-

US indices finished yesterday's trading mixed - S&P 500 gained 0.14%, Dow Jones moved 0.18% lower, Nasdaq added 0.40% and Russell 2000 finished flat

-

Indices from Asia-Pacific traded mixed today - Nikkei gained 0.6%, S&P/ASX 200 traded flat, Kospi dropped 0.5% and Nifty 50 declined 0.4%. Indices from China traded mixed

-

DAX futures point to aflat opening of the European cash session today

-

Budget proposal from US President Joe Biden includes tax hikes. Administration proposes hiking the corporate tax rate from 21 to 28%, imposing a 25% minimum tax on billionaires and hiking capital gains tax rate from 20 to 39.6%. However, chances that Congress will approve such hikes are very slim

-

The Dutch government confirmed that it will impose export restrictions on sales of advanced semiconductor printers to China. Deal to restrict supply of such machines to China was reached at the end of January by US, the Netherlands and Japan but it was not until now that Dutch government confirmed that restrictions will be imposed

-

Japanese trade minister said that nothing has been decided yet on restricting chip exports to China

-

Lower house of the Japanese parliament approved Kazuo Ueda to succeed Haruhiko Kuroda as Bank of Japan chair. Ueda is expected to also be approved by the upper house

-

Chinese CPI inflation decelerated from 2.1 to 1.0% YoY in February (exp. 1.9% YoY) while PPI inflation moved further into negative territory, dropping from -0.8% to -1.4% YoY (exp. -1.2% YoY)

-

Japanese Q4 GDP was revised lower from 0.2% QoQ, signaled in preliminary reading, to 0.0% QoQ

-

Cryptocurrencies took another hit after Silvergate Capital announced yesterday that it will shut down operations of and liquidate Silvergate Bank

-

Energy commodities trade higher - oil gains 0.2% while US natural gas prices advance 0.7%

-

Precious metals trade little changed - gold and silver trade flat while platinum adds 0.4%

-

JPY and AUD are the best performing major currencies while CAD and USD lag the most

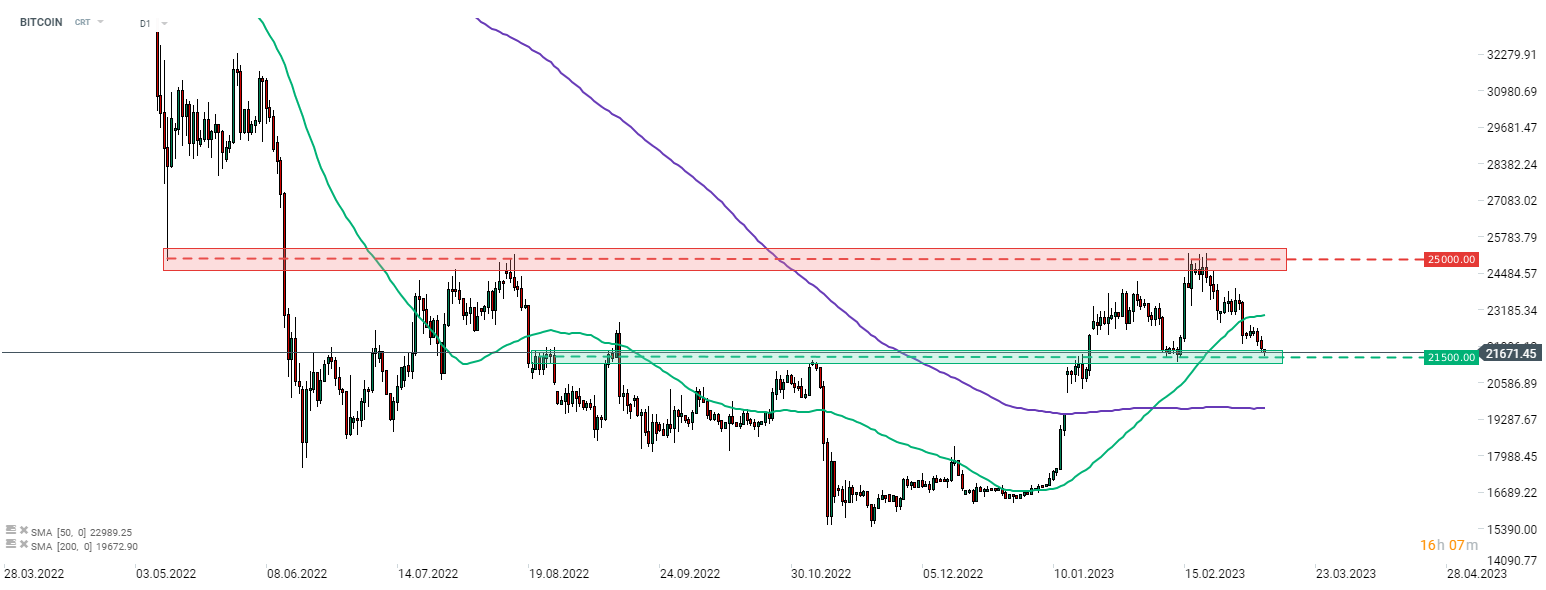

BITCOIN deepened declines yesterday after Silvergate Capital announced liquidation of Silvergate Bank. The coin is making another test of the $21,500 support zone. Source: xStation5

BITCOIN deepened declines yesterday after Silvergate Capital announced liquidation of Silvergate Bank. The coin is making another test of the $21,500 support zone. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.