-

US indices gained during the first trading session after a long weekend. S&P 500 added 0.16%, Nasdaq surged 1.75% and Russell 2000 gained 0.79%. Dow Jones was a laggard and dropped 0.42%

-

Stocks in Asia took a hit today. Nikkei dropped 1.1%, S&P/ASX 200 moved 0.3% lower and Kospi plunged 1.8%. Indices from China traded 1-2% lower

-

DAX futures point to a higher opening of the European cash session today

-

UK Chancellor of Exchequer Sunak and UK health minister Javid resign along with a number of lower-rank Conservative Party officials. Discontent with party leadership, especially Prime Minister Boris Johnson, was explained as a reason

-

Russian court ordered a 30-day halt on exports from CPC terminals in Black Sea. CPC terminals have a maximum export capacity of slightly below 3 million barrels per day and mainly export crude from Kazakhstan

-

Norway government intervened to end oil workers strike

-

Citi estimates that oil price may drop to $65 in case of a recession

-

Most cryptocurrencies trade lower today. Bitcoin drops 1.6% to $20,000 while Ethereum trades 1.7% lower

-

Oil prices stabilized after yesterday's massive plunge. WTI trades little changed near $99.50 while Brent gains slightly

-

Precious metals pull back. Platinum and silver drop over 1% while gold trades 0.1% lower

-

Safe haven flows can be spotted on the FX market with JPY and CHF being top performing G10 currencies. AUD, NZD and GBP lagged the most

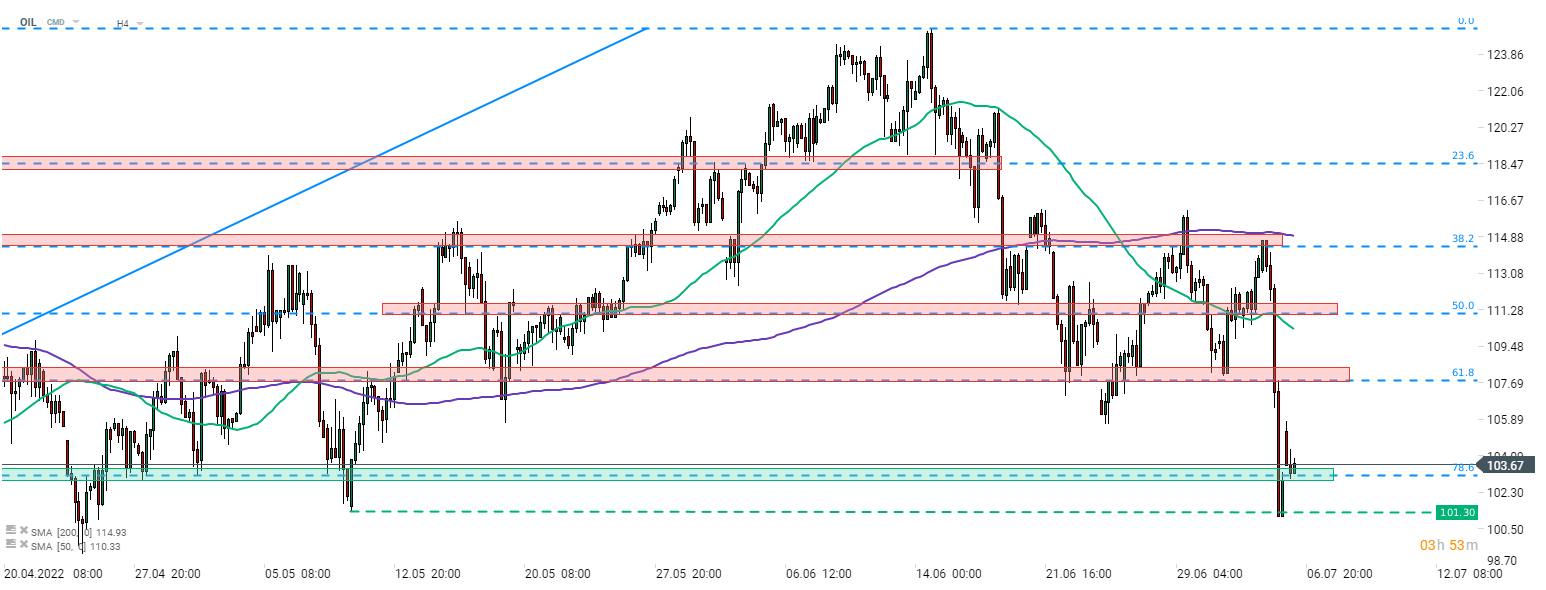

Brent (OIL) retested lows from May 11, 2022 in the $101.30 area during yesterday's plunge. A sell-off has been halted for now, price managed to recover above the support zone marked with 78.6% retracement of the upward move started in March. Source: xStation5

Brent (OIL) retested lows from May 11, 2022 in the $101.30 area during yesterday's plunge. A sell-off has been halted for now, price managed to recover above the support zone marked with 78.6% retracement of the upward move started in March. Source: xStation5

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

Three markets to watch next week (09.02.2026)

Market update: recovery takes hold, but investors remain on edge

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.