-

Stocks in Asia are trading lower at the beginning of a new week amid increase in risk aversion. Nikkei dropped almost 0.5%, Kospi moved 0.9% lower and indices from China plunged. S&P/ASX 200 added 0.4%

-

DAX futures point to a higher opening of the European session

-

Oil rallies with Brent jumping above $70 per barrel. Saudi export port and production facilities have been targeted by a drone and missile attack over the weekend with Iran-backed Houthi being named as the aggressor. Saudi Arabia said that there were no injuries or major property damage

-

US Senate passed $1.9 trillion stimulus deal. However, some amendments were added and now the bill will head back to the House (vote expected on Tuesday)

-

Fed interest rate hike is fully priced in for December 2022

-

According to New York Times, United States plans to retaliate against Russian hackers by targeting networks used by Russian intelligence and military

-

Chinese imports increased 22.2% YoY in February (exp. 15% YoY) while exports rose 60.6% YoY (exp. 37.5% YoY)

-

Bitcoin recovered and tested the $51,500 mark over the weekend. However, coin was unable to break above it and price pulled back below $50,000

-

Precious metals gain with silver being top performer and platinum being top laggard. Industrial metals trade lower while agricultural commodities gain

-

AUD and USD are the best performing major currencies while CHF, EUR and NZD lag the most

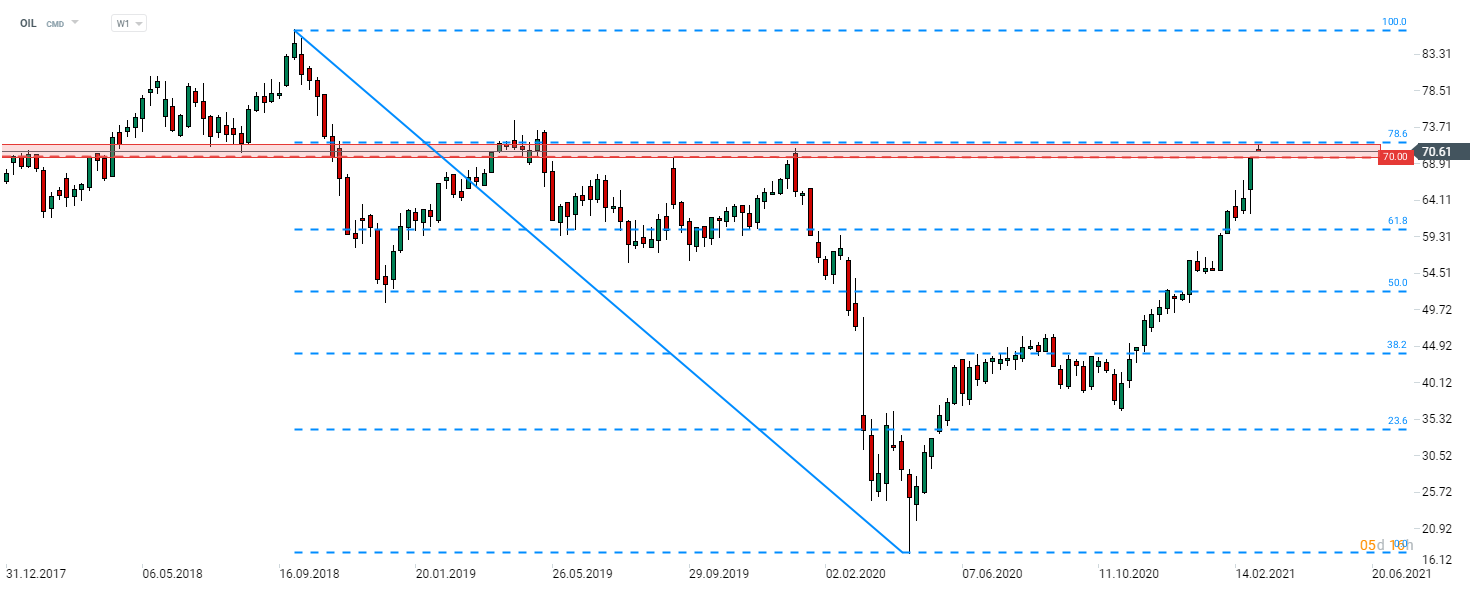

Oil launched a new week with a big bullish price gap following attacks on Saudi oil facilities. Brent (OIL) opened above $70 per barrel and reached the highest level since May 2019. Major resistance zone ranges between $70 mark and 78.6% retracement of the downward move started in October 2018 ($72). Source: xStation5

Oil launched a new week with a big bullish price gap following attacks on Saudi oil facilities. Brent (OIL) opened above $70 per barrel and reached the highest level since May 2019. Major resistance zone ranges between $70 mark and 78.6% retracement of the downward move started in October 2018 ($72). Source: xStation5

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.