-

The first Asian session of a new week turned out to be mixed. S&P/ASX 200 dropped 0.1%, Kospi moved over 1% lower and indices from China gained. Japanese stock market was shut for holiday

-

US and European index futures trade flat compared to Friday's cash close

-

A local Omicron outbreak was detected in Tianjin,China - city that is gateway to Beijing

-

Goldman Sachs expects the Federal Reserve to deliver 4 rate hikes in 2022. Meanwhile, IMF warned to quick pace of Fed rate hikes could have negative impact on asset prices and may weaken demand in the US

-

ECB's Schnabel said that action aimed at helping climate pose an upward risk to inflation in medium-term

-

Output on Tengiz oilfield, the largest in Kazakhstan, has been gradually restored over the weekend after it was disrupted by protests in the country.

-

China will host oil ministers from Saudi Arabia, Kuwait, Oman and Bahrain this week. China asked for talks as it grown concerned about supply security amid violent protests in Kazakhstan

-

Australian building approvals increased 3.6% MoM in November (exp. +0.2% MoM)

-

Major cryptocurrencies traded sideways over the weekend. Ethereum tested $3,000 area but failed to break below while Bitcoin dropped to as low as $40,500 before recovering slightly

-

Precious metals trade lower, industrial metals gain and oil trades flat at the beginning of a new week

-

GBP and AUD are the best performing major currencies while CHF and EUR lag the most

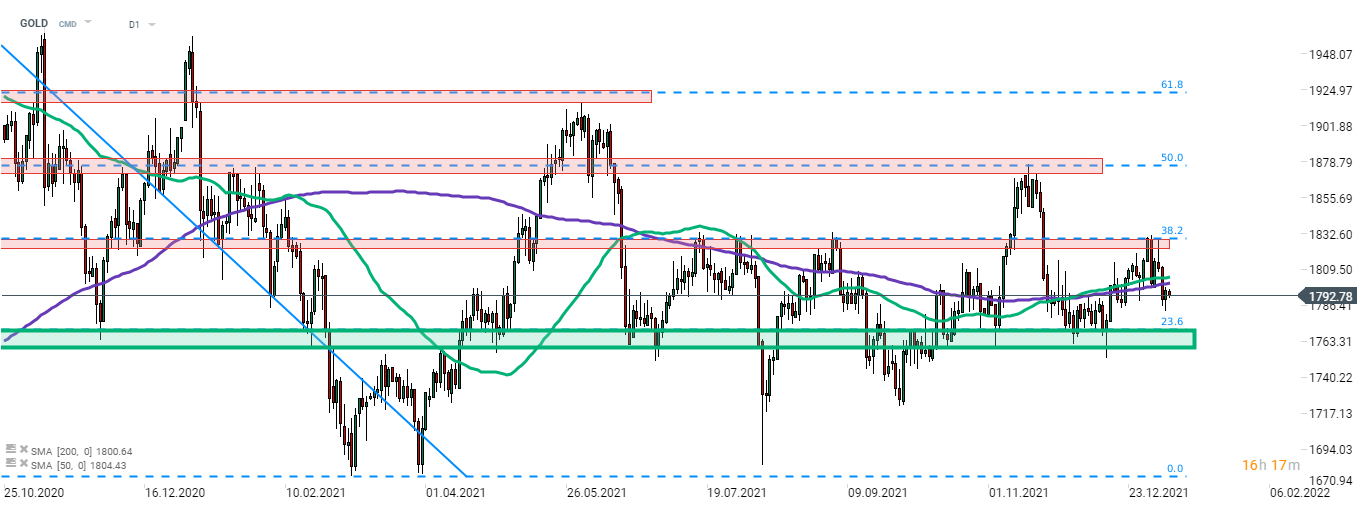

Precious metals trade slightly lower at the beginning of a new week. GOLD continues pullback started last week after a failed attempt of breaking above the resistance zone marked with 38.2% retracement of the downward move launched in August 2020. The nearest support to watch can be found at the 23.6% retracement ($1,770 area). Source: xStation5

Precious metals trade slightly lower at the beginning of a new week. GOLD continues pullback started last week after a failed attempt of breaking above the resistance zone marked with 38.2% retracement of the downward move launched in August 2020. The nearest support to watch can be found at the 23.6% retracement ($1,770 area). Source: xStation5

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

Three markets to watch next week (09.02.2026)

Market update: recovery takes hold, but investors remain on edge

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.