-

US indices finished yesterday's trading higher. S&P 500 gained 0.18%, Dow Jones moved 0.26% higher and Nasdaq jumped 0.63%. Russell 2000 rallied 2.65%

-

Moods weakened during the Asian session, especially in China, after Chinese authorities decided to halt classes at more than a dozen of schools in Beijing. Covid-19 outbreaks are the reasons

-

Nikkei dropped 0.4%, S&P/ASX 200 declined 0.6% and indices from China traded over 1% lower. Kospi outperformed, gaining 1.2%

-

DAX futures point to a slightly lower opening of today's European session

-

Reserve Bank of Australia left interest rates unchanged at the meeting today and purchases of government bonds are set to continue at A$4 billion per week. However, RBA decided to drop a 0.10% target on 10-year 2024 government bond yield

-

RBA Governor Lowe said that he thinks the market overreacted to the latest inflation data. He said that it is extremely unlikely for inflation to jump beyond projections

-

South Korean CPI inflation accelerated from 2.6 to 3.2% YoY - the highest level since January 2012

-

New Zealand building permits dropped 1.9% MoM in September

-

Precious metals are trading mixed - gold and palladium gain while platinum and silver drop

-

Bitcoin, Ethereum and Dogecoin climb. Chainlink, Litecoin and Tezos pull back slightly

-

USD and JPY the best performing major currencies while AUD underperforms the most

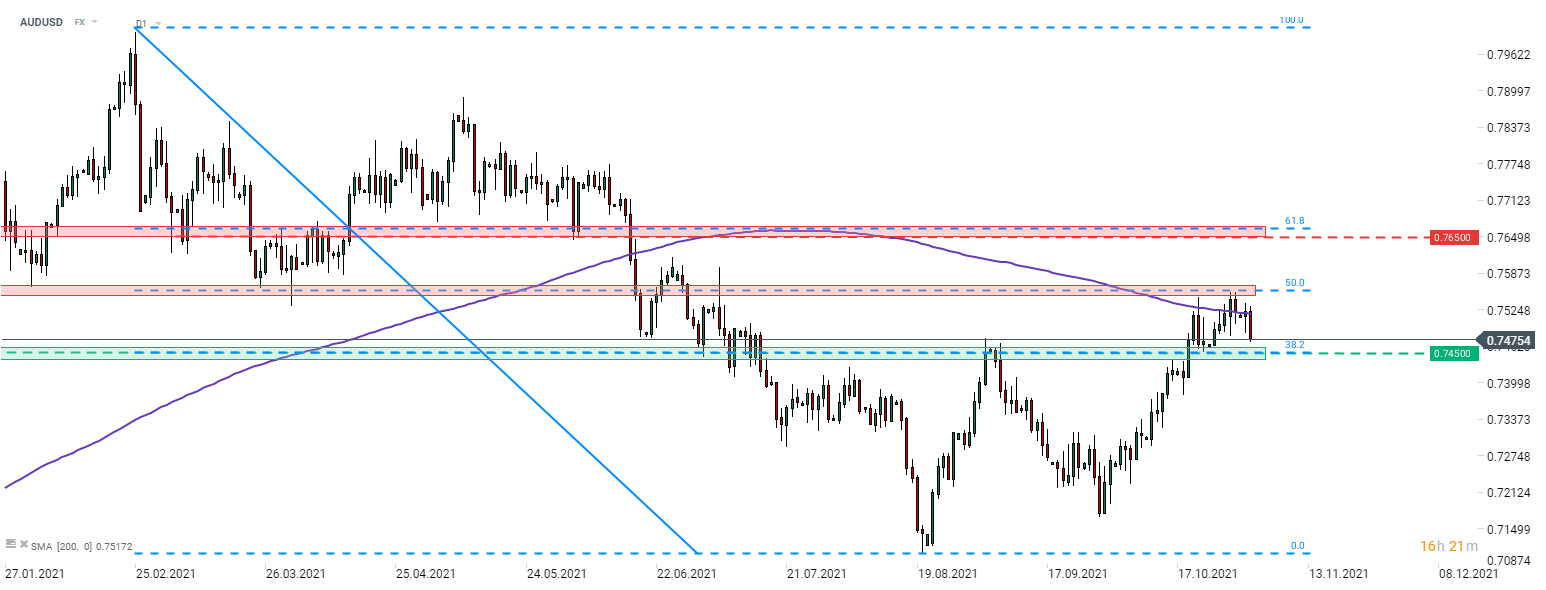

AUDUSD is plunging today following RBA's decision to drop a target bond yield. While the Bank sees a possibility of bringing the first rate hike forward from 2024 to 2023, Governor Lowe hinted that rate hike in 2022 is extremely unlikely. AUDUSD pulled back from the 200-session moving average (purple line) and dropped below the 0.75 handle. Source: xStation5

AUDUSD is plunging today following RBA's decision to drop a target bond yield. While the Bank sees a possibility of bringing the first rate hike forward from 2024 to 2023, Governor Lowe hinted that rate hike in 2022 is extremely unlikely. AUDUSD pulled back from the 200-session moving average (purple line) and dropped below the 0.75 handle. Source: xStation5

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.