-

US indices finished yesterday's session low but slightly off the daily lows. S&P 500 dropped 0.73%, Dow Jones moved 0.56% and Nasdaq moved 0.28% lower

-

Stocks in Asia traded mixed - Nikkei dropped 0.3% while S&P/ASX 200 gained 1%. Indices from China plunged and finished 1.7-5.0% lower

-

DAX futures point to a higher opening of the European cash session today

-

The United States announced a total ban on Russian oil, natural gas and coal. United Kingdom announced that it will phase out Russian oil in the coming months

-

In response, Putin signed a decree banning exports of certain commodities from Russia. However, list of those commodities have not been defined yet and is expected to be announced within days

-

According to media reports, NATO is considering imposing a no-fly zone over Western Ukraine to guard humanitarian corridors

-

Bank of Russia limited USD withdrawals from personal accounts to $10,000. Remaining balance can be withdrawn only in RUB

-

More companies announce withdrawal from or suspension of services in Russia. McDonald's, Starbucks and Coca-Cola are the latest to make such announcements

-

Fitch expects Russia to default on its debt imminently

-

According to Reuters report, United States offered Venezuela to relax oil sanctions but only under condition that oil will be shipped directly to US

-

API report pointed to a 2.8 million barrel build in US oil inventories (exp. -0.8 mb)

-

The Japanese GDP report for Q4 2021 was revised lower from 1.3% to 1.1% QoQ (exp. 1.4% QoQ)

-

Chinese CPI inflation remained unchanged at 0.9% YoY in February (exp. 0.9% YoY) while PPI inflation decelerated from 9.1 to 8.8% YoY (exp. 8.7% YoY)

-

Cryptocurrencies caught a bid during the Asian session with Bitcoin jumping almost 8% to $41,500

-

Oil continues to trade near recent highs

-

Palladium, platinum and silver gain over 1% while gold trades flat

-

AUD and GBP are the best performing major currencies while JPY and USD lag the most

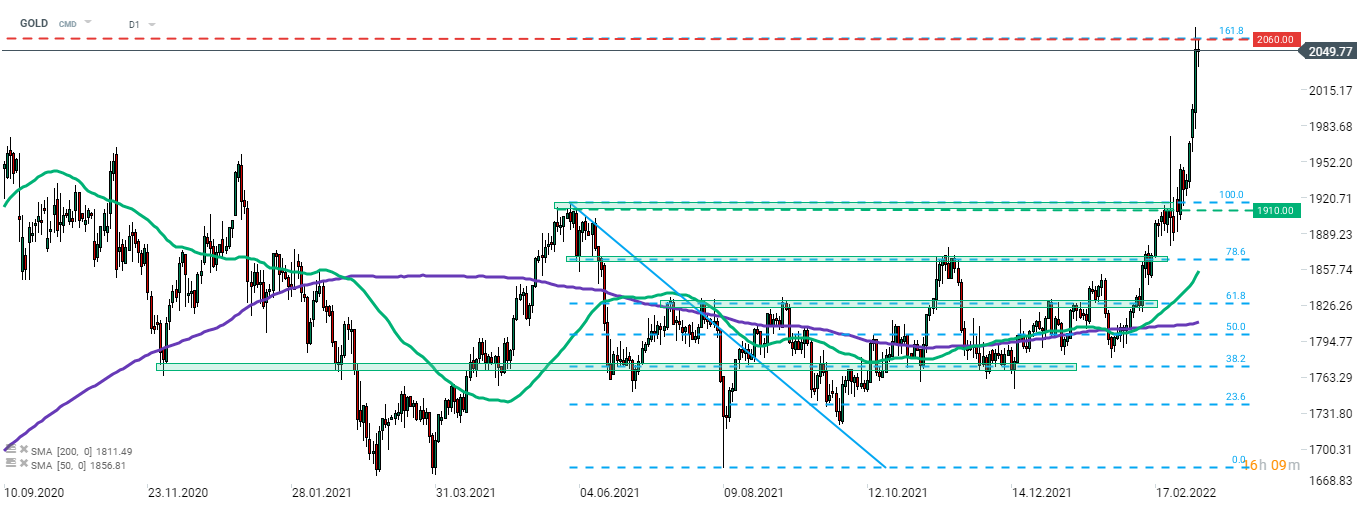

GOLD look towards record highs yesterday but ultimately finished trading below 2020 highs. Advance was halted at the 161.8% exterior retracement of June-August 2021 correction ($2,060 per ounce) and price pulled back to the $2,050 area. Gold trades flat today, awaiting catalyst for the next move. Source: xStation5

GOLD look towards record highs yesterday but ultimately finished trading below 2020 highs. Advance was halted at the 161.8% exterior retracement of June-August 2021 correction ($2,060 per ounce) and price pulled back to the $2,050 area. Gold trades flat today, awaiting catalyst for the next move. Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.