Microsoft (MSFT.US), a major US tech company, is scheduled to report its fiscal-Q1 2024 (calendar Q3 2023) today after the close of the Wall Street session. Company is expected to report the fourth consecutive quarter of below-10% growth in total revenue. However, revenue growth in the Intelligent Cloud business is expected to pick up compared to fiscal-Q4 2023. Let's take a quick look at what to expect from Microsoft's results.

Fiscal-Q1 2024 expectations

- Revenue: $54.54 billion (+8.7% YoY)

- Productivity & Business Processes: $18.29 billion (+10.8% YoY)

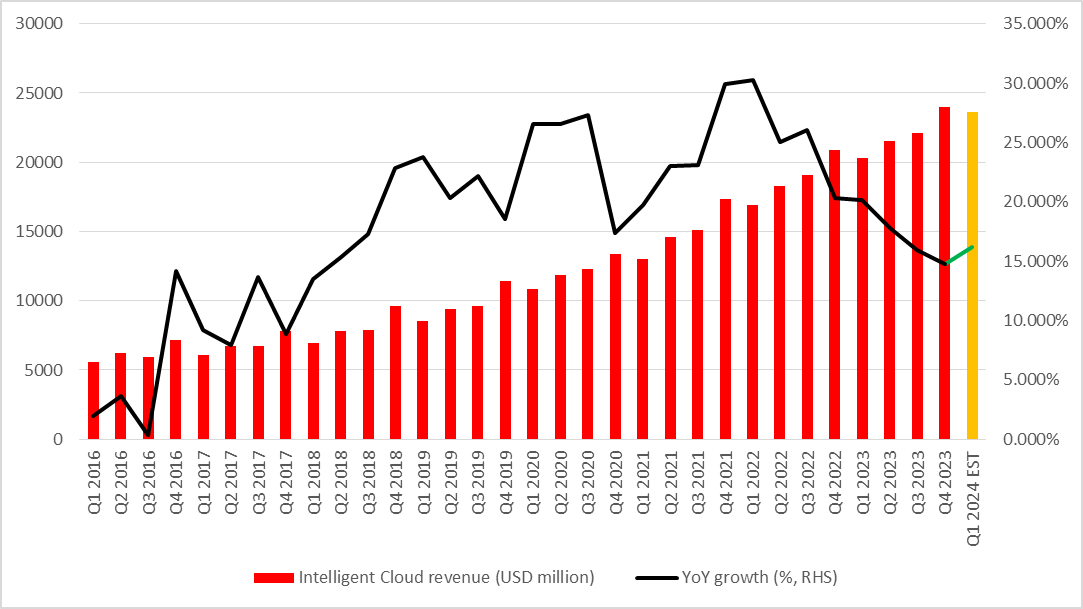

- Intelligent Cloud: $23.61 billion (+15% YoY)

- More Personal Computing: $12.89 billion (-4.1% YoY)

- Adjusted Gross Profit: $38.02 billion (+9.7%)

- Adjusted Gross Margin: 69.3% (69.2% a year ago)

- Adjusted Operating Income: $24.12 billion (+12.1% YoY)

- Productivity & Business Processes: $9.23 billion

- Intelligent Cloud: $10.31 billion

- More Personal Computing: $4.41 billion

- Adjusted Operating Margin: 44.3% (42.9% a year ago)

- Productivity & Business Processes: 50.5%

- Intelligent Cloud: 43.7%

- More Personal Computing: 34.2%

- Adjusted Net Income: $19.74 billion (+12.4% YoY)

- Adjusted EPS: $2.66 ($2.35 a year ago)

- Cash Expenditures: $9.25 billion

Growth in cloud segment expected to pick-up

Microsoft is expected to report higher sales and profits for the quarter ended on September 30, 2023. However, there are some concerns about the pace of the growth, especially when it comes to the key cloud segment. Analysts expect sales growth in the Intelligent Cloud segment to reach 15-16% YoY. While this would be slightly higher growth than the one achieved in fiscal-Q4 2023 (calendar Q2 2023), it would be lower than 26% achieved in fiscal-Q1 2023 (a year ago quarter). Performance of the cloud segment will be closely watched as demand for generative AI is strong and Microsoft has invested heavily in the field. Forecasts for fiscal-Q2 2024 as well as full fiscal-2024 may be a key point in the upcoming earnings release from Microsoft.

Source: Bloomberg Finance LP, XTB Research

Source: Bloomberg Finance LP, XTB Research

Will AI bring turnaround?

If analysts' expectations are met and Microsoft indeed reports 8.7% YoY growth in total revenue in fiscal-Q1 2024, it would mark the fourth consecutive quarter of below-10% revenue growth for the company. There is a lot of promise in AI, and it is already supporting Microsoft's Azure results. However, it remains unknown how much AI will impact a company's overall results. Analysts will look for hints - qualitative or quantitative - on how big this impact may be. Microsoft has recently announced a 5 billion AUD investment in AI in Australia and analysts are likely to press management on the earnings call about more details. Apart from AI, traders will also look at how the company view's impact of its recent acquisition of Activision Blizzard on its business.

Source: Bloomberg Finance LP, XTB

Source: Bloomberg Finance LP, XTB

A look at the chart

Taking a look at Microsoft (MSFT.US) chart at D1 interval, we can see that the stock has recently pulled back from all-time highs reached in mid-July 2023. Stock has been trading sideways between 23.6% and 38.2% retracements of the upward move launched in October 2022. An attempt was made recently to break above the upper limit of the range but bulls failed to do so. A small pullback was launched later on and it looks to have been halted at the 50-session moving average (green line). Stock continues to trade near the upper limit of the range and should Microsoft earnings report surprise positively, an upside breakout may be a matter of time.

Source: xStation5

Source: xStation5

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

NFP preview

Economic calendar: NFP data and US oil inventory report 💡

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.