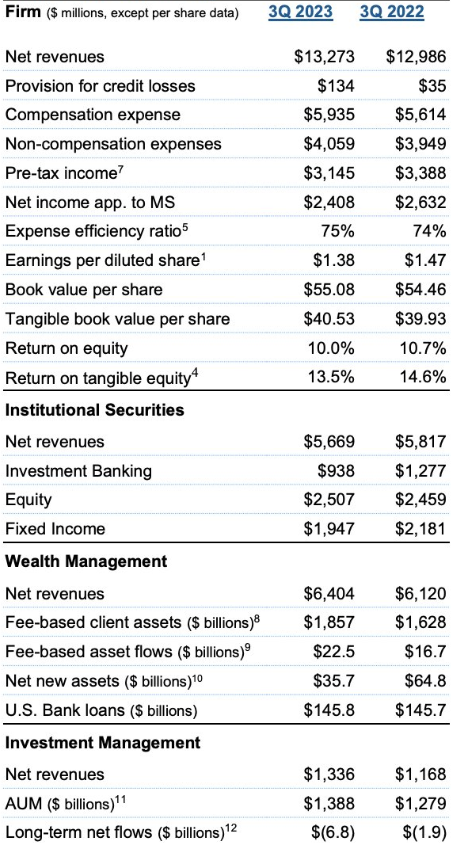

Morgan Stanley (MS.US) revenues in Q3 was slighlty higher on yearly basis and earnings per share were not enough high to cause the optimistic reaction on the financial report. Provision for credit losses surged more than 350% y/y. Now bank shares loses 2% before the market open after revenues from wealth management and especially investment banking disappointed investors.

- Revenues: 13,3 mld USD vs 13,25 mld USD expected

- Earnings per share (EPS): 1,38 USD vs 1,32 USD expected

What's more revenue from the fixed-income trading (FICC) slumped 11% with lower fees from dealmaking. Finally net income dropped. Net new assets slumped to $35.7 billion from $89.5 billion the prior quarter.

Morgan Stanley revenues on y/y basis. Investment Management revenues dynamics was higher y/y with increasing AUM but it wasn't enough to boost earnings. Revenues from Fixed Income and even Investment Banking were lower y/y. US bank loans increased just by $1 milion to $145,8 million. Source: Morgan Stanley report

Morgan Stanley (MS.US) chart on W1 interval

We can see that the price of Morgan Stanley shares dropped below SMA200 on W1 (red line) and 38,2 Fibonacci retracement level of upward wave from April 2020. Levels below 78 USD per share may signalize further and longer weakness. Last time when price dropped below SMA200 was in 2020 and 2008 during GFC.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.