-

US indices slumped yesterday, erasing all of post-FOMC gains. S&P 500 dropped 3.56%, Dow Jones moved 3.12% lower and Nasdaq slumped 4.99%. Russell 2000 dropped 4.04%

-

Indices from Asia-Pacific followed Wall Street's lead and also slumped. S&P/ASX 200 dropped 2.2%, Kospi dropped 1.1% and indices from China traded 2-4% lower

-

DAX futures point to a slightly lower opening of the European cash session

-

Josep Borrell said that agreement on next sanctions package on Russia has almost been reached by EU members

-

Hungary's Orban said that his country will need 5-year exemption from Russian oil embargo

-

According to RBA Statement on Monetary Policy, interest rates in Australia will need to increase further as inflation is seen staying above goal until at least 2024

-

ECB's Holzmann said that European Central Bank will discuss raising rates and may even decide to deliver a rate hike in June

-

Cryptocurrencies trade mostly higher. Ripple trades over 2% higher, Ethereum gains 0.5% and Bitcoin adds 0.1%

-

Precious metals pull back amid USD strengthening. Platinum is top laggard with a drop of 2.7%

-

Energy commodities do not experience major moves on Friday. Brent and WTI trades 0.2% higher

-

USD and CAD are the best performing major currencies while JPY and CHF lag the most

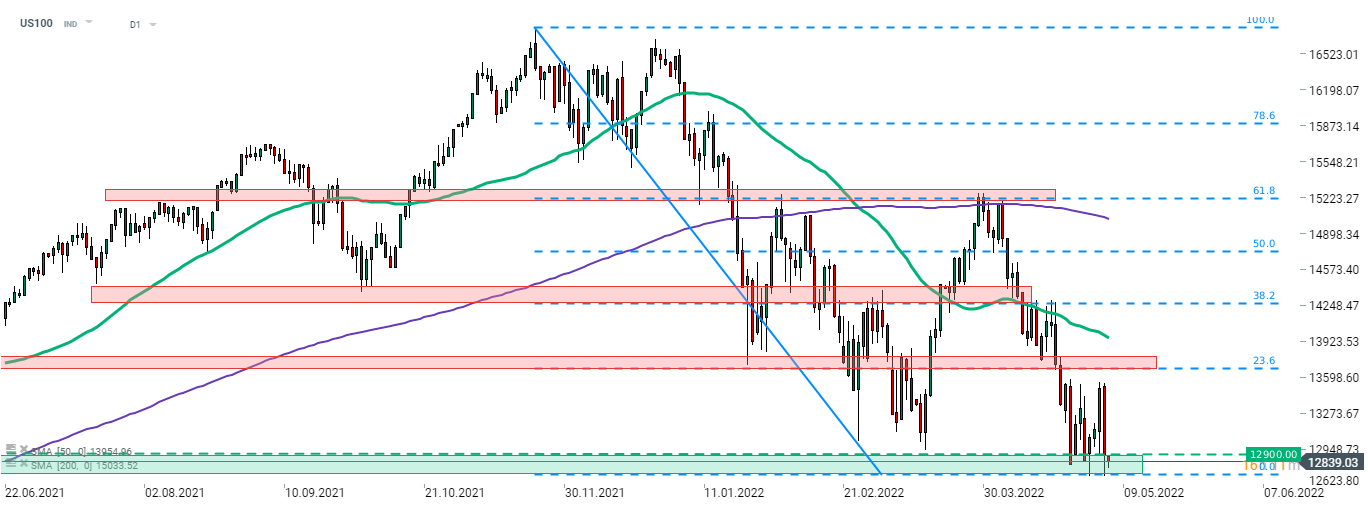

Nasdaq-100 (US100) and other US indices slumped yesterday, erasing all of the post-FOMC gains. US100 is once again testing a support zone ranging below 12,900 pts handle. While yesterday's plunge was very steep, it looks like the situation has calmed somewhat during overnight trading. Source: xStation5

Nasdaq-100 (US100) and other US indices slumped yesterday, erasing all of the post-FOMC gains. US100 is once again testing a support zone ranging below 12,900 pts handle. While yesterday's plunge was very steep, it looks like the situation has calmed somewhat during overnight trading. Source: xStation5

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

Wall Street extends gains; US100 rebounds over 1% 📈

Market wrap: Novo Nordisk jumps more than 7% 🚀

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.