- Indices from Asia-Pacific launched new week's trading higher. Nikkei and S&P/ASX 200 gained 0.5%, Kospi trades 0.6% higher and Nifty 50 trades flat. Indices from China trade 1.0-2.5% higher

- Strong gains in China were driven by property sector stocks. This comes after a weekend reports saying that Chinese developer Country Garden won approval to extend payments on onshore bonds

- European index futures point to a slightly higher opening of the cash session on the Old Continent today

- Liquidity on the markets may be thinner today, especially in the afternoon, as traders from the United States and Canada will be off to celebrate Labour Day holiday

- Money markets are pricing in less than a 10% chance of a 25 bp rate hike at September FOMC meeting, following NFP report that show a spike in unemployment rate

- ECB's Wunsch said that underlying inflation continues to be persistent and that more rate hikes will be needed

- Morgan Stanley is no longer expecting ECB to hike rates at its September meeting and instead thinks that ECB rate hike cycle is over already

- Moody's lowered its Chinese GDP growth forecast for 2024 from 4.5 to 4.0%. Forecast for 2023 was left unchanged at 5.0%

- Australian business inventories dropped 1.9% QoQ in Q2 2023

- Cryptocurrencies are trading higher today - Bitcoin gains trades flat, Ethereum gains 0.1%, Dogecoin adds 0.4% and Ripple jumps 1%

- Energy commodities pull back - oil drops 0.3-0.4% while US natural gas prices drop 2.5%

- Precious metals gains - gold, platinum and silver trades 0.3% higher while palladium rallies 0.9%

- AUD and GBP are the best performing major currencies while USD and JPY lag the most

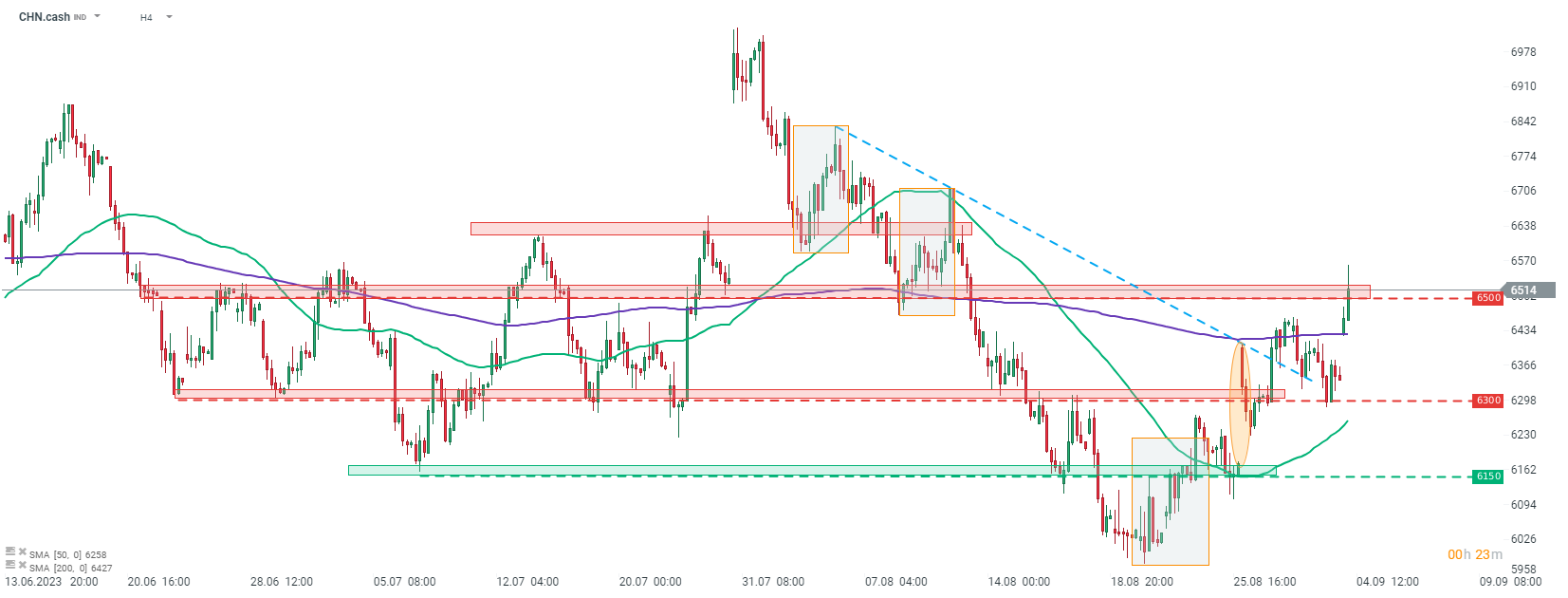

CHN.cash is trading over 2.5% higher today, as sentiment towards the Chinese property sector improved. The index is currently testing a 6,500 pts resistance zone. Source: xStation5

CHN.cash is trading over 2.5% higher today, as sentiment towards the Chinese property sector improved. The index is currently testing a 6,500 pts resistance zone. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.