested a 3,960 pts support. Declines were halted there and index futures started to regain ground during the Asian trading. US500 managed to climb back above 4,000 pts mark but rebound lacks momentum and may be fragile. Source: xStation5

S&P 500 (US500) dropped below 4,000 pts handle yesterday and tested a 3,960 pts support. Declines were halted there and index futures started to regain ground during the Asian trading. US500 managed to climb back above 4,000 pts mark but rebound lacks momentum and may be fragile. Source: xStation5

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

Wall Street extends gains; US100 rebounds over 1% 📈

Market wrap: Novo Nordisk jumps more than 7% 🚀

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.