-

US indices finished yesterday's trading lower following hawkish FOMC minutes release. S&P 500 dropped 0.97%, Dow Jones moved 0.42% lower and Nasdaq dropped 2.22%. Russell 2000 dropped 1.42%

-

FOMC minutes showed that many Fed members were opting for a 50 basis point rate hike in March. Document signaled that QT is likely to start in May with monthly limits for reduction at $60 billion for Treasuries and $35 billion for mortgage-backed securities

-

Indices from Asia-Pacific are trading lower today. Nikkei dropped 1.6%, S&P/ASX 200 moved 0.6% lower and Kospi declined 1.2%. Indices from China traded over 1% lower

-

DAX futures point to a slightly lower opening of the European cash session today

-

The US House Speaker will visit Taiwan this Sunday. This will be the first Taiwan visit of such a high-profile US politician in 25 years and is likely to increase tensions between US and China

-

Joe Biden signed an executive order banning all new US investments in Russia

-

UK Foreign Minister Truss said that her country is working on a timetable for elimination of Russian energy imports

-

The Australian trade balance for February reached A$7.46 billion (exp. A$11.7 billion)

-

Majority of cryptocurrencies trade lower on Thursday. Bitcoin drops 1.4% and trades near $43,200

-

Oil tries to recover from yesterday's declines. Brent trades 1% higher and approaches $103 per barrel area

-

Precious metals trade lower. Palladium is an exception and trades 1.7% higher

-

GBP and EUR are the best performing major currencies while AUD and NZD lag the most

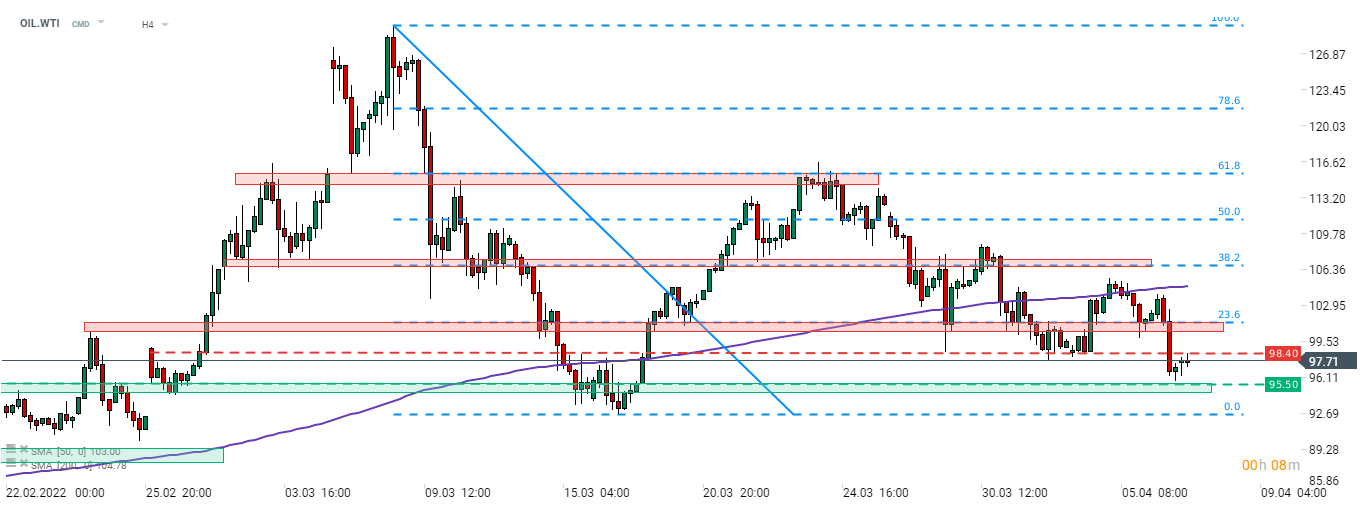

Oil prices plunged yesterday in the afternoon with WTI (OIL.WTI) moving back below the psychological $100 per barrel area. Drop was halted at a $95.50 support zone and an attempt to recover can be spotted today. $98.40 swing area is the first near-term resistance to watch while the next can can be found ranging below 23.6% retracement of the downward move launched in early-March ($101.20). Source: xStation5

Oil prices plunged yesterday in the afternoon with WTI (OIL.WTI) moving back below the psychological $100 per barrel area. Drop was halted at a $95.50 support zone and an attempt to recover can be spotted today. $98.40 swing area is the first near-term resistance to watch while the next can can be found ranging below 23.6% retracement of the downward move launched in early-March ($101.20). Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

Three markets to watch next week (09.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.