-

US indices finished yesterday's trading lower. S&P 500 dropped 0.13%, Dow Jones moved 0.20% lower and Nasdaq declined 0.57%. Russell 2000 plunged 1.14%

-

Bears also dominated during the Asian trading hours. Nikkei dropped 0.7%, S&P/ASX 200 plunged almost 2% and Kospi moved 1.4% lower. Indices from China declined

-

DAX futures point to a lower opening of the European cash session today

-

Fed Kaplan said that if there is no major change to the fundamental outlook he would support the decision to taper in October. Kaplan said that he is proponent of launching taper as soon as possible

-

Gazprom plans to start flow of natural gas via its Nord Stream 2 pipeline at the beginning of October

-

Japan decided to extend the state of emergency in Tokyo and other virus-hit areas until the end of September. Economy Minister said that significant easing of restrictions is planned for the late-November

-

Chinese CPI inflation decelerated from 1% YoY to 0.8% YoY in August (exp. 1% YoY). PPI inflation accelerated from 9.0% YoY to 9.5% YoY (exp. 9.1% YoY)

-

API report pointed to a 2.88 million barrel draw in oil inventories (exp. -3.8 mb)

-

Bitcoin trades slightly above $46,000 mark

-

Precious metals and agricultural goods trade lower, oil trades flat and industrial metals gain

-

CHF and JPY are the best performing major currencies while CAD and AUD lag the most

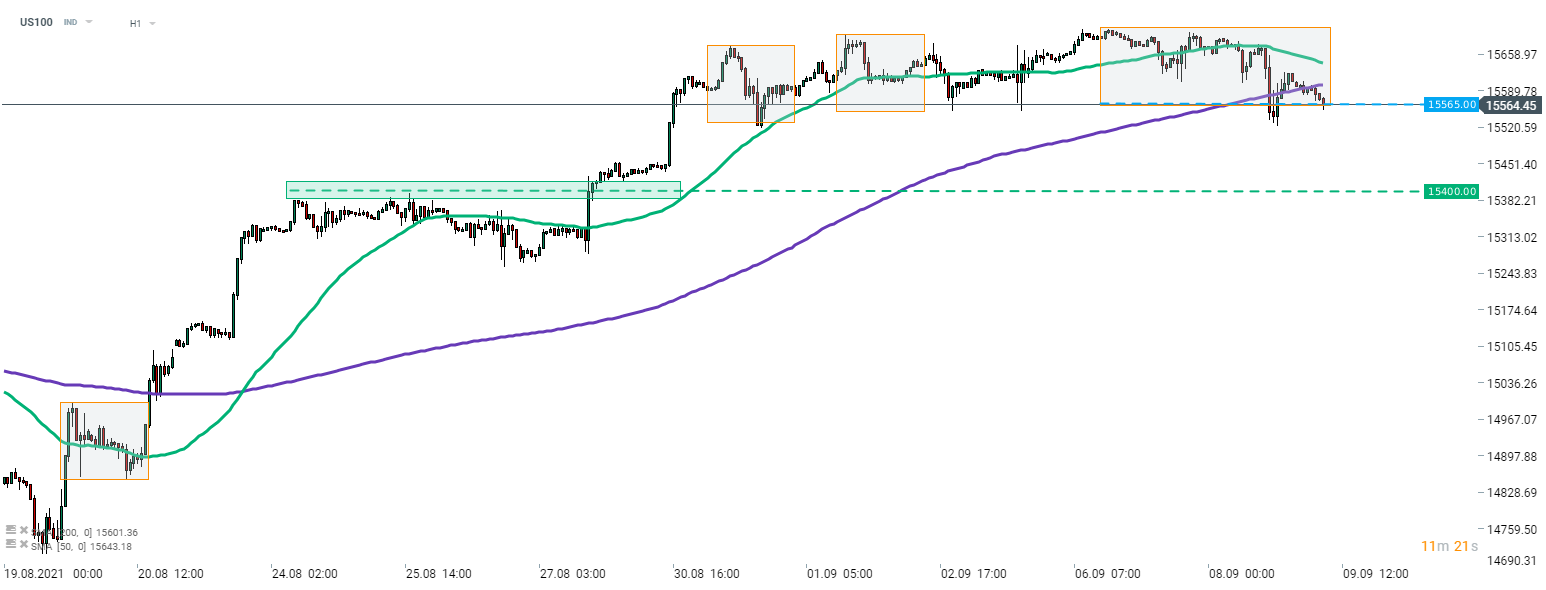

While US100 has been more resilient than other Wall Street indices recently, it began to move lower this week. US tech index pulled back from all-time highs and is testing the lower limit of local market geometry at 15,565 pts. Next support to watch can be found in the 15,400 pts swing area. Source: xStation5

While US100 has been more resilient than other Wall Street indices recently, it began to move lower this week. US tech index pulled back from all-time highs and is testing the lower limit of local market geometry at 15,565 pts. Next support to watch can be found in the 15,400 pts swing area. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.