-

US indices finished yesterday's trading higher. S&P 500 gained 0.8%, Dow Jones moved 0.30% higher and Nasdaq rallied 1.90%. Russell 2000 gained 0.21%

-

Stocks from Asia-Pacific traded slightly higher on Tuesday. Nikkei gained 0.2% while S&P/ASX 200 and Kospi added around 0.05% each. Stock exchanges in China and Hong Kong and Taiwan were closed for holiday

-

DAX futures point to a flat opening of the European cash session today

-

US Treasury said that it will block any attempts by Russia to settle its USD-denominated debt with reserves it holds in US financial institutions

-

World Bank expects Chinese economy to grow 5% in 2022, lower than official Chinese estimate of 5.5%

-

BoJ Governor Kuroda said that policy will become less effective once Japanese 10-year yield jumps above 0.25%. BoJ plans to continue to buy unlimited amounts of government bonds in near-term

-

The Reserve Bank of Australia left the interest rate unchanged at a meeting today. However, RBA no longer stressed "patience" in its policy statement

-

Japanese household spending increased 1.1% YoY in February (exp. +2.7% YoY)

-

Brent and WTI trade around 0.8% higher each today

-

In spite of USD weakness, precious metals trade mixed - gold and platinum drop slightly while silver and palladium gain

-

AUD and NZD are the best performing major currencies while USD and EUR lag the most

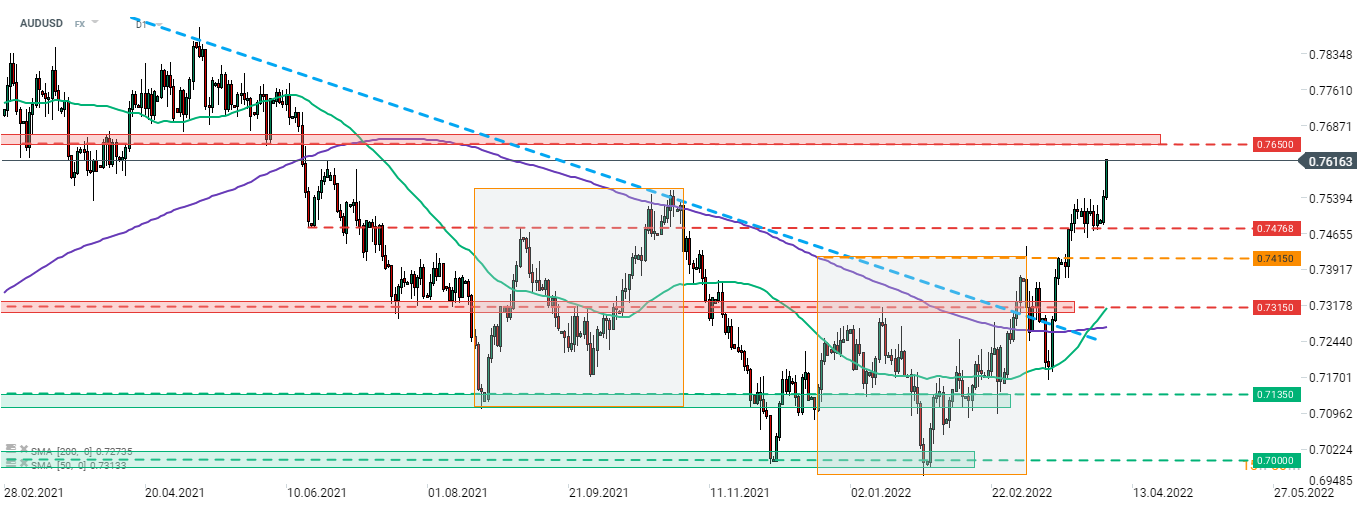

AUDUSD rallied today after mention of patience was removed from RBA statement. This suggests that RBA may decide to hike rates at one of the coming meetings. AUDUSD reached the highest level since June 2021 following the decision and is looking towards resistance zone ranging above 0.7650. Source: xStation5

AUDUSD rallied today after mention of patience was removed from RBA statement. This suggests that RBA may decide to hike rates at one of the coming meetings. AUDUSD reached the highest level since June 2021 following the decision and is looking towards resistance zone ranging above 0.7650. Source: xStation5

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.