-

Wall Street indices had another poor session yesterday. S&P 500 dropped 0.88%, Dow Jones moved 0.82% lower and Nasdaq slumped 1.33%. Russell 2000 dropped 0.66%

-

Global equity sell-off continued during the Asian session. Nikkei dropped 1.6%, S&P/ASX 200 traded 0.1% lower and Kospi plunged 1.4%. Indices from China traded 0.5-0.7% lower

-

DAX futures point to a lower opening of the European cash session

-

Further deterioration in market moods is fueled by the latest reading of Atlanta Fed GDP indicator, which now points to a US GDP contraction in Q2 2022

-

Libya’s National Oil Corporation said that daily oil output in the country is almost 1 million barrels lower. Exports dropped 865k bpd

-

The Ecuadorian government has reached an agreement to end protests. Authorities hope to lift oil exports limits by July 7

-

Chinese manufacturing PMI, private Caixin/Markit survey, jumped from 48.1 to 51.7 in June (exp. 50.2). This was the highest reading since May 2021

-

Japanese unemployment rate ticked higher in May, from 2.5 to 2.6% (exp. 2.5%)

-

New Zealand building permits dropped 0.5% MoM in May (exp. -0.6% MoM)

-

Cryptocurrencies jumped on rumors that the Japanese regulator may allow trust banks to manage cryptocurrencies. Bitcoin is trading 3.5% higher at $19,400

-

Brent and WTI trade around 1% lower while gold drops 0.5%

-

JPY and USD are the best performing major currencies while AUD and NZD lag the most

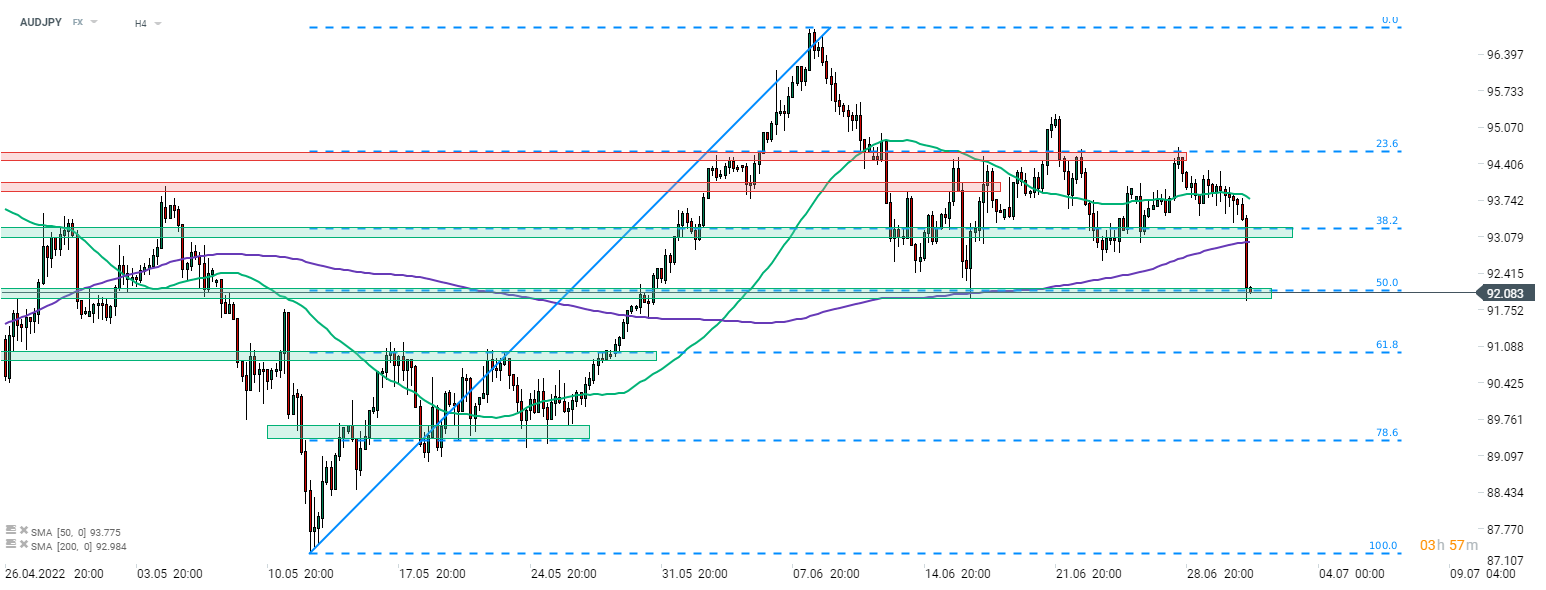

AUDJPY, a FX pair often seen as a risk barometer, is slumping today. The pair plunged below 38.2% retracement of recent upward move and 200-period moving average (purple line, H4 interval) and is now testing support zone at 50% retracement in the 0.9200 area. Source: xStation5

AUDJPY, a FX pair often seen as a risk barometer, is slumping today. The pair plunged below 38.2% retracement of recent upward move and 200-period moving average (purple line, H4 interval) and is now testing support zone at 50% retracement in the 0.9200 area. Source: xStation5

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.