-

US indices finished yesterday's trading significantly lower - S&P 500 dropped 1.40%, Nasdaq declined 2.20% and Russell 2000 closed over 1.40% lower.

-

The stock market experienced a sell-off, driven by robust jobs data and an increase in Treasury issuance.

-

This market reaction came a day after the U.S. credit was downgraded, leading traders to pull back following a rally that amassed $6.5 trillion.

-

Equities suffered broad declines, with the S&P 500 experiencing its worst performance since April.

-

The Nasdaq 100 index fell by 2%, following a 40% increase earlier in the year, spurred by interest in artificial intelligence.

-

Both NVIDIA and Tesla shares dropped by at least 2.7%.

-

The VIX, often referred to as Wall Street's "fear gauge," saw its most significant rise in nearly five months.

-

Ten-year bond yields reached levels not seen since November.

-

The U.S. dollar appreciated against all other developed-market currencies. Despite gains, the mood surrounding the dollar remains cautious, with less than 0.1% changes observed in dollar pairs.

-

Concerns grew among traders regarding a steepening yield curve, as rates on long-term bonds rose more quickly than those on short-term maturities.

-

A high-level conversation took place between the Pentagon's top Asia official and a representative from China's Ministry of Foreign Affairs, focusing on U.S.-China defense relations and regional security.

-

Australian Composite PMI registered at 48.2, and Australian Services PMI was 47.9.

-

Japanese Services PMI came in at 53.8, with the Composite PMI at 52.2.

-

Australian Trade Balance was reported at 11321M, with imports decreasing by 4% and exports by 2%.

-

The Chinese Caixin Services PMI was measured at 54.1.

-

India's Services PMI was recorded at 62.3.

-

Japan's Chief Cabinet Secretary Matsuno emphasized the close monitoring of foreign exchange movements and their potential effects on the Japanese economy.

-

Bill Ackman, of Pershing Square Capital Management, is taking a short position on bonds, anticipating a persistent inflation rate around 3%.

-

A preview of the Bank of England's Monetary Policy meeting hints at a potential 25 basis points rate increase.

-

Both Deutsche Bank and Japanese bank Nomura are projecting a 25 basis points rate hike from the Bank of England.

-

Analysts at ANZ bank are holding their end-of-year oil price prediction at $100 per barrel, citing expected slow growth in U.S. oil production.

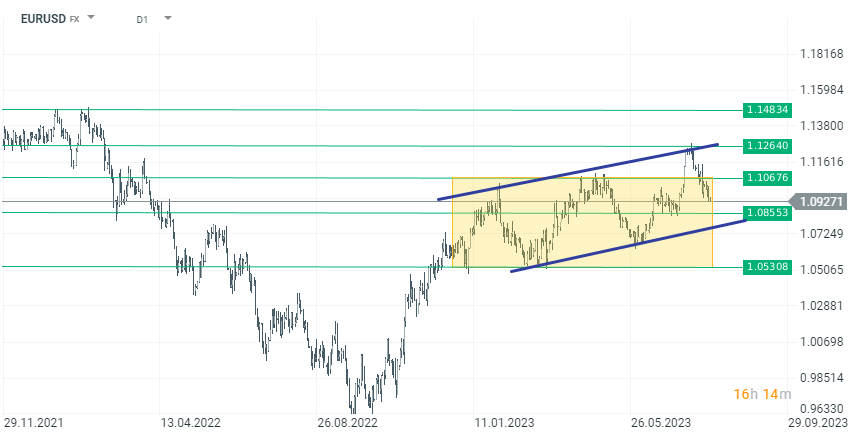

The U.S. dollar continues to strengthen, and today it is the best-performing currency among the rest of the developed countries. EURUSD has returned to the consolidation range and below the key level of 1.10. Currently, EURUSD is trading 0.10% lower at 1.0927.

The U.S. dollar continues to strengthen, and today it is the best-performing currency among the rest of the developed countries. EURUSD has returned to the consolidation range and below the key level of 1.10. Currently, EURUSD is trading 0.10% lower at 1.0927.

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

Market wrap: Novo Nordisk jumps more than 7% 🚀

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.